Why These Two Budget Styles Get So Much Hype

If you’ve ever Googled “how do I finally get my money under control,” you’ve almost certainly bumped into two ideas: zero-based budgeting and the 50/30/20 rule. They’re constantly mentioned in blogs, TikToks, and every personal budget planner compare budgeting methods guide out there.

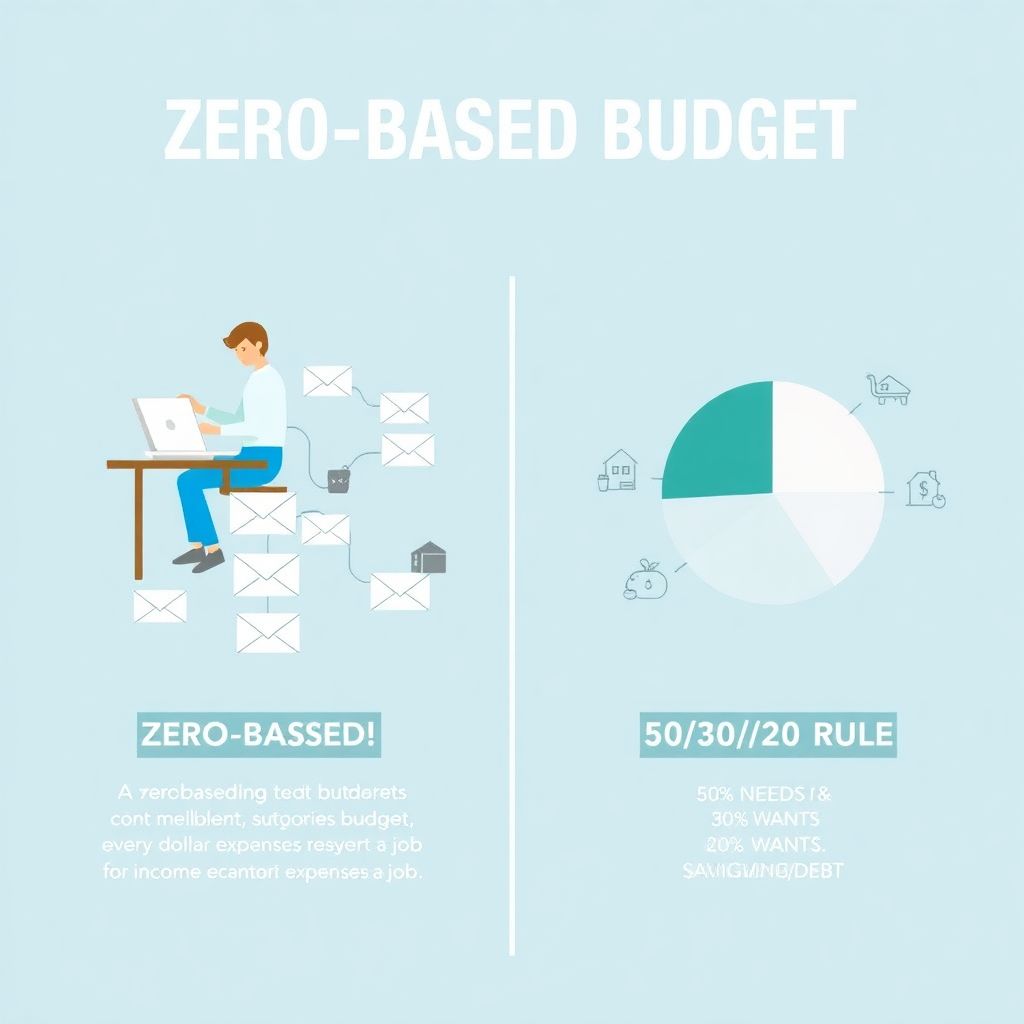

One style wants you to tell every single dollar exactly where to go before the month even starts. The other gives you a simple ratio: 50% needs, 30% wants, 20% savings and debt. Both can work. The real question is: which one fits your actual life, habits, and attention span?

