Category: Investment Insights

-

Budgeting for a move to a bigger city without breaking the bank

Why Moving to a Bigger City Is a Money Trap for Some – And a Smart Upgrade for Others Переезд в крупный город почти всегда звучит как шаг вверх: больше зарплата, больше возможностей, больше впечатлений. Но без плана это легко превращается в долговую яму: по данным U.S. Bureau of Labor Statistics, средние расходы городских домохозяйств…

-

How to create a family money day and improve financial communication

Money is the topic couples swear they’ll “talk about later” — и именно поэтому он рвётся наружу в виде ссор. Family Money‑Day — это заранее выделенное время, когда вы всей семьёй обсуждаете доходы, расходы и цели в спокойной обстановке, а не между дверью и такси. По данным исследований Fidelity и Ramsey Solutions за 2022–2023 годы,…

-

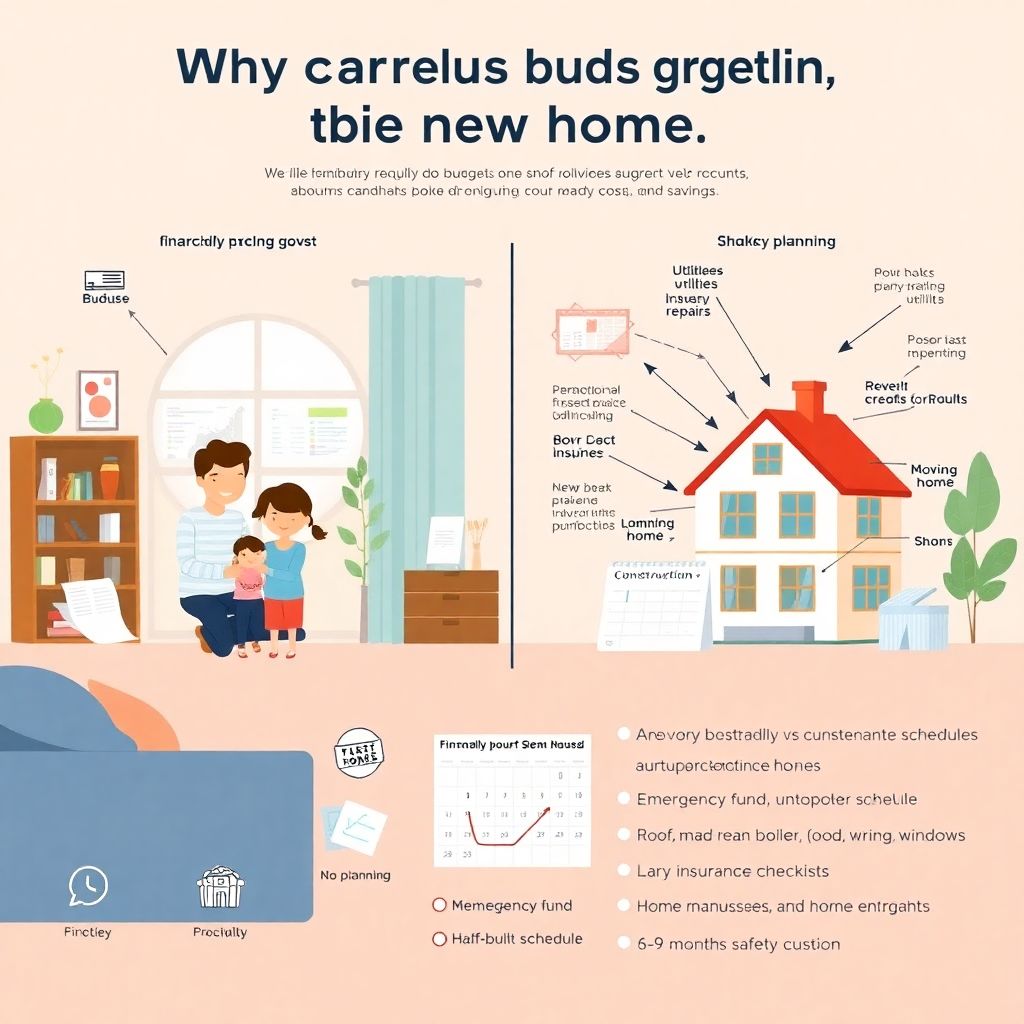

How to build a financially strong budget for your new home

Why Your New Home Budget Matters More Than You Think Bringing a new home dream to life без продуманного бюджета похоже на попытку построить дом без фундамента: что‑то получится, но малейшее финансовое землетрясение тряхнёт так, что станет страшно. Люди часто уверены, что раз банк одобрил ипотеку, значит, они «точно потянут» расходы, но в реальности платёж…

-

How to build a financially strong family on a tight budget and secure your future

Why Financial Strength Matters Even When Money Is Tight When доход barely covers bills, разговоры о «финансовой силе семьи» звучат как теоретический роскошь. Но как раз на низком доходе устойчивость особенно важна: любой сбой — сломалась машина, заболел ребёнок, задержали зарплату — моментально превращается в кризис. По данным Federal Reserve, около 37–40% американских семей не…

-

How to build a debt reduction habit in 30 days and finally pay off faster

Most people don’t fail at getting out of debt because the math is hard. They fail because turning “I should” into “I actually do this every day” is hard. Let’s talk about how to build a real, repeatable debt reduction habit in 30 days — not просто очередной план на бумаге, а систему, которая живёт…

