Category: Financial Planning

-

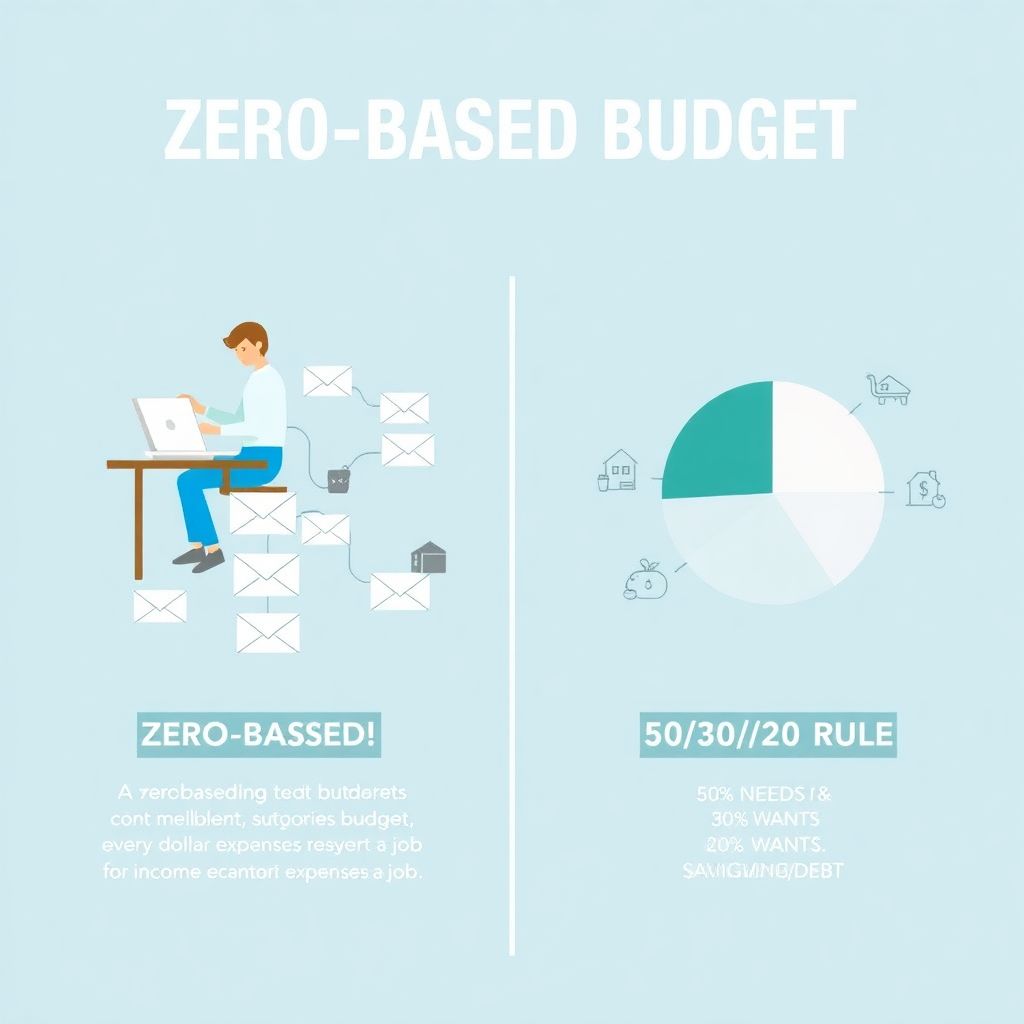

Zero-based budgeting vs 50/30/20 rule: which budgeting method fits your life

Money choices shape nearly every part of life, но большинство людей до сих пор живут “от зарплаты до зарплаты” просто потому, что не выбирают осознанно метод ведения бюджета. Две самые обсуждаемые системы — Zero-Based Budgeting и правило 50/30/20. Понять разницу важно не только ради цифр: от этого зависит, разберёшься ли ты с долгами, накопишь ли…

-

Latest personal finance trends and what recent news means for your wallet

Why Personal Finance News Suddenly Feels So Urgent News about inflation, interest rate cuts and new fintech tools is no longer abstract background noise: it directly impacts how far your paycheck goes and how fast your savings grow. The latest personal finance trends 2025 are shaped by three big forces: expensive credit, volatile markets and…

-

Money moves to make in your 20s, 30s, 40s and 50s for long-term financial success

Why Your Money Strategy Must Age With You Money habits that work at 23 often backfire at 53. Income, risk tolerance, family load and health risks all shift, so trying to use one static blueprint is a recipe for financial drag. Modern experts recommend structuring financial planning by age 20s 30s 40s 50s as a…

-

Zero-based budgeting vs 50/30/20: choose the budget style that fits your life

Why These Two Budget Styles Get So Much Hype If you’ve ever Googled “how do I finally get my money under control,” you’ve almost certainly bumped into two ideas: zero-based budgeting and the 50/30/20 rule. They’re constantly mentioned in blogs, TikToks, and every personal budget planner compare budgeting methods guide out there. One style wants…

-

How to build a pay yourself first system on a tight budget and start saving

Why “pay yourself first” работает даже на жёстком бюджете Pay yourself first звучит как совет для людей с запасом денег, но на практике это спасательный круг именно для тех, у кого счёт до зарплаты постоянно на нуле. Суть метода проста: при поступлении дохода вы сначала откладываете часть себе – на цели и безопасность, – и…

-

How to automate your savings and grow wealth on autopilot

Why Automating Your Savings Works Better Than Willpower Автоматизация накоплений звучит как что‑то сложное и «для продвинутых», но по факту это просто способ убрать из финансов человеческий фактор: лень, забывчивость и импульсивные решения. Вместо того чтобы каждый месяц убеждать себя «в этот раз точно отложу денег», вы один раз настраиваете систему — и она тихо…

-

Index funds vs individual stocks: key insights every new investor should know

Нervous about choosing between index funds and individual stocks? You’re not alone. Almost каждый начинающий инвестор упирается в этот выбор, а в платных консультациях на него уходит половина первой встречи. Ниже — разбор на простом языке, с практическими примерами и тем, как смотрят на эту дилемму профессиональные управляющие. Что вообще такое индексный фонд и чем…

-

How to negotiate lower interest rates and reduce your debt faster

Why Negotiating Interest Rates Matters More Than Ever The cost of borrowing has quietly turned into one of the biggest household expenses. In the US, the average credit card APR has climbed above 22% according to Federal Reserve data from 2024, and many borrowers with weaker credit see rates over 28%. At those levels, even…

-

Zero-based budgeting for beginners: step-by-step guide to mastering your money

Why Zero-Based Budgeting Is Different (And Why Beginners Actually Stick With It) Most people think “budget” means writing down some numbers and then feeling guilty when reality doesn’t match the plan. Zero-based budgeting flips that idea: instead of guessing and hoping, you give every single dollar a specific job before the month begins, so that…

-

Financial plan for a creative entrepreneur: step-by-step guide to success

Why creatives need a real financial plan (not just “I’ll figure it out”) Most creative entrepreneurs строят карьеру на идеях, а не на таблицах. Но рынок стал жёстче: по данным Upwork за 2023 год, количество фрилансеров в США достигло примерно 64 млн человек, и креативные индустрии растут быстрее среднего. При этом исследование FreshBooks (Self-Employed Report…