Category: Saving Strategies

-

Escape the minimum payment trap and pay off credit cards faster

Why Minimum Payments Feel Safe — And Why They Keep You Stuck If you’ve ever looked at your credit card bill, sighed, and thought, “At least I can afford the minimum,” you’re not alone. The minimum payment system is designed to feel comfortable: just a small percentage of your balance, often 2–5%. The problem is…

-

Beating inflation: smart ways to protect your savings and purchasing power

Why Inflation Eats Into Your Money Faster Than You Think Inflation sounds abstract, but its impact is brutally concrete: your cash buys less every year. Over the last decade, developed economies were used to 2% annual price growth, yet 2021–2023 brought spikes above 8% in the US, UK and Eurozone. При таком темпе реальные сбережения…

-

One-page financial plan for the next 5 years: how to create it step by step

Why a One-Page Plan Beats a 20-Page Report in 2025 Long, dusty financial reports are relics of the pre‑app era. Вy 2025 your money strategy has to be both smart and lightning‑fast in use: one screen, clear numbers, no jargon. Мир меняется: инфляция скачет, ставки по кредитам дергаются, AI‑сервисы подсказывают инвестиции, а работа на удалёнке…

-

How new tax rules could affect your budget and long-term financial plan

Historical Context of Tax Rules and Personal Budgets From Simple Tariffs to Complex Personal Tax Systems Modern tax rules didn’t appear overnight. Early income taxes were flat and mostly hit businesses and the very wealthy, so regular households barely noticed them in day‑to‑day budgeting. Over the last century, brackets, deductions and credits multiplied, and suddenly…

-

Rising interest rates: how they affect your savings, debt and investments

Why rising rates suddenly matter again For years, money was almost free: central banks kept rates near zero after the 2008 crisis and again during the pandemic. Cheap loans pushed people toward mortgages, margin trading and growth stocks, while savings accounts paid almost nothing. When inflation jumped, central banks reacted with the fastest tightening cycle…

-

Saving for big goals: roadmap to fund vacations, a new car and home down payment

Why Big Money Goals Still Matter in 2025 In 2025 it’s insanely easy to spend and ridiculously hard to save. One tap — car sharing, delivery, subscriptions, “pay in 4.” Your phone is basically a portable shopping mall. But that’s exactly why big money goals — a dream vacation, a new car, or saving for…

