Category: Новости

-

Smart strategies for paying off debt while saving for the future wisely

Why It’s Smart to Kill Debt and Save at the Same Time Most people think in бинарных категориях: либо гасить долги, либо копить. На практике самые best strategies to pay off debt and save money объединяют оба направления. Причина проста: проценты по долгам «съедают» доход сегодня, а отсутствие накоплений подрывает финансовую устойчивость завтра. Если вы…

-

How to build a robust emergency fund within 3 months and secure your finances

Why a 3‑Month Emergency Fund Is Your First Real Safety Net Let’s keep it simple: An emergency fund is a stash of money that exists only for unexpected, urgent expenses — job loss, sudden medical bills, car breakdown, urgent travel. It is not for vacations, new phones or “I’m tired of cooking, let’s get delivery.”…

-

Smart ways to diversify your income streams and grow financial stability

In 2025 people are finally treating income like a portfolio, not a single paycheck. Automation, AI и геополитические скачки делают карьеру менее предсказуемой, поэтому вопрос уже не в том, стоит ли диверсифицировать доход, а как делать это умно, без выгорания и финансовых авантюр. Ниже разберём практичные подходы, цифры и прогнозы до конца десятилетия. — Why…

-

How to build a debt payoff system for a busy schedule and stay on track

Most people don’t need more motivation to get out of debt; they need a system that runs even when they’re exhausted after work. If your calendar looks like Tetris and your inbox is on fire, building такой system can feel unrealistic. Но как раз для загруженного графика и стоит настраивать процесс так, чтобы он требовал…

-

How to begin your financial journey with a clear money roadmap

Why Your Financial Journey in 2025 Needs an Actual Roadmap, Not Just Good Intentions In 2025 деньги, как ни странно, ведут себя не как раньше. У нас есть крипта, ИИ-подписки, микрозаймы в один клик, франкфуртские ETF и море финансовых приложений, которые обещают «разобраться за вас». В такой обстановке начинать путь к денежным целям без понятного…

-

Practical steps to achieve a balanced budget and improve your finances

Most people don’t need a finance degree to get their money under control; they need a clear map, a few tools and the habit of checking in regularly. A balanced budget is simply a plan where your income comfortably covers expenses, debt payments and savings, without constant mini‑crises before every payday. Below is a practical…

-

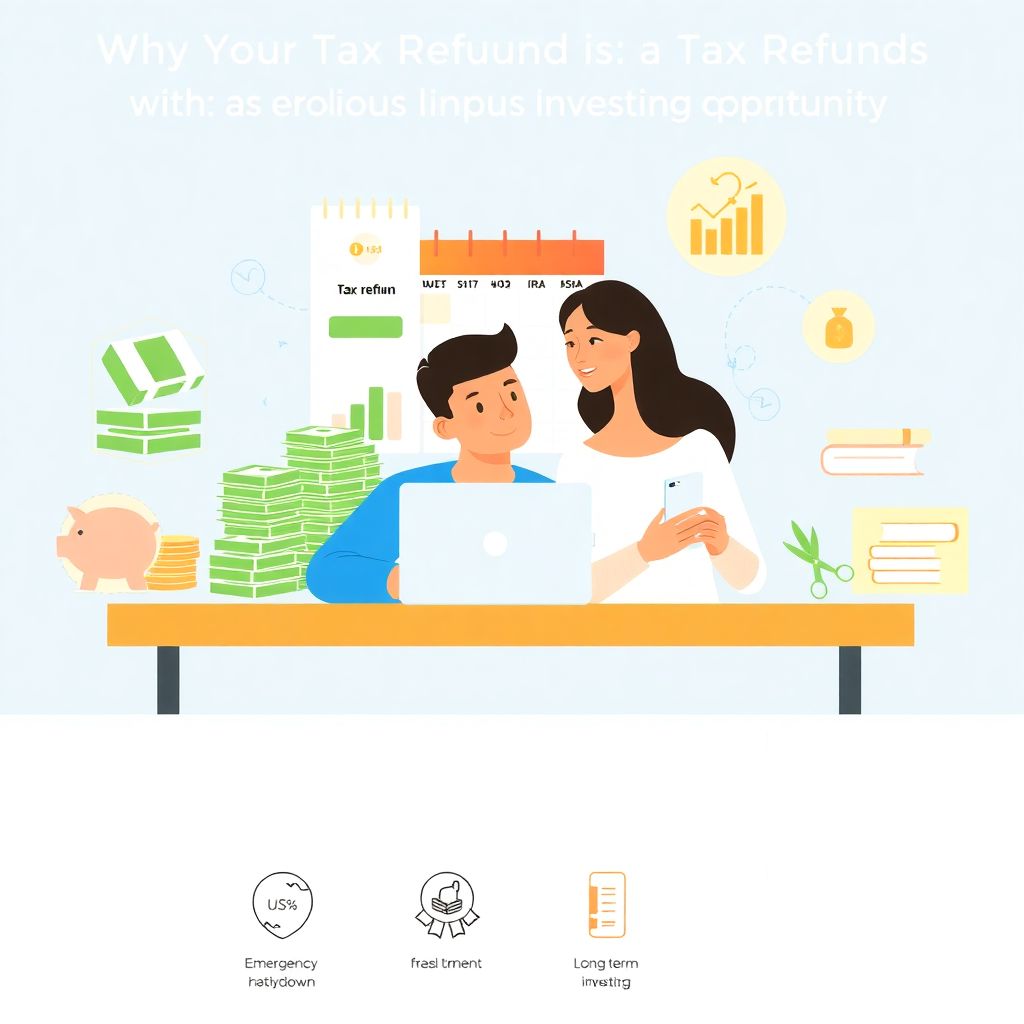

Smart ways to use your tax refund for investment and long-term growth

Why your tax refund is a serious investing opportunity Let’s put some numbers on what “just a refund” really is. According to IRS statistics, the average federal tax refund in the U.S. was about $3,253 in 2022 and roughly $3,167 in 2023. Early-season IRS data for the 2024 filing year (for 2023 tax returns) shows…

-

Budgeting for a family with teenagers: practical money strategies that work

Why Teenagers Change the Whole Budget Game When kids hit 13+, your spending pattern flips fast: food, gadgets, transport, activities, and later exam prep or college. According to the U.S. Bureau of Labor Statistics, families with teens spent about 9–12% more per year on “food at home” and over 20% more on transport between 2022…

-

How to plan for a financially stable retirement in your 50s and avoid money worries

Why your 50s are the make‑or‑break decade for retirement In your 50s, retirement stops being a distant “someday” and becomes a concrete project with a deadline and a budget. You usually have your peak earnings, many big expenses (childcare, mortgage, education) are stabilizing, and you still have 10–15+ years of compounding ahead. That combination makes…

-

Budgeting for small-space living: smart ways to save money in a tiny home

Why budgeting for tiny homes suddenly matters so much Back in the 1950s, the average new home in the US was around 90–100 square meters; by the 2000s оно почти удвоилось. Yet wages не росли таким же темпом, а с 2010‑х аренда в крупных городах стала обгонять доходы. К 2025 году мы пришли к парадоксу:…