Over the last three years (2022–2024), interest in structured budgeting has spiked. According to Google Trends, worldwide searches related to “budgeting” and “zero-based budgeting” have been roughly 30–40% higher in 2023–2024 than in 2021, and U.S. consumer surveys from firms like Deloitte and Ramsey Solutions show that more than 60% of respondents have tried some form of budgeting app or template since 2022. People are clearly experimenting. Let’s figure out which approach actually deserves a long-term spot in your life.

—

Quick Definitions: Zero-Based vs. 50/30/20

Zero-Based Budgeting in Plain English

Zero-based budgeting means you assign every unit of income a “job” before you spend it. Income minus all planned expenses (including savings and debt payments) equals zero. Nothing is left “unplanned.”

It sounds strict, but it can be surprisingly freeing because you’re telling your money what to do instead of wondering where it went.

Over the last few years, this method has moved from corporate finance into everyday personal money management. Fintech surveys in 2022–2023 showed that users of “envelope-style” and zero-based tools often reported faster debt payoff—sometimes cutting payoff timelines by 6–12 months compared to those who only tracked spending after the fact.

The 50/30/20 Rule in Plain English

The 50/30/20 budget is a ratio-based method:

– 50% of take-home pay → Needs (rent, utilities, groceries, basic transport, minimum debt payments)

– 30% → Wants (restaurants, streaming, travel, non-essential shopping)

– 20% → Savings and extra debt payments

If you want something that’s memorable, flexible, and doesn’t force you to track every coffee, this might be your style. During 2022–2024, this rule has been heavily promoted by banks and neobanks because it’s so easy to plug into a 50 30 20 budget calculator online and auto-categorize your transactions.

—

What the Last 3 Years of Data Tell Us

From 2022 to 2024, inflation and rising interest rates pushed a lot of people to re-evaluate their finances. A few highlights from aggregated surveys from central banks, major consultancies, and fintech reports (figures rounded):

– Between 2022 and 2024, the share of U.S. households using any budget rose from roughly the mid‑30% range to around 45–50%.

– Among app users self-reporting a “specific method,” zero-based and envelope-style approaches grew from around 20–25% of users in 2021 to around one‑third by 2023.

– Simple rule-of-thumb approaches like 50/30/20 also grew, particularly among people under 35; in several 2023 youth finance surveys, about one in five young adults who budgeted said they used some type of percentage rule.

Results matter more than labels:

– Users of stricter methods (zero-based, envelope, line-item budgets) reported higher savings rates: often 3–5 percentage points more of income saved compared with looser “track-only” approaches.

– But they also had higher dropout rates: a notable chunk quit after 3–6 months because of “too much effort” or “budget fatigue.”

So the trade-off is very real: precision and speed vs. simplicity and stickiness.

—

Which Method Fits Which Type of Person?

Zero-Based Budgeting Often Fits If You…

If any of this sounds like you, zero-based may be your best friend:

– You’ve tried “just tracking” spending and nothing changed.

– Your income is tight, and you can’t afford many mistakes.

– You like details, lists, or planning ahead.

– You’re tackling big goals (debt payoff, down payment, aggressive investing).

The best budgeting method zero based vs 50 30 20 often comes down to urgency. If your financial situation feels intense—debt piling up, or you’re on a strict income—zero-based tends to create the fastest behavioral shift because it forces you to make trade-offs on paper *before* you swipe your card.

50/30/20 Often Fits If You…

You may gravitate toward 50/30/20 if:

– You get overwhelmed by spreadsheets.

– You want a “good enough” structure that doesn’t eat your evenings.

– Your income is reasonably stable, and your basic needs are met.

– You want a method you can stick to for years with minimal friction.

For many people, the 50/30/20 rule functions like financial guardrails: you might not know every detail, but you’ll generally be on course as long as your categories stay inside the lines.

—

Necessary Tools: What You Actually Need to Start

Core Tools for Both Methods

You don’t need a fancy setup, but a few things make a huge difference:

– A bank app that shows transactions quickly and clearly

– Somewhere to plan: notebook, spreadsheet, or budgeting app

– Calculator (phone is fine)

– A calendar or reminder system for due dates

Even with the rise of every new zero based budgeting app for personal finance, the essentials haven’t changed: you need clear numbers and a place to make decisions before the month begins.