-

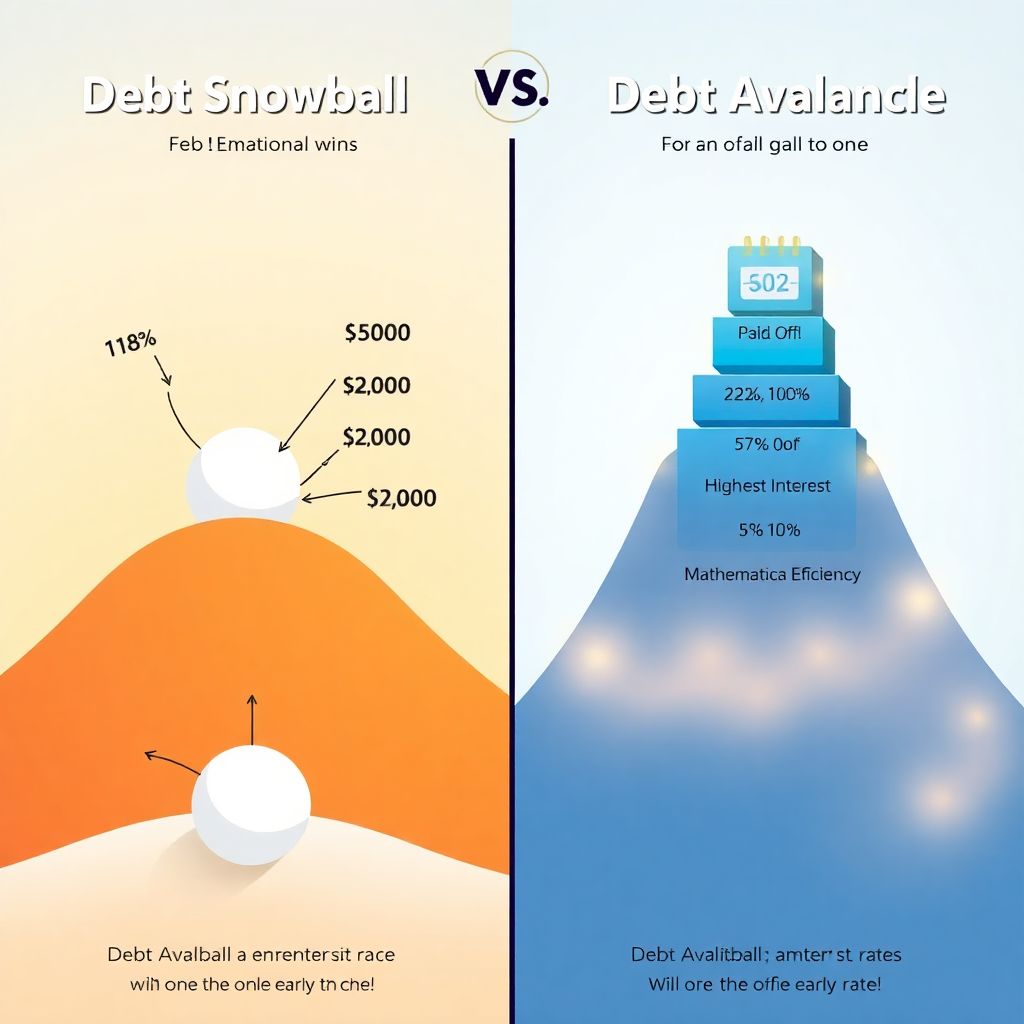

Snowball vs avalanche debt payoff: which repayment strategy is best for you

Most people don’t wake up excited to think about debt payoff strategies, but choosing the right one can save you years and thousands of dollars. Two methods dominate the conversation: the Snowball and the Avalanche. Both work. The real question is which one fits your brain, your habits, and your stress level. Let’s unpack that…

-

Practical guide to saving for a long-term vacation and planning your dream trip

Why Long‑Term Vacation Saving Deserves Its Own Strategy Planning a two‑week getaway is one thing; saving for a three‑month sabbatical or a year of slow travel is a completely different beast. The cash flow, risks and psychological traps меняются сильно when you stretch your time away. Before we dive into the numbers and tools, let’s…

-

Sustainable retirement in your 40s: how to plan now for long‑term security

Planning for a sustainable retirement in your 40s in 2025 feels very different from how your parents did it. They relied on company pensions, cheap housing and predictable career ladders. You face gig work, high real‑estate prices, volatile markets and longer life expectancy. That sounds scary, but it actually gives you more tools and data…

-

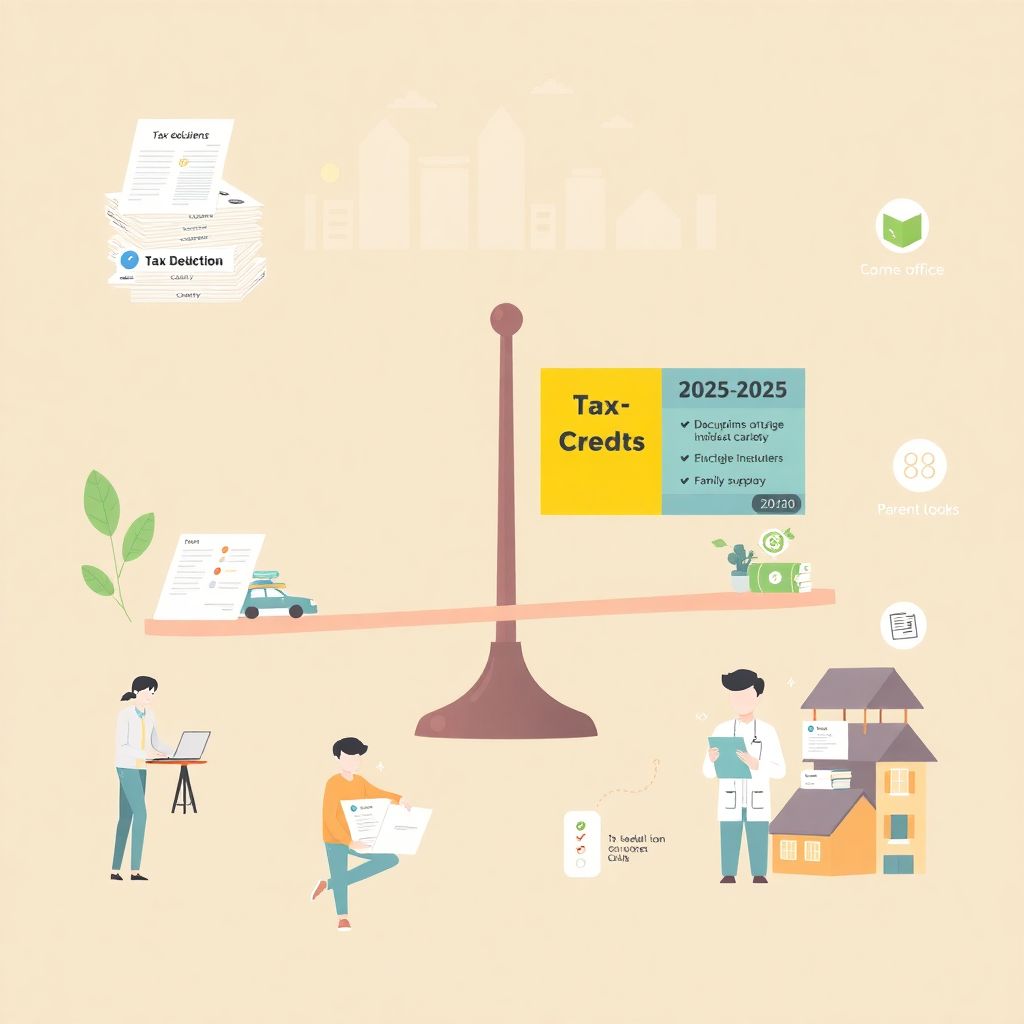

Tax credits and deductions practical guide to understanding and maximizing savings

Why Tax Credits and Deductions Matter More Than You Think If you’re paying taxes but not really sure what “credits” and “deductions” actually do, you’re leaving money on the table. A solid tax credits and deductions guide isn’t about turning you into an accountant; it’s about helping you keep more of your own cash, legally…