Category: Financial Planning

-

Smart investing for beginners with a practical approach to grow your money wisely

Smart Investing for Beginners: A Practical Approach Understanding the Foundations of Smart Investing Smart investing isn’t about chasing quick returns or following trendy stocks—it’s about making informed, well-researched decisions tailored to your financial goals. In 2025, with the rise of automated platforms, AI-driven analysis, and fractional shares, smarter investing has become more accessible than ever….

-

Creating a budget that works: how to manage finances and cut through the noise

Understanding the Modern Budgeting Landscape In 2025, financial planning is more complex than ever. With an oversaturated market of budgeting tools, conflicting financial advice on social media, and volatile economic conditions, creating a budget that delivers clarity — not confusion — is a necessity. Budgeting today isn’t just about tracking expenses; it’s about filtering out…

-

Maximize your 401(k) during career transitions with smart financial strategies

Understanding the 401(k) During Career Transitions Definition and Core Function of a 401(k) A 401(k) is a tax-advantaged retirement savings plan offered by many U.S. employers. It allows employees to contribute a portion of their salary on a pre-tax basis, with potential employer matching. The funds grow tax-deferred until withdrawal, typically after age 59½. There…

-

Replacing debt with savings: a beginner’s guide to smarter financial planning

Understanding the Debt-Savings Paradox Replacing debt with savings may sound straightforward, but for many beginners, the transition is riddled with psychological and financial roadblocks. The paradox lies in the fact that while debt offers immediate solutions, savings require delayed gratification. Many individuals fall into the trap of minimum payments, believing they are managing their finances,…

-

Build wealth through consistent saving with smart financial habits and long-term planning

Building Wealth Isn’t Magic — It’s Consistency When we think of wealth, images of luxury cars, sprawling mansions, and million-dollar portfolios often come to mind. But here’s a reality check: building wealth isn’t about flashy wins or sudden windfalls. It’s about consistent saving and smart financial habits. The journey to financial stability and long-term prosperity…

-

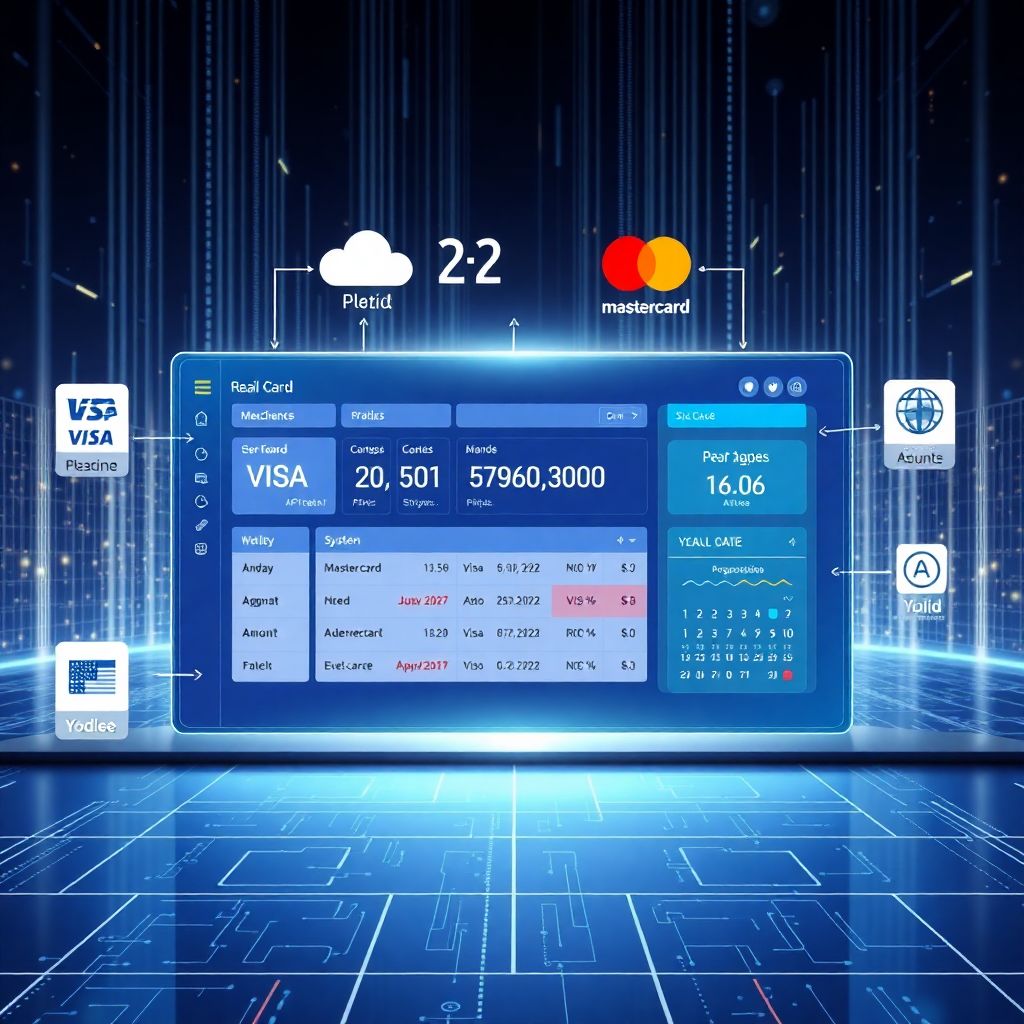

Credit card management tips: a practical approach to control your financial feed

Understanding the Credit Card Feed: Core Concepts and Definitions In the context of financial technology, the term *credit card feed* refers to the automatic transmission of transactional data from a credit card account to a financial management system, such as personal finance software or enterprise accounting platforms. The feed typically includes metadata such as transaction…