Extras That Help Zero-Based Budgets

For zero-based, tools that allow you to assign money to categories in real time are ideal:

– “Envelope” or category-based apps

– A spreadsheet with columns for “Planned,” “Actual,” and “Remaining”

– Optional: separate savings sub-accounts (emergency fund, travel, etc.)

These tools lower the friction of updating your plan during the month, which matters a lot for such a hands-on method.

Extras That Help 50/30/20 Budgets

For a 50/30/20 setup, automation is your best ally:

– An app that automatically tags “needs,” “wants,” and “savings”

– Direct deposits into savings/investment accounts

– A 50 30 20 budget calculator online (many banks embed this in their app dashboards)

You want to make it almost effortless to see your percentages and adjust slowly over time.

—

Step-by-Step: How to Start Zero-Based Budgeting for Beginners

Here’s a straightforward process you can follow even if you’ve never budgeted before.

1. Map Your Real Monthly Income

Include:

1. Salary after tax

2. Side hustle income (use realistic averages)

3. Benefits or stipends that arrive as cash

If your income varies, take the average of the last 3–6 months and budget from the *lower* end. It’s safer to be pleasantly surprised than scrambling later.

2. List Every Monthly Expense Category

Go through your last 2–3 bank statements and write down where your money actually goes: rent, groceries, subscriptions, gas, eating out, “random Amazon,” everything.

Then group them into reasonable categories—don’t go crazy with 50 line items; 15–25 categories are usually enough.

3. Assign Every Dollar a Job

Take your total monthly income. Start with fixed needs (rent, basic bills, minimum debt payments), then variable needs (groceries, gas), then savings and debt payoff, and only then wants.

Your formula must end as:

> Income – Needs – Wants – Savings/Debt = 0

If you have money “left,” increase savings or accelerate debt. If you’re negative, you have to cut or rearrange categories until the math works.

4. Add Realistic Buffers

Zero doesn’t mean “no wiggle room.”

It means you planned the wiggle room *on purpose*.

Create a small “miscellaneous” or “unexpected” line—maybe 3–5% of your income. That’s where surprise expenses go without destroying your whole plan.

5. Track and Adjust During the Month

At least once a week, compare reality to the plan:

– Move money between categories if necessary (but do it consciously).

– Avoid adding new spending without “stealing” from an existing category.

Treat your budget like a living document, not a contract you’re doomed to break.

—

Step-by-Step: Setting Up a 50/30/20 Budget

1. Calculate Your Take-Home Pay

Use net income (after taxes, health insurance, retirement payroll deductions). That’s what hits your account and what your percentages need to work with.

2. Sort Current Spending into Needs, Wants, and Savings

Look back over the last month or two and classify:

1. Needs: keep-the-lights-on essentials

2. Wants: your lifestyle extras

3. Savings and debt beyond the minimums

You may discover your “needs” are way above 50%—this is common in higher-cost cities since 2022 as rents and housing costs have outpaced wages.

3. Compare Your Reality to the 50/30/20 Targets

Calculate your current percentages:

– Needs % = Needs ÷ Income × 100

– Wants % = Wants ÷ Income × 100

– Savings % = Savings ÷ Income × 100

Then compare them to 50/30/20. Don’t panic if you’re far off. The point is direction, not perfection.

4. Nudge Your Numbers Closer Over Time

Pick one focus per quarter:

– If needs > 50%, hunt for housing or car options that slowly lower that share, or increase income.

– If wants > 30%, choose 1–2 categories to trim (not everything at once).

– If savings < 20%, automate a slightly higher transfer each month.

The strength of this method is that you can shift gradually instead of overhauling your life overnight.

---

How to Decide: A Simple 5‑Question Filter

Use this mini‑quiz to choose your starting point:

1. How chaotic is your current money life?

– Constant overdrafts, rising card balances → start with zero-based.

– You’re mostly okay, just not saving enough → 50/30/20 works.

2. How much detail can you realistically tolerate every week?

– You can sit down 30–60 minutes weekly → zero-based.

