Most people don’t actually want a “budget”; they want a life where money supports what matters instead of running the show. A value-based budget does exactly that: it turns your priorities—family, health, freedom, learning, impact—into concrete spending decisions. Surveys in the US and Europe consistently show that roughly 60% of people don’t follow a detailed plan for their money, and yet those who do report lower stress, more savings, and faster debt paydown. So the goal here isn’t to restrict you, but to design a money system that feels like you, not like a generic spreadsheet from a bank brochure.

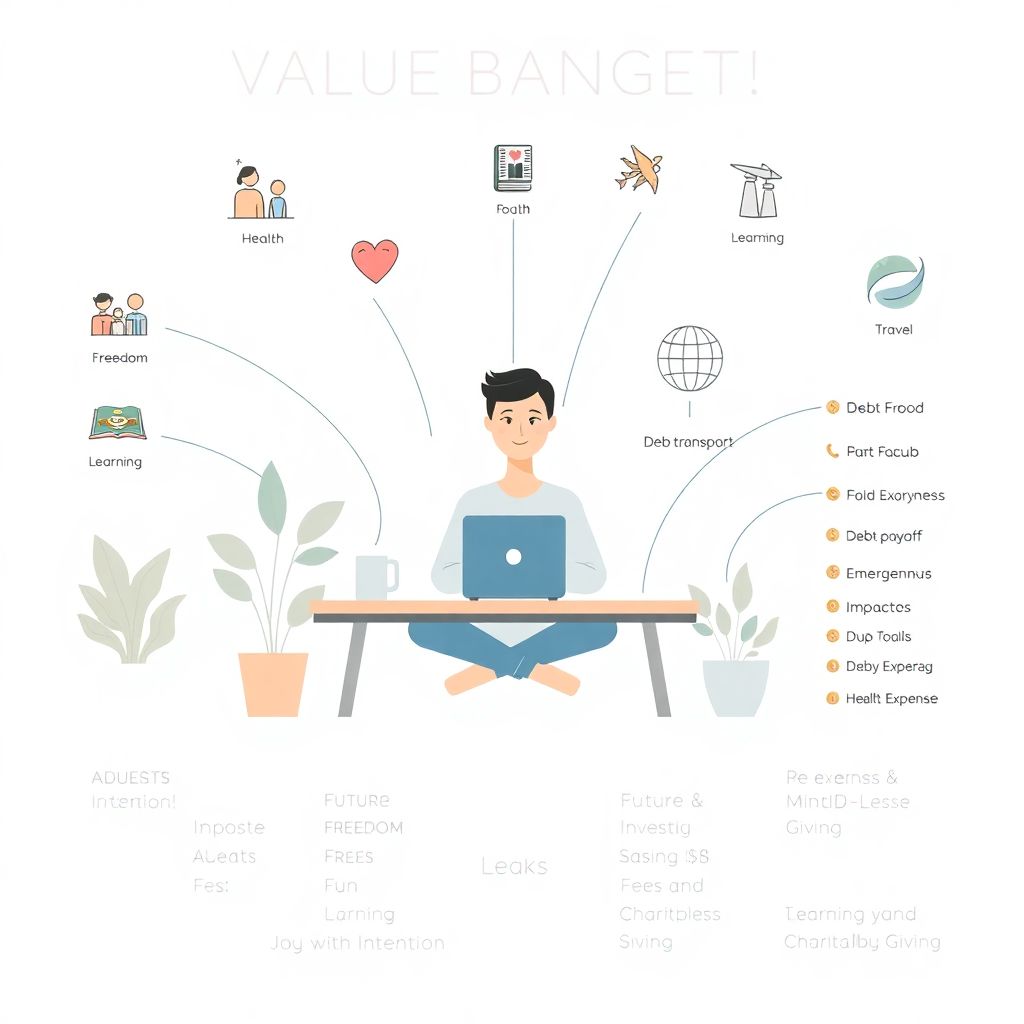

Start With Your Values, Not the Numbers

Before opening a spreadsheet or a personal budget planner online, grab a piece of paper. Experts in behavioral finance, like professors at leading business schools, recommend starting with a short values exercise because people are more likely to stick with a plan that reinforces their identity. Write down 5–7 things that matter most to you: maybe “time with kids”, “creative work”, “health”, “security”, “travel”, “giving back”. Then ask yourself: “Where did my last three months of spending actually go?” Most people are surprised to see that their money flows toward habit and convenience, not intention, and this gap is precisely where a value-based budget can change your trajectory.

Audit Your Real Spending with Radical Honesty

Download your last 3–6 months of transactions from your bank and cards; many of the best budgeting apps for personal finance can categorize this for you automatically, which saves hours. Personal finance coaches say this “money MRI” is the key diagnostic step most people skip. Group every expense into broad categories: Housing, Food, Transport, Debt, Health, Fun, Learning, Giving, and “Leaks” (fees, random impulse buys). Global inflation over the last few years has quietly nudged many categories upward, especially housing and groceries, so don’t be shocked by higher totals. The point is not to feel guilty but to see, in black and white, where your cash actually lives.

Translate Values into Concrete Spending Categories

Now map your values to specific budget categories. If “health” is a top value, that might mean more allocated to good food, a gym membership, or therapy—and less to low-value convenience spending. If “freedom” matters, then an aggressive debt payoff and robust emergency fund belong high on your list. Behavioral economists note that when people label categories with emotionally meaningful names—“Future Freedom Fund” instead of just “Savings”—they stick to contributions more reliably. This alignment process turns your budget from a guilt spreadsheet into a values playbook, which research suggests significantly improves long-term adherence.

