Most people don’t need a finance degree to get their money under control; they need a clear map, a few tools and the habit of checking in regularly. A balanced budget is simply a plan where your income comfortably covers expenses, debt payments and savings, without constant mini‑crises before every payday. Below is a practical roadmap you can start using this week, even if your finances currently feel chaotic or you’ve tried and “failed at budgeting” before.

—

Understanding What a Balanced Budget Really Means

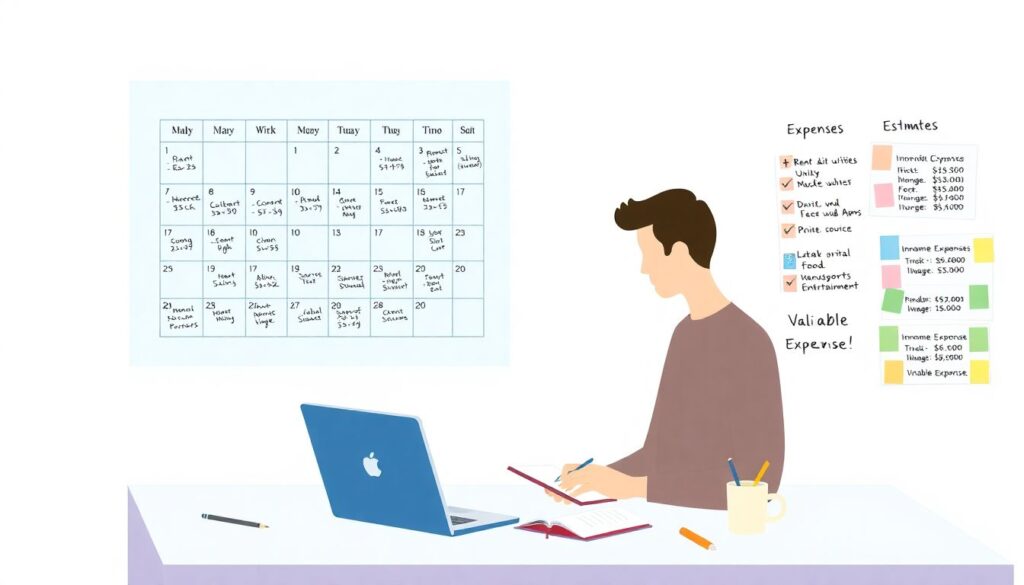

A balanced budget isn’t about perfection or denying yourself every pleasure. Вasically, you decide in advance what each unit of your income will do: pay fixed bills, handle food and transport, reduce debt, grow investments, fund fun. Over a few months, this plan stabilizes cash flow and shrinks the gap between paydays and obligations. From a popular‑science angle, budgeting works like feedback control in engineering: you observe the system (your money flows), compare it with a target (your goals), then adjust. The closer and more frequently you track, the less drama and surprise you get.

—

Necessary Tools for Modern Budgeting

Apps, Accounts and Simple Spreadsheets

To make progress, you need visibility more than complexity. The best budgeting apps for personal finance connect to your bank accounts, categorize spending automatically and show where money leaks out. If you prefer simple tools, a spreadsheet with three columns—income, fixed costs, flexible costs—already works. Learning how to create a monthly budget plan often starts by looking back three months and averaging real expenses instead of guessing. Separate accounts for “bills”, “everyday spending” and “savings” create physical boundaries that protect your goals, much like separate lab containers keep experiments from contaminating one another.

Human Help and Education

Digital tools aren’t always enough. A qualified financial advisor for budget planning can help you prioritize debts, choose realistic savings rates and avoid emotional decisions during stressful months. If that feels too formal, local community centers, libraries and even credit unions often host free workshops or provide debt payoff and budgeting services near me–style assistance, just without the marketing phrase attached. For self‑paced learners, online budgeting courses for managing money explain core concepts—cash flow, interest, risk—in everyday language and give structured exercises so you actually apply what you learn instead of just nodding along.

—

Step-by-Step Process to Reach a Balanced Budget

Map Your Money Flows

Before optimizing, you need an honest snapshot. For 30 days, record every inflow and outflow—app, notebook, spreadsheet, anything you’ll actually use. Then:

1. List all sources of income and their exact dates.

2. List fixed expenses (rent, utilities, subscriptions) with due dates.

3. Estimate variable costs (food, transport, leisure) using the last 2–3 months.

4. Rank debts by interest rate and minimum payment.

5. Compare totals: income vs. expenses + debt + savings.

This transforms vague anxiety into concrete numbers. If the result looks ugly, that’s useful data, not a moral verdict. Now you know what must change.

Adjust, Automate and Prioritize

When the initial picture is clear, you start sculpting. First, trim or renegotiate anything that gives poor value: unused subscriptions, overpriced phone plans, frequent delivery. Next, decide non‑negotiables: a base savings amount and at least minimum payments on all debts, then add extra to the highest‑interest one. Automation is your ally: schedule transfers to savings and debt right after payday so your “future self” gets paid before your impulses. Restructure your calendar so big bills don’t cluster in the same week, and when possible, synchronize due dates with income to reduce reliance on credit cards between paychecks.

—

Troubleshooting Common Budget Problems

When the Numbers Never Seem to Work

If the math refuses to balance, you’re facing either an income problem, a cost problem, or both. Systematically test each side. On the expense side, revisit housing, transport and food—these three categories usually dominate the budget. Can you downsize, share costs, switch to public transport, cook more at home? On the income side, explore overtime, freelancing, selling unused items, or retraining into better‑paid roles. When high‑interest debt keeps you underwater, nonprofit credit counseling or community‑based debt payoff and budgeting services near me–type organizations can negotiate rates or structure manageable plans, often more affordably than commercial “debt relief” ads.

Staying Motivated Over the Long Haul

Psychologically, the hardest part isn’t starting, it’s continuing after a bad month. Treat budgeting like a health plan: relapses happen, but the trend matters. Build small, visible wins—a tiny emergency fund, one fully paid‑off card, a month with no overdraft fees. Review your numbers at a fixed weekly time, ideally with a partner or friend, to turn money from a source of shame into a shared project. Use visual cues: progress bars for debt, charts for savings, sticky notes for goals. Over time, your “default” self becomes someone who checks the numbers first, rather than someone constantly surprised by them.

—

The Future of Budgeting: Outlook Beyond 2025

AI, Automation and Personalized Money Coaching

As of 2025, budgeting is rapidly shifting from manual tracking to intelligent assistance. New tools don’t just show past spending; they predict upcoming cash crunches, warn you before subscriptions renew, and simulate how choices today affect savings years ahead. Expect apps that behave like a gentle coach, blending behavioral psychology and data science: they’ll adjust goals during stressful periods, negotiate some bills automatically, and integrate with micro‑investing and insurance in the background. We’re also likely to see hybrid services where human planners use AI analyses to offer affordable, bite‑sized advice sessions, making structured money help accessible well beyond traditional high‑net‑worth clients.