Category: Budgeting Basics

-

How to build wealth with consistent investing over time and grow your money steadily

Почему в 2025 году “просто откладывать” уже не работает В 2025 году денег на депозите или под матрасом явно недостаточно: инфляция, рост цен на технологии, жильё и образование съедают накопления быстрее, чем растут проценты по вкладам. Чтобы реально двигаться к финансовой свободе, нужен осознанный, повторяемый процесс инвестирования, а не разовые рывки. Консистентное инвестирование — это…

-

401(k) contributions explained: a practical guide to grow your retirement

Most people first meet their 401(k) on day three of a new job: a stack of HR forms, a vague mention of “free money,” and a box that asks how much of your paycheck you want to send into the void. This guide is meant to make that void less mysterious and more like a…

-

Practical guide to budgeting for a thrifty family and saving more every month

Why a “Thrifty” Family Budget Is Not About Deprivation Before diving into spreadsheets and apps, it helps to переосмыслить само понятие «экономная семья». Thrifty doesn’t mean living in constant restriction; it means ваша семья осознанно решает, куда идут деньги, и получает максимум ценности из каждого доллара. В реальной жизни это выглядит так: вы снимаете с…

-

How to save on entertainment costs without sacrificing fun or experiences

Why Entertainment Got So Expensive (And What Changed by 2025) Еще десять–пятнадцать лет назад «развлечения» чаще всего означали поход в кино, ресторан, клуб или крупный концерт. Тратишь — отдыхаешь. Не тратишь — сидишь дома. Потоковые сервисы только набирали обороты, VR был игрушкой для гиков, а локальные «бюджетные» варианты мало кто реально искал. Сейчас, в 2025…

-

Secure digital wallet: how to protect your finances online

What a secure digital wallet really is (and what it isn’t) A secure digital wallet is an app or hardware device that stores your payment cards, bank details and sometimes documents, then uses encryption so nobody can read them without your keys. Think of it as a locked safe that only opens when you authenticate…

-

Paying off student loans faster: a realistic guide to becoming debt free

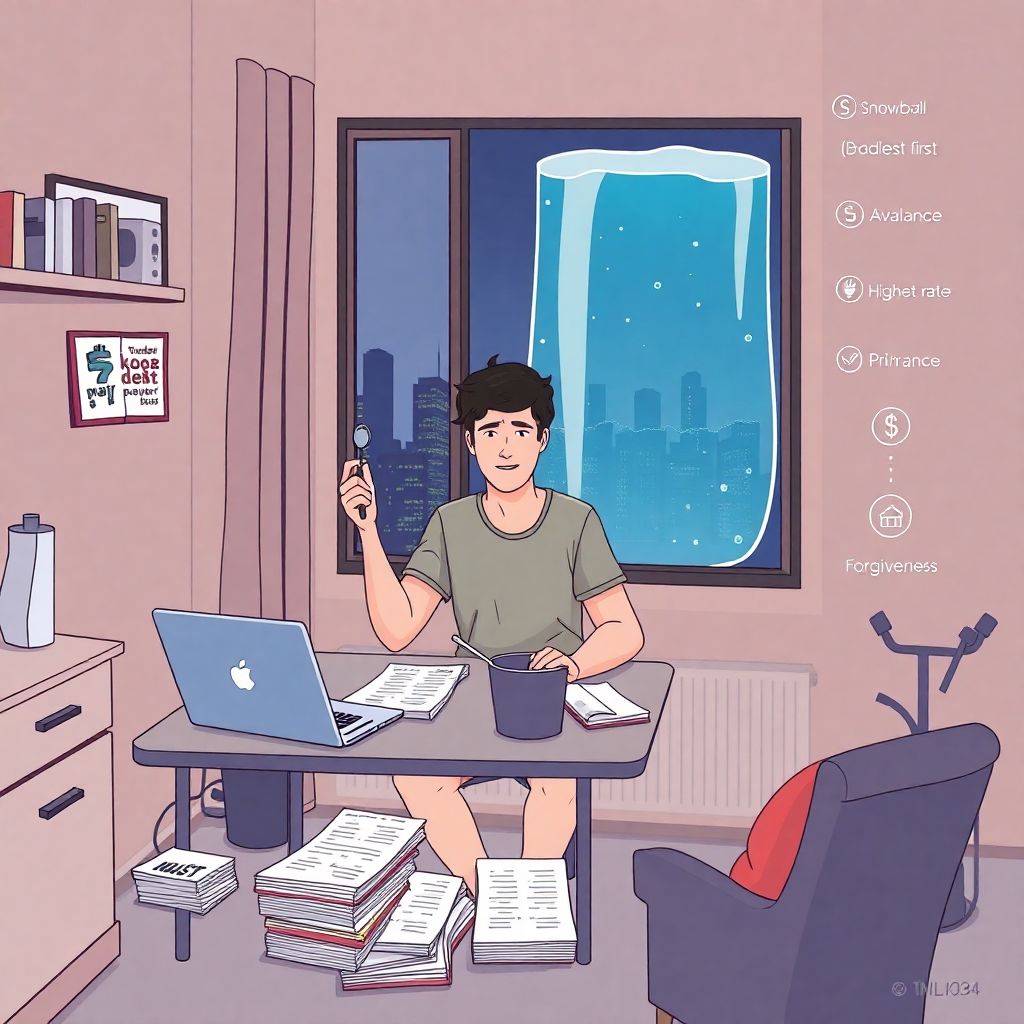

Paying off student debt can feel like trying to empty a swimming pool with a spoon, especially when everyone online screams “pay off student loans fast!” without mentioning rent, groceries and real life. Let’s walk through a realistic approach: where эти кредиты вообще взялись, какие стратегии действительно работают, чем они отличаются друг от друга и…