Build the First Draft of Your Values-Based Budget

Now it’s time to create the actual numbers. Start with your average monthly income after tax. Then assign ranges to each value-based category instead of obsessing over perfect numbers on day one. For instance, you might aim for 50–60% of income for essentials, 10–20% for long-term goals (debt, savings, investing), and the rest for “joy with intention”. Many advisors highlight that even a 1–2% shift each month from low-value to high-value spending compounds massively over a decade because it either reduces interest costs or grows invested capital. Think of this first draft as a hypothesis you’ll refine, not a law carved in stone.

Step-by-Step: Put the Budget into Daily Life

Below is a practical sequence many financial planners use with clients to turn a value-based plan into daily behavior:

1. Calculate your real monthly income (after tax, after irregular extras) over the past 6–12 months.

2. Average your spending by category from your transaction audit and compare it to your value-based target categories.

3. Decide on 2–3 immediate shifts (for example, cut delivery food by 20% and redirect to savings + therapy).

4. Automate transfers on payday to savings, debt, and priority categories so decisions happen once, not every day.

5. Set a weekly 15-minute “money check-in” to track where you stand and make tiny adjustments.

6. Review the entire budget every quarter, updating for income changes, inflation, or life events.

Advisors stress that implementation, not perfection, is what changes net worth and stress levels. Even partial adherence to a plan that reflects your values tends to beat strict adherence to one that doesn’t.

Choose Tools That Fit Your Personality (Not the Other Way Around)

Technology can either turbocharge or completely derail your efforts, depending on the match with your habits. If you love automation, using the best budgeting apps for personal finance with bank syncing, goal tracking, and alerts can reduce friction so you barely touch spreadsheets. If you’re more tactile, a printable system or customizable budget templates download might make more sense, especially if you like highlighting and writing notes. Many modern platforms now act as a personal budget planner online, letting you set rules—like automatically moving any income above a certain level into investments or savings—so your priorities are protected before impulse spending kicks in.

When Expert Help Supercharges Your Progress

For some people, information isn’t the problem—behavior is. That’s where financial coaching for personal budgeting can make a measurable difference. Certified financial planners and money coaches report that clients who meet even quarterly tend to increase savings rates by several percentage points and pay off consumer debt years faster. A coach can help you analyze your money story, identify emotional triggers, and customize your plan to your neurotype and lifestyle. If full one-on-one coaching feels expensive, many professionals now offer group cohorts or an online course on creating a personal budget, which blends education with accountability at a lower cost. This emerging coaching market is expanding quickly as more people seek personalized guidance rather than generic advice.

The Bigger Economic Picture: Why Your Budget Choices Matter

On the surface, a personal budget looks like a private spreadsheet; in aggregate, it is a powerful economic force. When millions of households redirect spending from high-interest debt and low-value consumption toward savings, education, and health, it shifts demand patterns in the broader economy. Economists point out that higher household savings and lower unsecured debt improve financial resilience, which in turn stabilizes consumption during downturns and reduces systemic risk. In many developed countries, household debt-to-income ratios remain historically elevated, so widespread adoption of more deliberate, value-based budgeting could gradually strengthen national balance sheets and reduce vulnerability to shocks like spikes in interest rates or energy costs.

How Value-Based Budgeting Reshapes the Financial Industry

Your decision to align money with values also nudges the financial industry itself. As more people seek ethical investing options, transparent fee structures, and tools that prioritize user wellbeing over engagement-at-all-costs, financial institutions are forced to adapt. The surge in budgeting and money-management apps over the last decade has turned into a competitive landscape where user experience, behavioral design, and mental-health-aware features now matter for market share. Fintech firms are integrating coaching elements, journaling prompts, and community features into their platforms because data clearly shows that emotional alignment, not just calculators, keeps users active. Over time, this demand for values-based tools can push the industry toward more responsible products and away from pure credit-pushing models.

Trends and Forecasts: Where Personal Budgeting Is Headed

Industry analysts forecast continued growth in digital money-management tools as younger generations demand personalization and simplicity. We’re already seeing AI-driven apps that predict cash-flow issues days in advance, nudge you before you overspend in a weak category, and suggest real-time trade-offs consistent with your past choices and stated values. As open-banking regulations expand, your financial data will likely be more portable, allowing you to switch to systems that better match your priorities without starting from scratch. Experts expect that within the next decade, many workers will treat value-based budgeting as a standard life skill, much like using email, and employers may increasingly offer budgeting education and tools as part of wellness benefits because financially stable employees are more productive and less stressed.

Expert-Backed Habits That Make Your Budget Stick

Seasoned planners and coaches repeatedly see the same habits separate those who succeed from those who drift: they keep the system simple enough to maintain on a bad week; they automate the most important moves; and they tie money goals to vivid, emotional pictures of the future. Many recommend a short monthly “money date” with yourself or your partner, where you review wins, problem spots, and upcoming expenses while reconnecting to your values. Research in behavioral science supports this: frequent, low-pressure check-ins beat occasional, high-stress overhauls. By making your budget an ongoing conversation rather than a one-time New Year’s resolution, you turn a static plan into a living map that grows with your life.

Putting It All Together

Creating a personal budget that reflects your values isn’t about chasing perfection or copying an influencer’s template. It’s about clearly naming what matters, mapping your actual spending, then gradually shifting flows of money so your daily choices line up with your deeper priorities. With honest data, practical tools—from a simple notebook to a sophisticated personal budget planner online—and, if needed, guidance from experts or a structured online course on creating a personal budget, you can build a system that reduces anxiety and strengthens both your personal life and, in a small but real way, the wider economy. Your budget becomes less of a restriction and more of a lens that keeps your time, energy, and money pointed in the same direction.