If you work festivals in summer, ski resorts in winter, or jump between gigs on platforms, you already know money doesn’t arrive in neat, equal paychecks. That’s exactly why 2025 is the year to stop winging it and actually learn how to build an emergency fund on a seasonal income. The good news: modern tools finally match your lifestyle. You’ve got high‑yield “vaults” inside neobanks, AI‑based budgeting apps that read your patterns, and even prepaid cards that lock money from impulse spending. Instead of dreaming about a mythical “steady job,” you can build a real buffer around the life you already live, handling off‑season gaps, broken gear, medical surprises and last‑minute travel without panic or high‑interest debt.

Tools that really work for seasonal workers in 2025

First, forget complicated spreadsheets if they scare you; in 2025 your phone is your main money hub. You want one banking app with sub‑accounts or “spaces” to park your emergency stash, and at least one budgeting app that connects to all your cards and wallets, including gig platforms. Turn on automatic transfers during peak seasons, use spending alerts, and make sure your bank supports instant internal transfers so you can reach cash fast without touching credit.

When people ask about the best savings accounts for emergency fund for seasonal workers, what they really mean is: “Where can I park money so it grows a bit, stays safe, and is available in hours, not weeks?” Look for an online bank or digital credit union that offers a high‑yield savings account with no withdrawal penalties, full government deposit insurance, and a simple mobile interface. Avoid locking your entire emergency cushion in long‑term investments or crypto; those are fine for long‑term goals, but for a crisis you want boring, predictable, and easy. If your country allows multiple banks, many seasonal workers open a quiet “out‑of‑sight” savings account at a different app than their everyday spending so they’re less tempted to raid it on slow nights or during festival season splurges.

Step‑by‑step: turning shaky income into a solid buffer

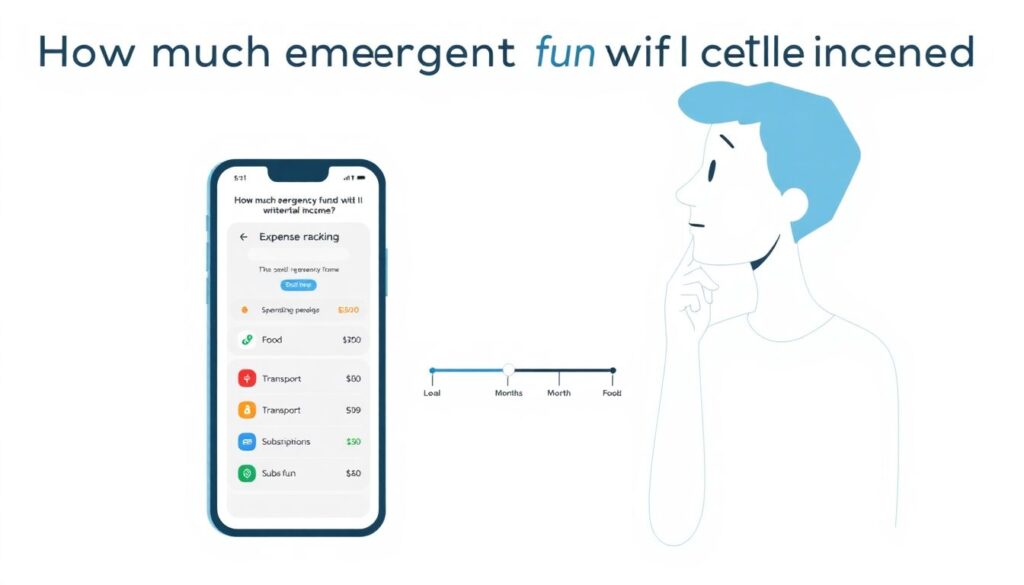

The question “how much emergency fund do I need with irregular income” sounds scary, but it’s actually a sliding scale, not a pass/fail test. Start by tracking three months of spending through an app that automatically categorizes food, rent, transport, subscriptions and random fun. From there, aim first for a tiny win, maybe one month of bare‑bones costs, not your ideal lifestyle. During high season, agree with yourself that a fixed percentage of every payout, say 20–30%, jumps straight to your emergency sub‑account before you see it. That “pay your buffer first” move is the backbone of financial planning for seasonal workers emergency savings in 2025, because apps can now automate it: rules like “every deposit over X moves Y% into savings” mean discipline is coded into your banking, not left to willpower at midnight after a long shift.

You don’t need a perfect system from day one; you just need a plan that survives real life. Practical budgeting tips for seasonal workers to save emergency fund include building two mini‑budgets: an “on‑season” version with aggressive saving targets and an “off‑season” one where you intentionally shrink big expenses like housing, transport, or subscriptions. Some workers house‑sit in low months, switch to prepaid phone plans, or pause non‑essential streaming. The trick is to design these moves in advance, not in panic. Every time money comes in, follow three steps: fund essentials, top up your emergency account according to your rule, then decide what’s left for lifestyle. If a massive gig or overtime boost lands, treat it like “found money” and let most of it jump straight into your safety net before lifestyle inflation catches you.

Troubleshooting: when your plan falls apart

Even the slickest app can’t protect you from real‑world chaos, so let’s be honest: you will have months when the emergency account shrinks instead of grows. That’s normal, not failure. The key is to treat every dip as data, not drama. After a rough stretch, open your banking history and ask two blunt questions: did a genuine emergency hit, or did lifestyle creep eat your buffer? If it was real – broken snowboard, urgent vet bill, last‑minute relocation – good, your system worked. Just turn your savings percentage up slightly next high season. If it was lifestyle stuff – extra takeout, impulse trips, buy‑now‑pay‑later gadgets – adjust the environment: lower card limits, freeze certain cards in the app, or route gig payouts straight to savings first.

The big trend in 2025 is that you no longer have to do any of this alone or from scratch. Most banking and budgeting apps now offer goal‑based saving, AI‑generated cash‑flow projections, and even alerts when your upcoming bills collide with a slow month in your seasonal cycle. Use that tech to stress‑test your plan: simulate a two‑month income gap and see if your buffer survives on‑screen before life throws it at you. When friends in the same seasonal job swap money stories, compare systems, not just horror tales: Which app automation actually works? Who found a bank that doesn’t randomly freeze gig income? Bit by bit, your emergency fund stops being a vague hope and turns into a quiet, reliable teammate that lets you enjoy the wild parts of seasonal work without constantly bracing for disaster.