Why your tax refund is a serious investing opportunity

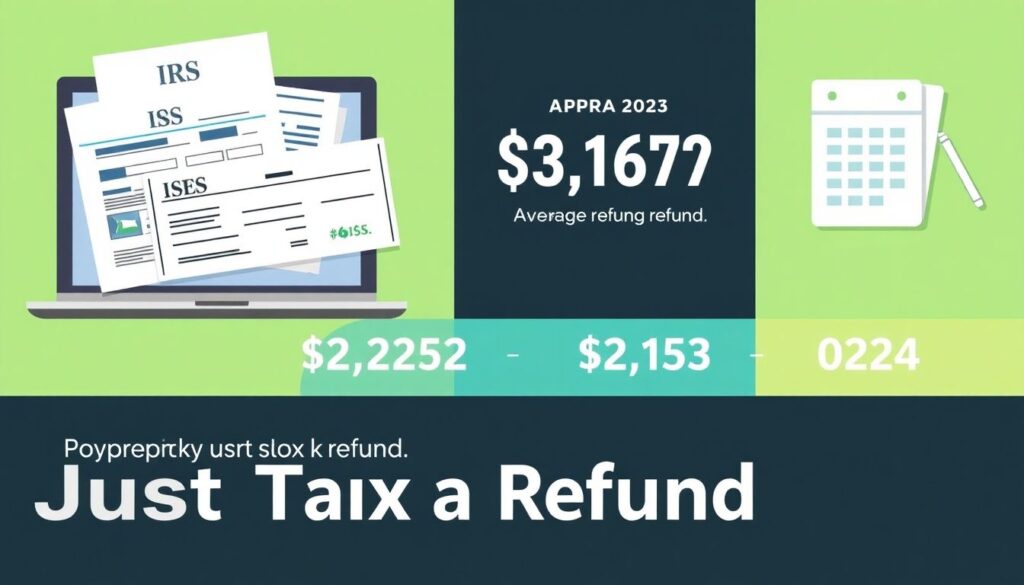

Let’s put some numbers on what “just a refund” really is.

According to IRS statistics, the average federal tax refund in the U.S. was about $3,253 in 2022 and roughly $3,167 in 2023. Early-season IRS data for the 2024 filing year (for 2023 tax returns) shows average refunds trending slightly lower again, hovering a bit above $3,000. That’s still a sizeable chunk of money dropping into many people’s accounts once a year.

If you treat that refund as investment capital instead of “bonus spending money,” the math changes quickly. A $3,000 refund invested annually at a 7% average return can grow to roughly $123,000 in 20 years—without you increasing the amount at all. That’s the hidden power we’re talking about when people search for the *best ways to invest tax refund* money instead of letting it evaporate on impulse buys.

And because it’s already “out of sight, out of mind” throughout the year, psychologically it’s one of the easiest sources of investment cash you’ll ever handle.

—

Necessary tools before you invest a single dollar

Think of your tax refund as fuel. Before you pour it in, you need a working engine. That “engine” is a set of accounts, apps, and guardrails that make your decisions repeatable instead of random.

1. The right accounts and platforms

You don’t need a Wall Street setup. But you do need a few basic containers for your money:

– High‑yield savings account

For emergency funds and near-term goals (1–3 years). Look for FDIC/NCUA insurance and a competitive APY, often far higher than big brick‑and‑mortar banks.

– Retirement accounts (IRA, 401(k), etc.)

If you’re wondering *how to invest tax refund for retirement*, this is where you start: Roth IRA or traditional IRA, and possibly boosting contributions to a workplace 401(k) or 403(b).

– Taxable brokerage account

For flexible long‑term investing (5+ years) outside retirement limits. Low-cost index funds and ETFs are usually the backbone here.

– Health Savings Account (HSA), if eligible

Triple tax advantage (pre‑tax contribution, tax‑free growth, tax‑free medical withdrawals) makes this arguably one of the most powerful accounts available.

You can open all of these at major brokerages or banks in under an hour. The tools matter less than your commitment to use them consistently.