-

Budgeting for a family gym membership and wellness on any income

Why a Family Gym Budget Matters More Than You Think Когда семья решает оформить общий абонемент в фитнес-клуб, эмоции часто бегут впереди калькулятора. Кажется, что спортзал автоматически сделает всех здоровее, спокойнее и энергичнее, и в теории это правда. Но если не посчитать заранее, family gym membership cost может внезапно начать съедать бюджет на продукты, кружки…

-

Smart ways to build credit while budgeting for life on any income

Why Building Credit and Budgeting Belong in the Same Conversation Most people думают о деньгах по частям: вот бюджет, вот кредиты, вот долги. В реальности это одна система. Если вы игнорируете кредитную историю ради экономии «здесь и сейчас», позже расплаты будут дороже: ипотека, авто, аренда, страховка — всё завязано на ваш кредитный счёт. Нужно смотреть…

-

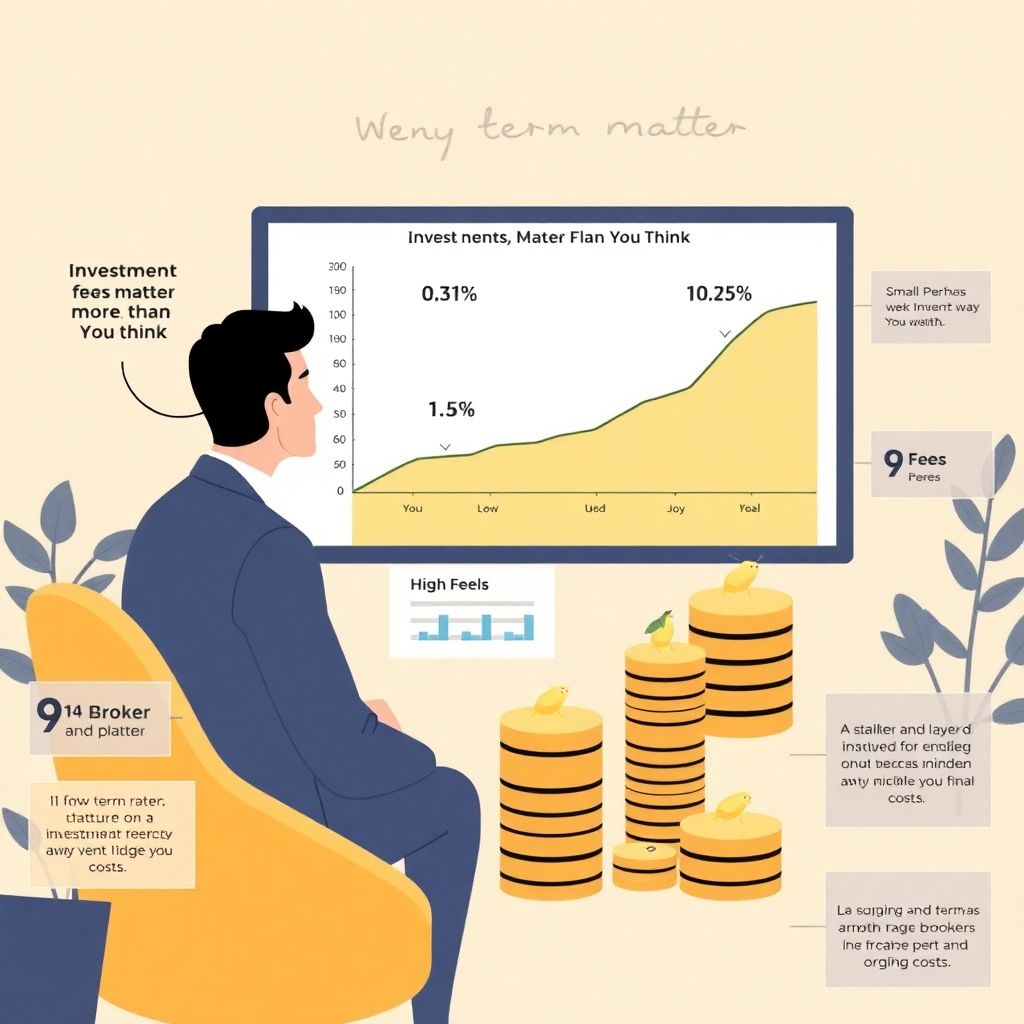

Practical guide to understanding your investment fees and expenses clearly

Why Your Investment Fees Matter More Than You Think Investment fees explained на человеческом языке Most people focus on returns and barely glance at costs, хотя именно комиссии тихо «едят» ваш капитал год за годом. В упрощённом виде investment fees explained так: есть явные комиссии — вроде процента за управление портфелем или годовой платы за…

-

Financial roadmap for a successful career transition: step-by-step guide

Why Your Career Change Needs a Financial Roadmap, Not Just Courage Switching careers can feel like jumping off a moving train and hoping you land on your feet. You might be full of ideas, but without thoughtful career change financial planning, даже самая вдохновляющая цель превращается в стрессовый марафон от зарплаты до зарплаты. Финансовая дорожная…

-

Personal finance for freelancers: a practical guide to managing money

Why Freelancers Need a Different Money Playbook When you work for yourself, money behaves differently. There’s no HR department, no automatic paycheck every two weeks, no built‑in retirement plan. That’s why personal finance for freelancers is less about fancy investment tricks and more about building a simple, repeatable system you can stick to even when…