What Is a Budget, Really?

At its core, a budget is just a plan for your money. Not a prison, not a moral test, not a spreadsheet sent from above. It’s you deciding, in advance, what you want your money to do instead of wondering where it mysteriously disappeared at the end of the month.

Put even more simply: a budget is a written list of all the money that comes in and all the money that goes out, plus a decision on purpose for every dollar. That’s it. No fancy math required, just honesty and a bit of consistency.

—

A Short Historical Detour

The word “budget” comes from the Old French *bougette* — a little leather bag or pouch. In medieval Europe, that pouch was where officials kept documents about taxes and spending. When a government “opened the budget,” they were literally opening the bag with the plans for money.

For centuries, budgets were mainly for kings, states, and big landowners. Ordinary people mostly lived day to day, tracking things in their heads or in tiny notebooks. The idea that everyone should have a personal budget grew in the 20th century with the spread of wages, consumer credit, and, later, online banking.

By now, the logic has flipped: tools that used to be reserved for governments are in your phone, and a “beginner guide to managing personal finances” is something you can find in a two-minute search. The principles, though, haven’t changed much: plan first, spend second, review third.

—

Basic Principles of Budgeting

To use a budget in real life, you don’t need to memorize formulas. But there are a few basic principles that make the whole thing work and keep it from turning into self‑torture.

First principle: every unit of income gets a job. Whether you earn $500 or $5,000, each dollar should be assigned somewhere: rent, groceries, fun, savings, debt, investing. Money without a job tends to vanish into impulse buys and random subscriptions you forgot about.

Second principle: plan by month, act by week, adjust by day. Most bills repeat monthly, so a monthly plan is convenient. But your behavior is daily and weekly. That’s why a budget works best when you look at the big picture monthly, then regularly check in for small course corrections.

Third principle: your budget should reflect your real life, not your fantasy life. An honest budget includes delivery, coffee, hobbies, gifts, and little “treats.” Pretending you’ll never order takeout again usually leads to quitting the plan, not to perfect self‑discipline.

A few more principles that help budgets survive contact with reality:

– Make it simple enough to update in under 10 minutes.

– Automate routine things (bills, savings transfers) when possible.

– Review, don’t judge: use your budget as feedback, not a guilt machine.

—

How to Create a Personal Budget Step by Step

If you’re wondering how to create a personal budget without getting overwhelmed, think of it as a short experiment, not a lifelong contract. Give it one month. You can always redesign it.

Here’s a simple step‑by‑step way to start:

1. Collect your numbers.

– Net income (after tax): salary, freelance, side gigs, regular transfers.

– Fixed expenses: rent, utilities, phone, internet, subscriptions, loan payments.

– Variable expenses: groceries, transport, restaurants, fun, gifts, random stuff.

2. Write down an “honest month.”

For one month, don’t try to be perfect. Just write down everything you actually spend. Use your banking app, notes on your phone, or a notebook. This becomes your real baseline, not an optimistic guess.

3. Group your spending into categories.

For example:

– Housing & utilities

– Food (groceries + eating out, at least at the start)

– Transport

– Health & personal care

– Debts

– Savings & investments

– Fun & lifestyle

4. Decide on targets for next month.

Look at last month’s totals and ask:

– What’s clearly too high for my goals?

– What absolutely must be paid?

– How much can I realistically save or put toward debt?

Adjust categories until your income – expenses ≥ 0 and, ideally, shows at least a small surplus.

5. Plan your paychecks, not just your month.

If you’re paid twice a month, decide in advance:

– What will the first paycheck cover?

– What will the second paycheck cover?

6. Check in once a week.

Spend 5–10 minutes comparing plan vs. actual. Shift money between categories if needed (say, “less restaurants, more groceries”) instead of giving up.

You now have a living budget: a plan you tweak, not a rigid law you break.

—

Real-Life Examples and Simple Frameworks

Different lives need different budget “shapes.” But simple frameworks can give you a starting point so you’re not guessing from zero.

