Category: Investment Insights

-

Build a budget that works for your morning routine and supports your daily goals

Why Your Morning Deserves Its Own Budget Most people try to fix their finances by tweaking big categories like rent or groceries, но утро quietly eats money every single day. Coffee, transport, snacks “on the way”, apps, and “just this one pastry” turn into a monthly black hole. When you design a budget that fits…

-

Inflation explained: a beginner’s guide to its effects on your wallet

Why Inflation Matters More Than You Think When people hear “inflation”, they often picture abstract charts on the news, not their day‑to‑day life. Yet the real question most beginners have is: what is inflation and how does it affect my money right now and in the next few years? Вasically, inflation means that, over time,…

-

How to build an emergency fund in a seasonal job and save for the off-season

If you work festivals in summer, ski resorts in winter, or jump between gigs on platforms, you already know money doesn’t arrive in neat, equal paychecks. That’s exactly why 2025 is the year to stop winging it and actually learn how to build an emergency fund on a seasonal income. The good news: modern tools…

-

Debt payoff plan: how to create one that keeps you motivated to stay on track

Why motivation matters more than math in your debt payoff plan When people ask how to create a debt payoff plan, они обычно ждут формулу в стиле: “умножь это, вычти то, и вот ответ”. Но в реальности главный «движок» — не формулы, а ваша устойчивая мотивация. Да, процентные ставки, графики платежей и амортизационные расчёты важны,…

-

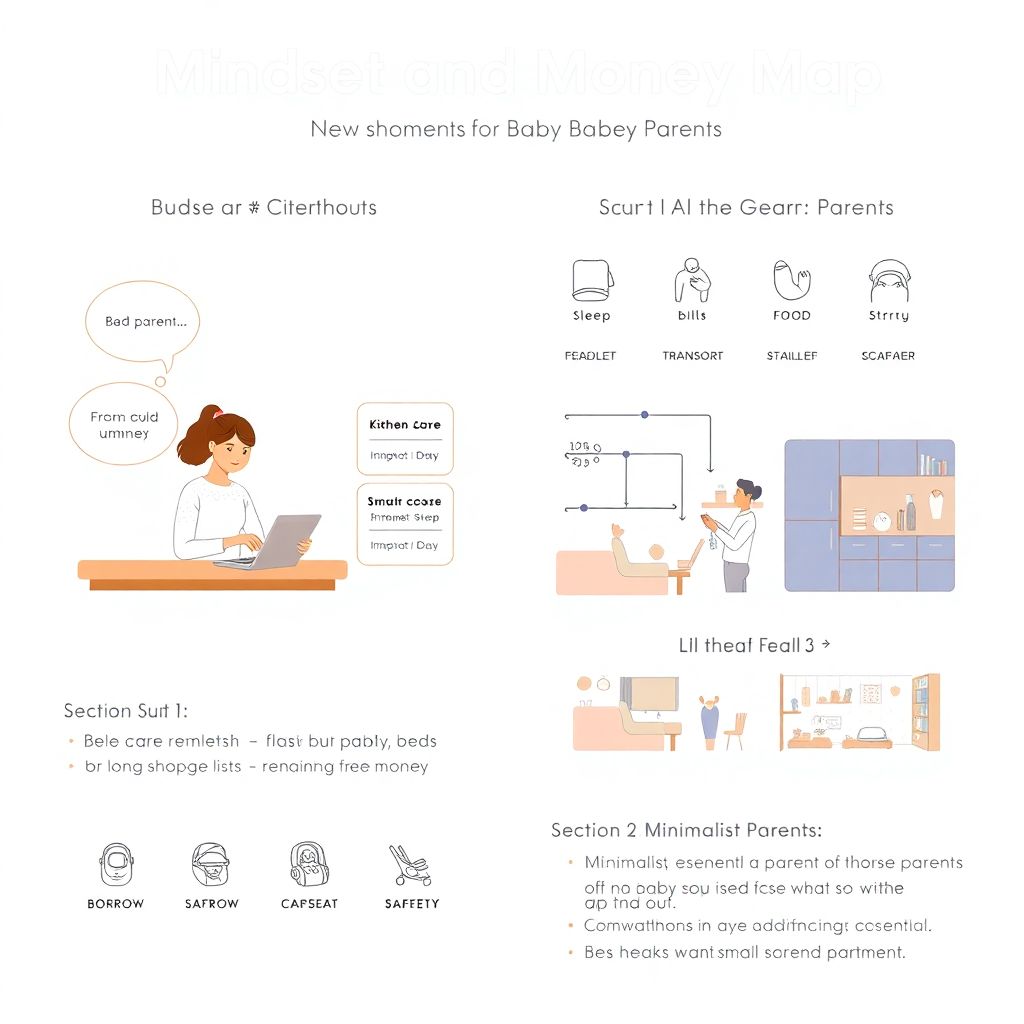

How to prepare for a baby on a budget and save money before birth

Mindset and Money Map Start with the real numbers, not the fears Most people overspend not потому что у них много денег, а потому что страшно что‑то не купить и «быть плохим родителем». Полезнее сначала посчитать: сколько реально свободных денег остаётся после обязательных платежей, а уже затем решать, что впишется. Один подход — классический список…

-

How to create a debt-repayment plan for a large family and stay on budget

Understanding Your Family’s Financial Starting Point The first step in creating a debt‑repayment plan for a large family isn’t a spreadsheet, it’s honesty. Sit down together, no blame, just facts: who you owe, how much, the interest rates and minimum payments. Think of it as taking a group photo of your finances before the makeover….

