Category: Investment Insights

-

Understanding your first paycheck and taxes: how to read what you really earn

Step 1: Don’t Just Stare at the Number — Break the Paycheck into Pieces When you see your first paycheck, the instinct is to zoom in on the “Net Pay” line and wonder what went wrong. Before you panic, slow down. Your paycheck is basically a layered receipt: gross pay, pre‑tax stuff, taxes, post‑tax stuff,…

-

How to create a sane workflow for modern teams and boost productivity

Why “Creating a Sane” Life Is a Design Problem, Not a Moral One When people talk about sanity, they usually frame it как силу воли: «надо просто держаться». В 2025 году это звучит так же устаревше, как модемный интернет. “Creating a sane” life — это не про то, чтобы быть «крепче», а про то, чтобы…

-

How to save for a large wedding without debt and plan your dream day wisely

Why a Big Wedding Without Debt Is Absolutely Realistic Most couples secretly думают: “Large wedding = large credit card bill.” That’s not a law of nature. You can absolutely have a big celebration, a full dance floor, and gorgeous photos without dragging a loan behind you for the next five years. The real trick isn’t…

-

How to build a financial vision for your family and secure your future

Why ваша семья нуждается в финансовом видении A financial vision for your family – это не красивый лозунг, а рабочая модель того, как вы хотите жить через 5, 10 и 25 лет, и на какие ресурсы будете опираться. Без такой рамки решения принимаются хаотично: то ипотека «пока дают», то машина «пока скидка». В результате доход…

-

How to save on books and build a great library on a small budget

The price of books has been growing faster than many people’s incomes, но это не повод меньше читать. В 2025 году есть столько цифровых инструментов и сервисов, что экономия на книгах превращается в управляемый процесс, почти как оптимизация бюджета в стартапе. Если подойти к делу системно — сочетать подписки, библиотечные платформы, маркетплейсы и кэшбэк‑сервисы —…

-

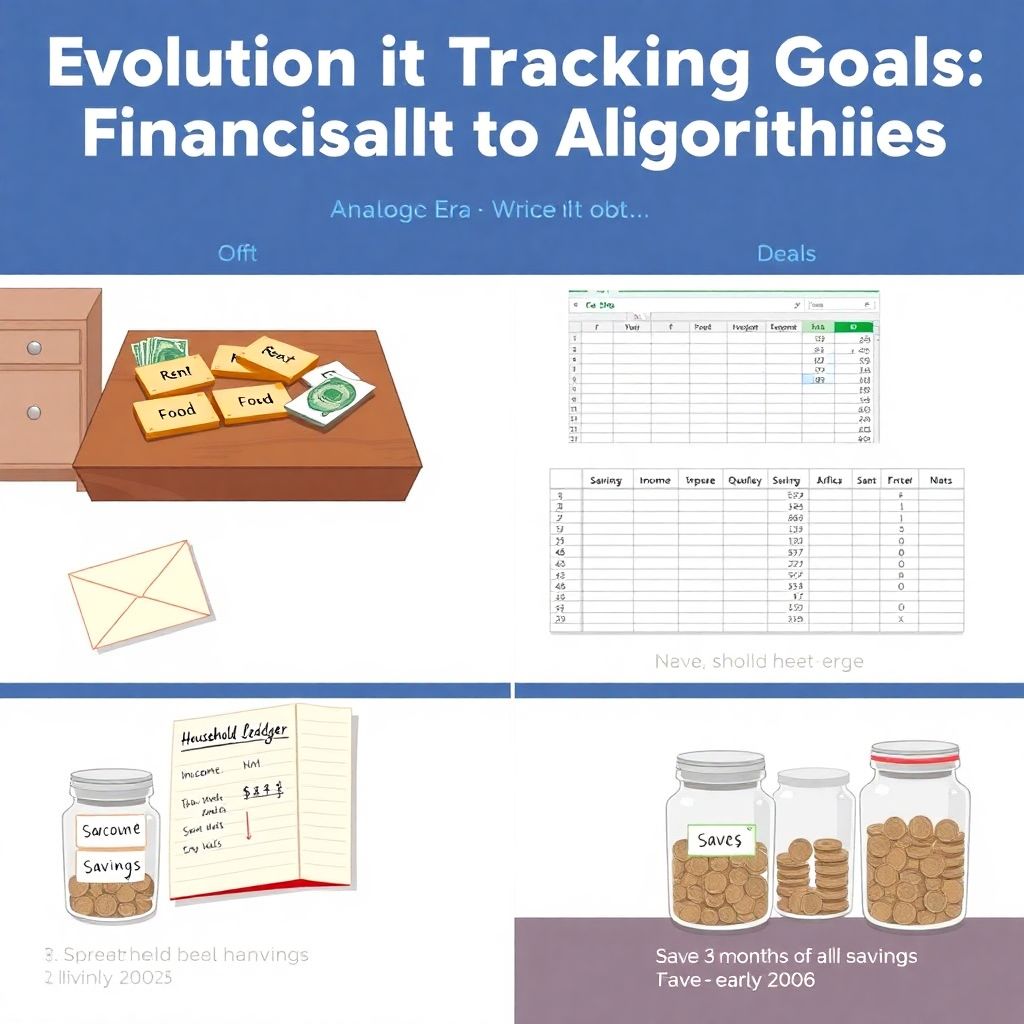

How to track progress toward financial goals effectively and stay on target

Evolution of Tracking Financial Goals: From Envelopes to Algorithms Historical Background of Financial Goal Tracking Long before anyone googled *how to create and track personal financial goals*, people relied on purely analog methods. Cash envelopes, handwritten ledgers and simple “money jars” served as basic financial goal tracking tools for budgeting and saving. The approach was…

-

Budgeting for a sustainable lifestyle: how to save money and live eco-friendly

Most people assume that a “green” way of life is a luxury project: organic food, bamboo everything, solar panels on the roof. In reality, budgeting for a sustainable lifestyle looks much more like detective work than like shopping therapy. You’re investigating where your money leaks out every month, and deciding which leaks are also bad…

-

Real estate taxes for beginners: practical guide to understanding them

Why Real Estate Taxes Deserve Your Attention (Especially as a Beginner) Real estate taxes look boring… right up until they hit your bank account. Then suddenly it’s very real. If you’re just starting with property — buying your first home or eyeing your first rental — understanding real estate taxes for beginners is not “optional…

-

How to budget for a flexible work schedule and stay financially secure

From Factory Whistles to Zoom Calls: Why Budgeting Changed with Flexible Work In the early 1900s, personal finance was almost boringly predictable: fixed wages, fixed hours, and fixed paydays. You worked at the factory, office, or mine, got your weekly envelope, and your entire household budget revolved around that stable cash flow. The modern idea…

-

How to create a financial plan that endures market downturns and protects you

Why Your Financial Plan Has To Survive Bad Markets, Not Just Good Ones Most people start planning money goals assuming “normal” markets. Then the first big drop hits, panic kicks in, and the nice-looking spreadsheet gets ignored. financial planning for market downturns is less about predicting the next crash and more about building a plan…