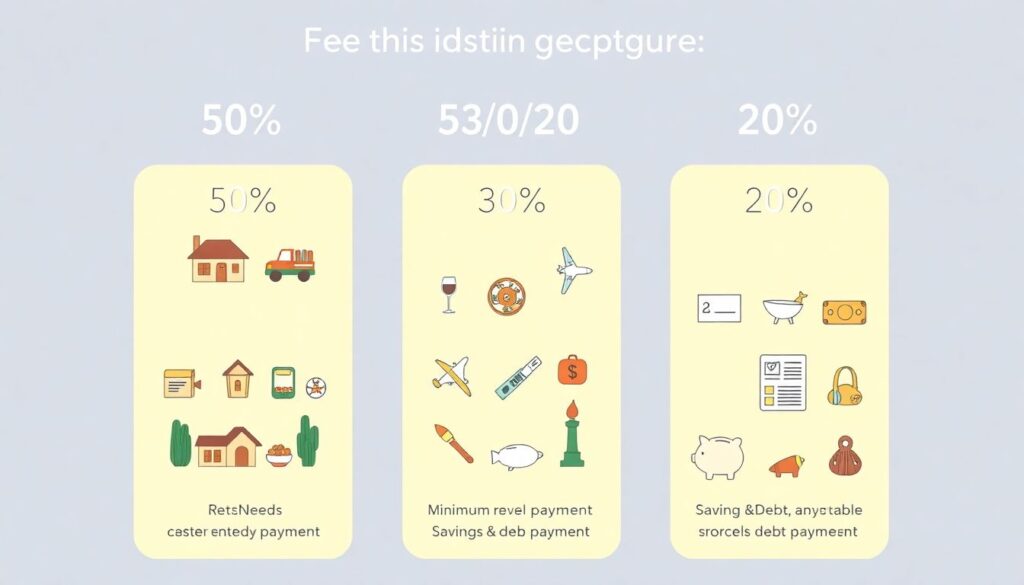

A popular model is the 50/30/20 rule:

– 50% of income: needs (housing, food, transport, minimum debt payments).

– 30%: wants (restaurants, entertainment, travel, hobbies).

– 20%: financial progress (savings, extra debt payments, investments).

If your rent is high, 50% for “needs” might be unrealistic. In that case, the rule becomes a diagnostic tool: if you’re at 65% for needs, maybe the long‑term move is cheaper housing, a roommate, or more income.

Another way is priorities‑first budgeting:

1. Survival (food, shelter, basic bills).

2. Stability (small emergency fund, minimum debt payments).

3. Progress (extra debt, investing).

4. Comfort (quality‑of‑life upgrades).

5. Luxury (things that are nice but non‑essential).

You pay level 1 and 2 no matter what. Level 3 is your main “engine” of financial improvement. Levels 4 and 5 expand as your income grows or as you become more efficient.

Here’s where practical budgeting tips to save money fast fit in. Instead of vaguely “spending less,” look for:

– One or two big recurring costs you can downsize (housing, car, subscriptions).

– Habits that repeat many times a month (coffee out, delivery, convenience snacks).

– Quick wins you can automate, like rounding up purchases into savings.

Shaving $10 off something you do 30 times a month beats one heroic “no spend week” that leaves you exhausted.

—

Tools, Apps, and Templates

You don’t get extra points for suffering through a notebook if you hate writing by hand. The best system is the one you’ll actually use, not the “purest” one.

Digital tools can seriously lower the friction. Many people start with a simple monthly budget planner template in Google Sheets or Excel. You plug in income and categories once, then copy the sheet each month. It’s flexible and transparent, and it forces you to see where the numbers don’t add up.

If you prefer everything on your phone, the best budgeting apps for beginners usually share a few traits:

– Automatic import of transactions from your bank.

– Clear category breakdowns.

– Easy editing on the go.

– Visual summaries (charts, progress bars) that show the big picture quickly.

Well‑known app types include:

– “Envelope” style apps that let you assign every dollar to a category before you spend it.

– Tracker apps that show you where your money went so you can adjust the next month.

– Hybrid tools that combine planning and tracking, often with goal‑setting features.

Whichever route you pick, keep the rule: 10 minutes or less per check‑in. If the process is too heavy, you’ll abandon it. Simpler and consistent beats complicated and abandoned.

—

Common Myths and Mental Traps

Budgeting suffers from a lot of myths that scare people away before they even try.

One myth: “Budgets are only for people who are bad with money.” In reality, it’s the other way around. People who consistently build wealth usually track and plan, not because they’re broke, but because they want their money to match their values and long‑term plans.

Another myth: “Budgeting means I’ll never have fun again.” A well‑designed budget does the opposite: it makes fun safe. When you intentionally assign money to “fun,” you can enjoy it without guilt because you already know the bills and savings are covered.

A third mental trap: “If I messed up this month, I failed.” A budget is more like a fitness tracker than a school test. The point is information and adjustment, not perfection. Overspent on one category? Move some money from another, note what happened, adjust next month’s target.

A few other traps to watch out for:

– All‑or‑nothing thinking. You don’t need to track every cent from day one. Start with the big categories, add detail over time.

– Copy‑paste budgets. Your friend’s perfect system may not fit your income, city, or family situation.

– Ignoring small leaks. One subscription or snack is nothing. Ten of them every month is a pattern that matters.

When you see budgeting as a learning loop instead of a verdict on your character, it becomes much easier to stick with.

—

Putting It All Together

A budget is simply you telling your money where to go before it wanders off. Historically, budgets started as tools for governments; now they’re everyday tools for anyone who wants more control and less anxiety about money.

You’ve now seen the basic principles, a practical walkthrough of how to create a personal budget, examples of frameworks, and how tools like apps and a monthly budget planner template can make the process lighter. More importantly, you’ve seen that a realistic plan includes both progress and pleasure.

If you treat this as your personal beginner guide to managing personal finances, the next steps are small and concrete:

– Track one honest month.

– Choose a simple structure (50/30/20, or your own categories).

– Use a basic sheet or one of the best budgeting apps for beginners to keep it running.

– Review weekly, adjust without drama, and keep going.

With that, budgeting shifts from a chore you avoid to a quiet habit that steadily makes your life easier.