– You want 10–15 minutes monthly → 50/30/20.

3. How urgent are your goals?

– High-interest debt, near-term big goal → zero-based for 6–12 months.

– Long-term wealth building with stable finances → 50/30/20 plus automations.

4. What’s your personality like?

– You like structure and rules → zero-based first.

– You resist restrictions and love flexibility → 50/30/20.

5. What’s your track record with past budgets?

– You never stuck with super-detailed systems → start with 50/30/20, refine later.

– You’ve used planners successfully before → zero-based can amplify your strengths.

Remember: you’re not marrying a method forever. Plenty of people start strict (zero-based) during a crisis, then loosen to a ratio rule later—or flip that progression as their income grows.

—

Practical Tools and Apps: Making the Methods Work

From 2022 to 2024, usage of budgeting apps climbed significantly; some fintech reports estimated annual growth rates above 10–15% in active users. That’s not just because apps are “cool”—they reduce friction.

Here’s how to think about tools without getting lost:

– For zero-based: favor apps or spreadsheets that let you pre-assign money to categories and move it between them easily. That’s the digital version of a cash envelope system.

– For 50/30/20: lean on tools that categorize transactions automatically and show you category percentages at a glance.

If you like tech, use a zero based budgeting app for personal finance and pair it with a 50 30 20 budget calculator online for periodic “big picture” checks. Mixing them is perfectly fine.

—

Troubleshooting: When Your Budget “Doesn’t Work”

Common Problems with Zero-Based Budgets

1. “I keep overspending one category and feel like I failed.”

This is normal. Move money from a lower-priority category to cover the overspend. The important thing is that the total still equals zero. That’s called “flexing,” not failing.

2. “It takes too much time.”

After month 2 or 3, it speeds up because most categories repeat. If it’s still painful, reduce the number of categories. You don’t need separate lines for every type of snack.

3. “Irregular expenses blow up my plan.”

For things like car repairs, gifts, or annual subscriptions, create “sinking funds” in your plan: set aside a bit every month. Over 2022–2024, many people got caught by rising insurance and service costs; buffering with sinking funds helps you absorb those jumps.

Common Problems with 50/30/20 Budgets

1. “My rent alone is nearly 50% of my income.”

In expensive cities, hitting 50% for all needs might be impossible right now. That’s okay—50/30/20 is a guideline, not a law. Aim for something like 60/20/20 or 55/25/20 temporarily and work on long-term moves (roommates, job change, learning new skills).

2. “I keep losing track of wants vs. needs.”

Decide in advance: minimum phone plan = need, premium extra features = want; basic groceries = need, takeout = want, etc. Write your own rules and stick with them for at least a few months before changing.

3. “I’m not seeing progress fast enough.”

The 50/30/20 rule is slower but more sustainable for many people. If progress feels *too* slow—say you’re stuck on high-interest debt—consider moving temporarily toward a hybrid: maybe 50/20/30 (needs/wants/savings) for six months and throw the extra 10% at debt aggressively.

—

Hybrid Strategy: You Don’t Have to Pick Just One Forever

You can absolutely blend the two approaches:

– Use zero-based budgeting for the next 6–12 months to crush a specific goal (pay off a credit card, build a starter emergency fund).

– Then relax into a 50/30/20-style system once you’ve built momentum.

Many people who describe their best budgeting method zero based vs 50 30 20 story end up doing exactly this: strict seasons for aggressive goals, and looser seasons for maintenance. In practice, a lot of real-world budgets look like a spectrum rather than a pure version of one “school.”

—

Bringing It All Together

Over the last three years, the main message from data and surveys has been simple: people who use *some* kind of structured system—zero-based, percentage rules, or a hybrid—consistently save more and carry less revolving debt than those who just “wing it.”

If you want maximum control and are willing to spend weekly time on it, start with zero-based. If you want a simple, sustainable frame that gently pushes you toward better habits, go with 50/30/20. Either way, pick a method, commit to three months of practice, and treat mistakes as data, not as evidence you’re bad with money.

Budgets are just feedback loops. The right style is the one you’ll actually keep using long enough to see your life change.