-

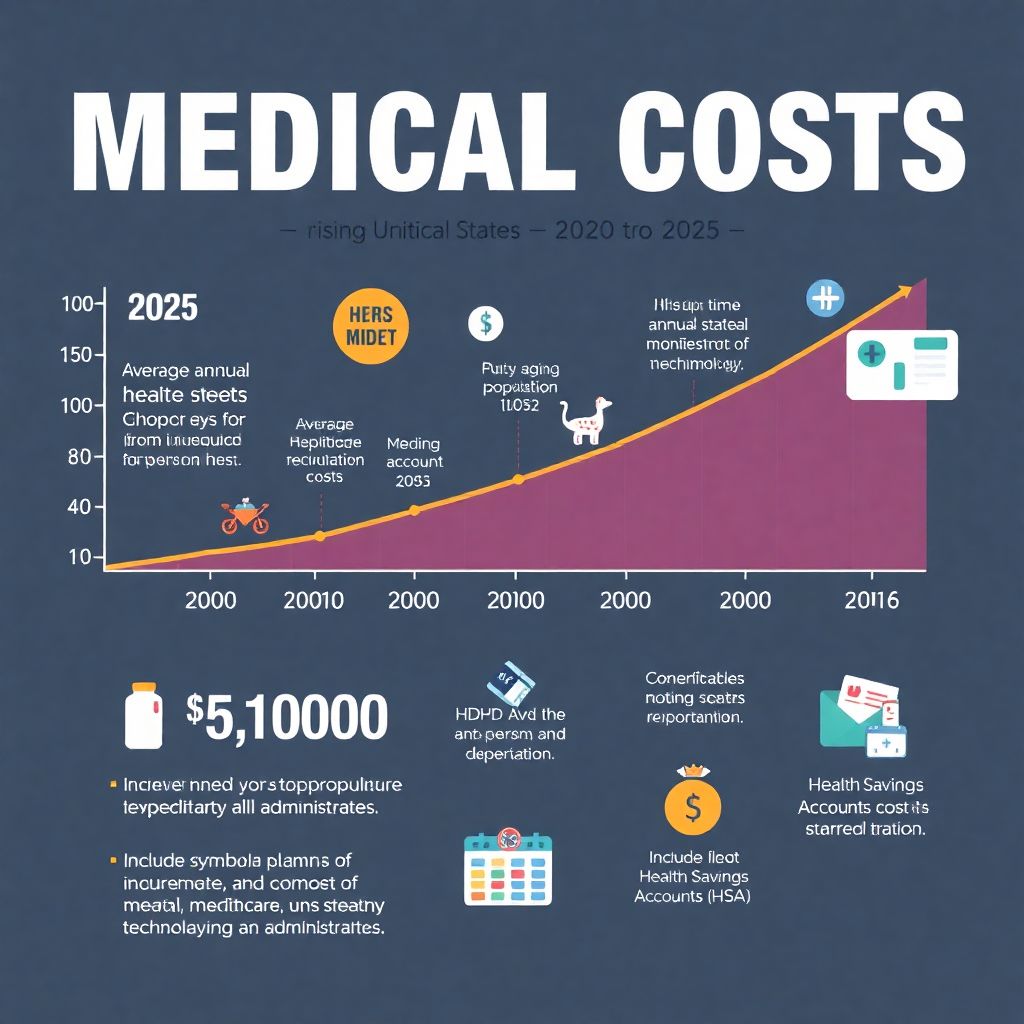

Plan for future medical costs and insurance premiums to secure your financial stability

Understanding the Rising Tide: Why Planning for Medical Costs Is Crucial in 2025 Over the past few decades, healthcare expenses in the United States have surged well beyond inflation. In 2000, the average annual health expenditure per person was around $4,800. By 2020, it had ballooned to over $11,500, and now, in 2025, projections estimate…

-

Optimize your taxes for investment income to maximize returns and reduce liabilities

Understanding the Tax Landscape for Investment Income Investment income is a crucial component of wealth-building, but it comes with its own set of tax considerations. Many investors, particularly beginners, fail to understand how different types of income—such as capital gains, interest, and dividends—are taxed. Long-term capital gains (from assets held over a year) typically enjoy…

-

Credit reports explained for beginners: a simple guide to understand your credit history

Why Understanding Credit Reports Matters More Than You Think Let’s be honest—credit reports sound boring. But here’s the truth: your credit report is like a financial passport. It tells lenders, landlords, and sometimes even employers whether or not they can trust you. For beginners, diving into the world of credit reports can feel overwhelming. But…

-

How to create a personal budget for a weekend warrior and manage money wisely

The Rise of the Weekend Warrior: A Historical Perspective The concept of the “weekend warrior” emerged prominently in the late 20th century, coinciding with the rise of the 40-hour workweek and the cultural shift toward prioritizing work-life balance. By the early 2000s, this lifestyle had evolved into a mainstream identity, characterized by professionals dedicating their…