2. Information and planning tools

The next step is reducing guesswork.

You’ll want:

– A basic budgeting or cash‑flow app (or a spreadsheet) to confirm how much of the refund you can lock away without hurting your monthly life.

– A free credit report and credit‑score tracker to see the true cost of your debts.

– A simple retirement calculator to estimate how extra contributions from your refund move your “retirement readiness” date.

None of this has to be complicated. The goal is to see clearly: debts, savings, and long‑term targets in one mental picture.

—

Step-by-step process: turning your refund into investments

Here’s a systematic way to allocate your tax refund so you’re not just winging it once a year.

Step 1. Stabilize: Build or top up your emergency fund

Before chasing returns, protect yourself from surprises.

Aim for 3–6 months of essential expenses in a high‑yield savings account. If that number sounds huge, use your refund to close the gap gradually. Even moving from 0 to one full month of expenses is a major financial upgrade.

A strong emergency fund keeps you from turning every setback into new credit‑card debt—indirectly boosting your investment power over time.

—

Step 2. Attack expensive debt strategically

The classic dilemma is *using tax refund to pay off debt or invest*. Mathematically, high‑interest debt almost always wins the “urgency” contest.

As a rule of thumb:

– Debt with interest above ~6–7% usually beats expected stock-market returns after taxes and risk.

– Credit-card debt at 18–25%+ is a guaranteed negative “investment” every month you let it sit.

Smart play:

Use a chunk of your refund to knock down any double‑digit interest balances. That can mean:

– Making a large one‑time payment on your highest‑rate card (debt avalanche approach).

– Paying fees to refinance or consolidate into a lower-rate loan, if the math clearly favors you.

– Getting just enough of a breathing room to stop relying on cards at all.

You’re not just freeing up cash; you’re buying back your future investment returns.

—

Step 3. Turbocharge retirement contributions

Once the emergency‑debt foundation is stronger, the next layer is long‑term wealth. This is where *how to invest tax refund for retirement* comes into full focus.

High‑impact options:

– Roth IRA contribution

Especially compelling if you expect to be in a higher tax bracket later. You invest after‑tax dollars now, and qualified withdrawals in retirement are tax‑free.

– Traditional IRA contribution

Helps reduce your taxable income today (if you qualify), giving you an immediate tax benefit.

– Extra 401(k) contribution

You can’t directly deposit your refund into a 401(k), but you can increase your payroll contribution and use the refund to cover living expenses. This effectively “funnels” more of your salary into the plan.

If you’re under 50, the IRA annual limit for 2024 is $7,000 (with a catch‑up allowance if you’re 50+). Even directing half of an average refund into an IRA each year can materially change your retirement picture over a decade.

—

Step 4. Invest for medium- and long-term goals

After retirement allocations, look at other goals:

– House down payment in 5–10 years

– Starting a business

– Funding a child’s education

– Building a “work optional” lifestyle earlier than traditional retirement

For these, a taxable brokerage account with diversified investments is usually the cleanest tool.

Common building blocks:

– Broad U.S. stock index funds (e.g., tracking the S&P 500 or total market)

– Broad international stock funds

– Bond funds if your timeline is shorter or your risk tolerance is lower

The analytical question isn’t “What’s the hottest stock?” but “What asset mix gives me the highest odds of meeting this goal on time?”

—

Step 5. Invest in your earning power

Not every investment lives in a brokerage account. Some of the highest returns come from improving your skills and opportunities.

You might use a slice of your refund for:

– A certification that raises your salary or promotion odds

– Tools or software that let you freelance or start a side business

– Courses in negotiation, data skills, or another in-demand area

A one-time $1,000 course that leads to an extra $5,000 a year in income beats almost any market return you’ll ever see.

—

Smart investment angles for your 2025 refund

If you’re planning ahead for *smart investments for tax refund 2025*, it helps to zoom out and look at recent trends.