-

How to create a sustainable side income plan that supports long-term financial goals

Why a sustainable side income matters in 2025 From one paycheck to a flexible life In 2025 having just one paycheck feels like relying on a single Wi‑Fi network in a thunderstorm: it might hold, but you don’t want to bet your future on it. Layoffs, automation and remote hiring mean your “stable” job can…

-

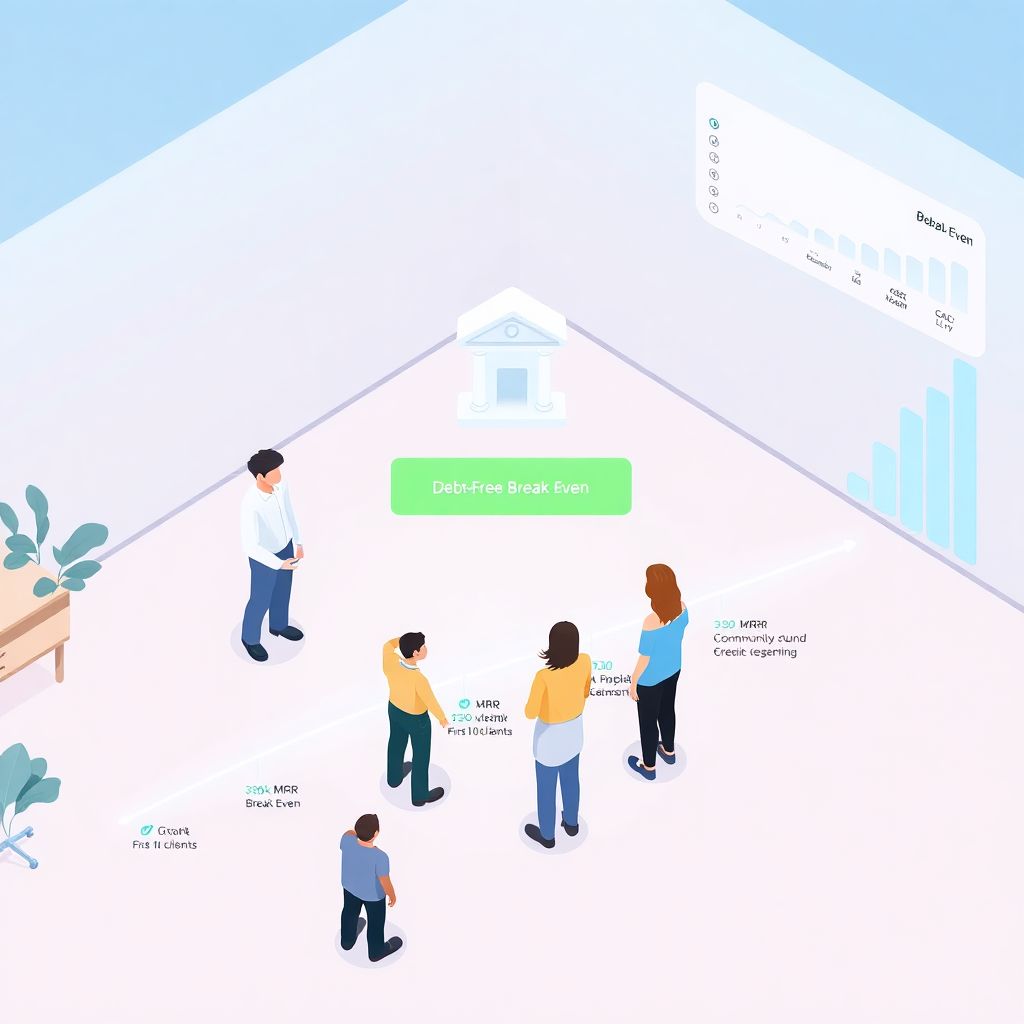

How to create a debt-free timeline for your startup and reach profitability faster

Why a Debt‑Free Timeline Matters More in 2025 Than Ever Silicon Valley’s old mantra “grow at all costs” quietly died sometime between the 2020 pandemic shock and the 2022–2023 rate hikes. Money got expensive, venture capital cooled down, и suddenly founders started googling how to fund a startup without loans and still stay alive. In…

-

Rental budget guide: practical steps to understand what you can afford

Understanding your rental budget sounds simple—“pay what you can each month and hope for the best”—but in 2025 that approach is risky. Rents track inflation, salaries don’t always keep up, and leases now often bundle in things like smart-home fees or mandatory insurance. A clear, realistic rental budget is less about pinching pennies and more…

-

Smart strategies to reduce Hoa fees and property taxes legally and effectively

Why HOA Dues and Property Taxes Keep Climbing Escalating HOA assessments and property taxes формируют устойчивый рост совокупной стоимости владения жильём. По данным муниципальных бюджетов США, налоговые поступления от недвижимости в ряде агломераций выросли на 20–30% за последние пять лет, при этом медианный HOA‑взнос в новых комплексах нередко превышает $300 в месяц. Для домохозяйств это…