-

How to save for a dream purchase without delaying your financial goals

Most people think a dream purchase automatically means sacrificing everything else: no investments, no travel, no fun. That trade-off used to be almost нормой, но с 2025 года финансовая среда сильно изменилась: появились умные приложения, дробные инвестиции, скоринговые сервисы. Ниже — практическое руководство по how to save money for a big purchase, не откладывая другие…

-

How to start investing with little money and grow your wealth over time

Why Investing Small Amounts Matters in 2025 Ин 2025, letting money sit in a savings account is basically watching it shrink quietly from inflation. That’s why learning how to start investing with little money is no longer a “nice to have”, it’s basic financial hygiene. Even 20–50 dollars a month, вложенные регулярно, начинают работать как…

-

How to create a realistic debt payoff schedule and become debt free faster

Why a Realistic Debt Payoff Schedule Beats “Willpower” Every Time Most people don’t fall into debt because they’re lazy; they fall in because life is messy and money is emotional. A realistic debt payoff schedule is simply a written plan that connects your actual income, your actual expenses, and your actual balances into a timeline…

-

How to build a wealth plan that scales with you and grows long term

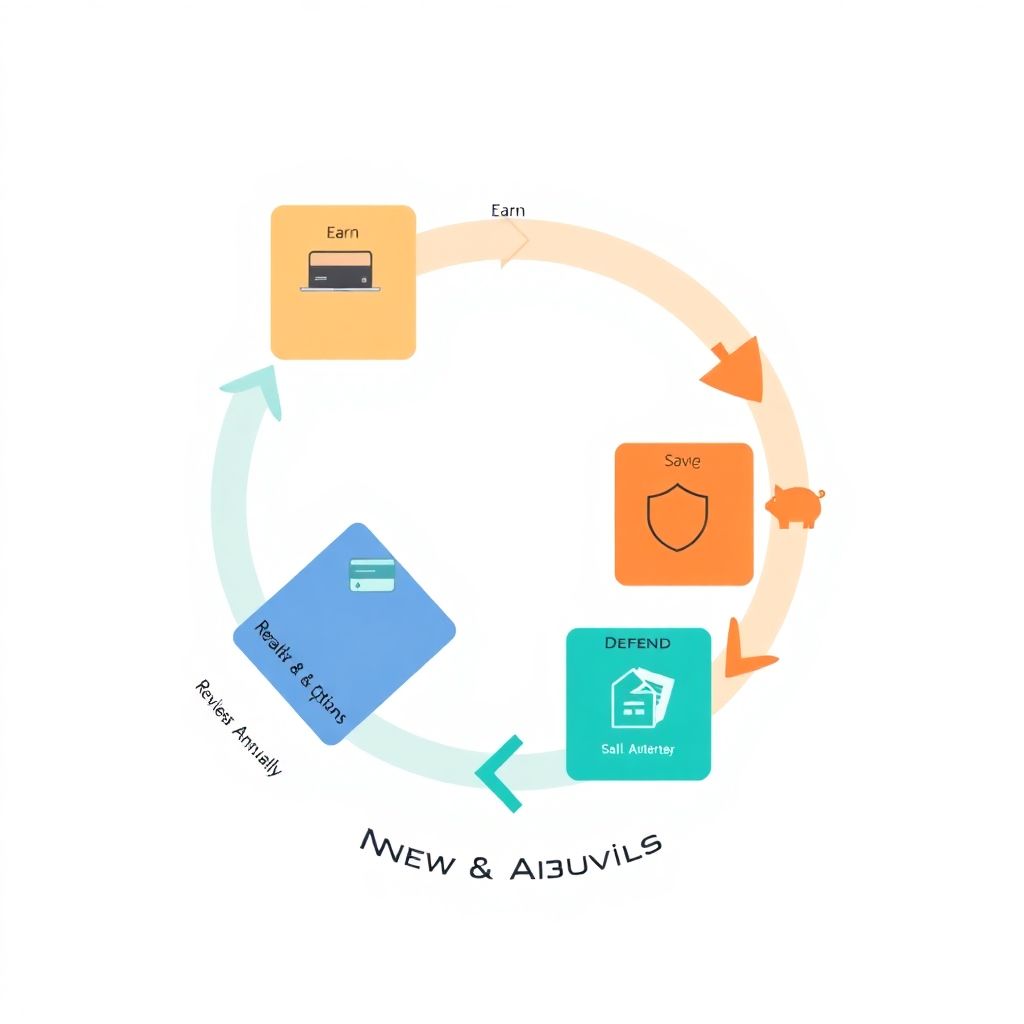

Why a “Scalable” Wealth Plan Beats a One‑Off Budget Most people treat money planning like a one‑time project: you sit down, make a budget, open a brokerage account, feel virtuous for a week and then life changes and the plan doesn’t. A scalable wealth plan is different. It’s a system that can handle a bigger…