From 2022–2024, Americans dealt with:

– Elevated but cooling inflation

– Rapid interest-rate hikes, then a plateau

– Stock markets that swung between volatility and strong recoveries

Here’s how those realities shape 2025 decisions:

1. Higher cash yields changed the game

When savings accounts pay 4–5% instead of near‑zero, parking short‑term money in high‑yield savings or short-term Treasuries becomes more attractive. For money you need in the next 1–3 years, this is a rational use of your refund.

2. Volatility is normal, not a bug

Equities still historically outpace inflation over long periods. Using your refund as part of an automatic, once‑a‑year “buy and hold” strategy is a simple way to take advantage of volatility instead of fearing it.

3. Debt paydown returns are still “risk‑free”

If your card is charging 20% interest, paying that down with your refund is effectively a guaranteed 20% return—far better than almost any plausible investment in a single year.

One simple 2025-friendly split for a typical household might be:

– 30–40% to high‑interest debt

– 30–40% to retirement accounts (401(k)/IRA/HSA)

– 10–20% to taxable investing for other goals

– 10–20% to skill-building or upcoming big expenses

You can tweak the percentages, but the mental model—debt, safety, long‑term growth, human capital—stays the same.

—

Troubleshooting common problems when investing your refund

Even with a clear plan, real life will still throw curveballs. Here’s how to handle the usual stumbling blocks.

Problem 1: “The market looks scary right now”

It always does, for one reason or another.

Data from the past several decades shows that time in the market has mattered far more than timing the market. Many of the best days follow some of the worst days, and trying to guess them has historically hurt most investors.

Practical fixes:

– Turn your refund into automatic contributions (e.g., split it into monthly investments over 3–6 months) instead of one big lump sum if that helps your nerves.

– Stick to diversified, broad‑market funds rather than individual stocks. That removes company‑specific drama from the equation.

Your job isn’t to outsmart short‑term traders; it’s to compound steadily over years.

—

Problem 2: Cash-flow emergencies after you’ve invested

Maybe you invested aggressively and then your car dies or you lose a shift at work.

If that happens:

– First, tap your emergency fund, not retirement accounts.

– If you don’t have one, that’s the signal that next year’s refund should prioritize building it.

– Only after exhausting those options should you consider selling investments, and even then, look at tax implications and possible penalties (especially for early retirement-account withdrawals).

This is exactly why the order—emergency fund, then debt, then long-term investing—exists. It’s not theory; it’s crash protection.

—

Problem 3: Analysis paralysis

You read ten articles, watch five videos, and end up doing… nothing.

To cut through that:

– Pre‑decide a simple default plan: for example, “Each year, 50% of my refund goes to debt, 30% to retirement, 20% to a broad stock-market index fund.”

– Automate every part you can. If possible, route the refund into a dedicated savings account and then set automatic transfers from there to your investment accounts on fixed dates.

– Review once a year instead of every week. You’re allowed to be “boringly consistent.”

The biggest cost of overthinking is not the wrong choice; it’s the absence of any choice.

—

When to get professional guidance

Not everyone needs an advisor, but certain situations justify paying for expertise.

Consider seeking financial advisor help invest tax refund funds if:

– You have a mix of stock options, RSUs, or business income that complicates your tax picture.

– You’re deciding between large competing goals (paying off a mortgage faster vs. investing more, early retirement vs. college funding, etc.).

– Your net worth has grown enough that tax planning, estate planning, and risk management really matter.

Look for:

– Fiduciary advisors who are legally obligated to act in your best interest.

– Clear, understandable fee structures (flat fee or percentage of assets, not hidden commissions).

– Someone who talks more about your *goals and behavior* than about hot stocks.

Even a one‑time session can help you validate your plan for this year’s refund and set a blueprint for the next decade.

—

Putting it all together

Your tax refund is not a windfall; it’s a once‑a‑year chance to shift your trajectory.

Use it to:

– Fortify your defenses (cash buffer, less toxic debt).

– Accelerate long‑term growth (retirement and taxable investing).

– Expand your opportunities (skills and tools that increase your income).

If you treat every refund from now on as committed investment fuel instead of surprise spending money, you don’t need perfect stock picks or complex strategies. You just need a repeatable process and the discipline to follow it year after year.