Most people don’t wake up excited to think about debt payoff strategies, but choosing the right one can save you years and thousands of dollars. Two methods dominate the conversation: the Snowball and the Avalanche. Both work. The real question is which one fits your brain, your habits, and your stress level.

Let’s unpack that without jargon and with just enough numbers to be useful.

—

Where Did These Strategies Even Come From?

The debt snowball method became widely known thanks to personal finance authors and radio hosts in the early 2000s, especially Dave Ramsey. The core idea—start with the smallest balance—wasn’t new, but he branded and popularized it as a behavior-first way to get people actually moving instead of feeling paralyzed.

The debt avalanche method has roots in mathematical optimization and behavioral economics. Economists have long known that if you want to minimize total interest paid, you should attack the highest interest rate first. Over time, bloggers, financial planners, and academics began framing this as the Avalanche approach to contrast it with the more emotionally driven Snowball.

Today, if you search for the *best debt payoff strategy snowball vs avalanche*, you’ll find a split camp: behavioral finance fans defending the Snowball, and spreadsheet lovers pushing the Avalanche. Both sides have a point—they just prioritize different kinds of “wins.”

—

Бasic Principles: How Each Method Actually Works

Let’s keep it simple. Imagine you have several debts: a couple of credit cards, a car loan, maybe a personal loan.

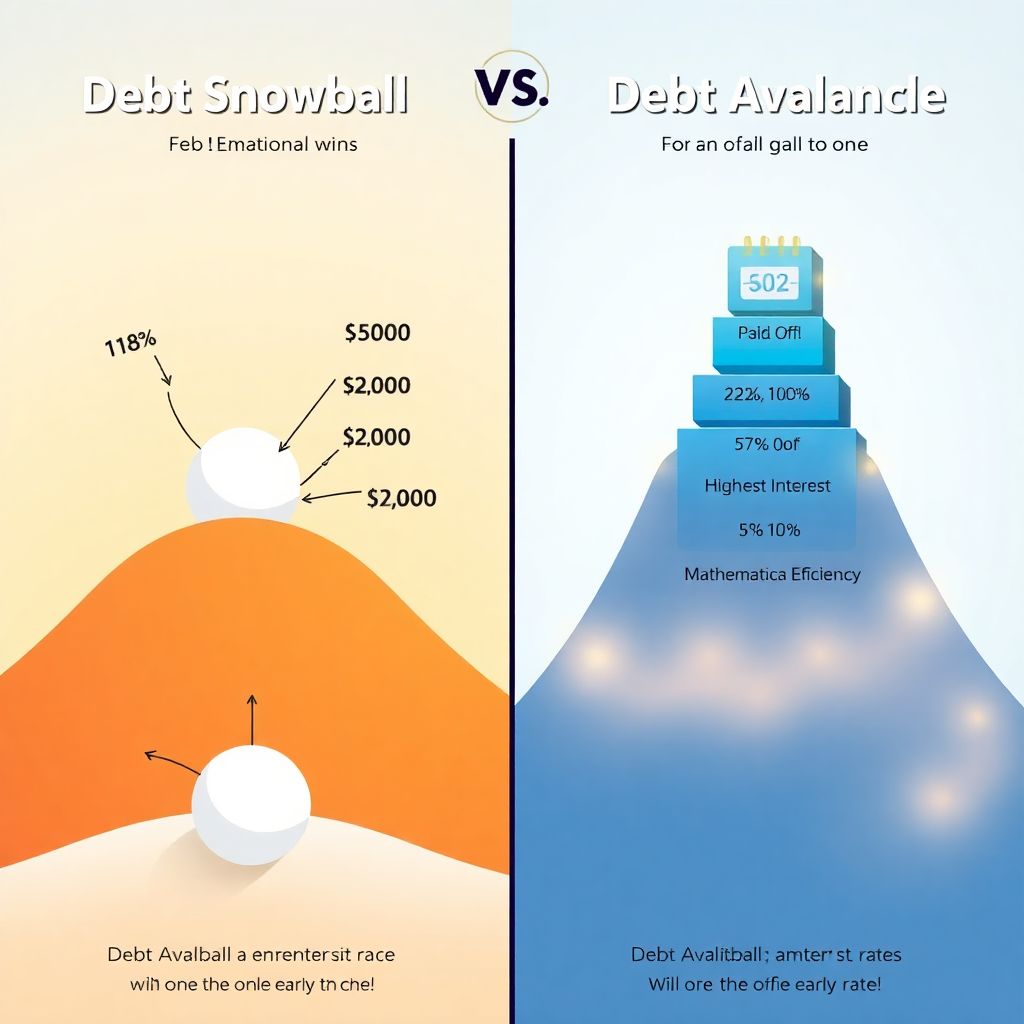

Debt Snowball: focus on emotional wins

– List all debts from smallest balance to largest balance, ignoring interest rates.

– Pay minimums on everything except the smallest.

– Throw every extra dollar at the smallest debt until it’s gone.

– When one debt is paid off, roll that payment into the next one—your “snowball” grows.

This approach creates quick psychological victories. You see debts disappear faster, which can be a huge motivator if you’ve struggled to stay consistent in the past. It’s often promoted as how to pay off credit card debt fast snowball method, because those small wins help people stay fired up.

Debt Avalanche: focus on mathematical efficiency

– List all debts from highest interest rate to lowest interest rate, ignoring balance size.

– Pay minimums on everything except the highest-interest debt.

– Throw all extra cash at the highest-interest account until it’s gone.

– Move down the list as each high-rate debt is eliminated.

This minimizes the total interest you pay and often gets you debt-free sooner in calendar time, assuming the total amount you pay each month is the same in both methods.

In short:

– Snowball: feel better sooner

– Avalanche: save more money overall

—

What About Calculators and “Perfect” Answers?

If you’re torn between them, you’re not alone. Many people play with a debt snowball vs debt avalanche calculator expecting it to spit out a single “correct” answer. What it really shows you is:

– How much interest you’ll pay with each method

– How many months (or years) until you’re debt-free

– How different extra payment amounts change the timeline

Those calculators are helpful, but they don’t measure the one variable that often decides success: your behavior under stress. A calculator can’t tell you whether you’ll stick with an Avalanche plan during a rough three-month stretch when progress feels slow.

So use calculators to frame the trade-offs—but recognize that the “best” method is the one you’ll actually follow for the next 12–36 months, not just the one that looks ideal on paper.

—

Real-Life Example: Snowball in Action

Say you have:

– $600 credit card, 18%

– $2,000 personal loan, 10%

– $7,500 car loan, 5%

Using the Snowball:

1. Order by balance: $600 → $2,000 → $7,500

2. Pay minimums on the $2,000 and $7,500.

3. Hammer the $600 card with every spare dollar. Maybe you clear it in two months.

4. Now the payment you used for the $600 card gets added to the minimum on the $2,000 loan.

5. Debts disappear one by one. Your list gets shorter fast.

Psychologically, that “one debt gone already!” feeling is powerful. For someone who’s been avoiding their statements, this can flip the story from shame to “I can actually do this.”

—

Real-Life Example: Avalanche in Action

Same debts:

– $600 credit card, 18%

– $2,000 personal loan, 10%

– $7,500 car loan, 5%

Using the Avalanche:

1. Order by interest rate: 18% → 10% → 5%

2. The $600 card still happens to be first, but imagine the numbers were different:

– $600 at 10%

– $2,000 at 22%

– $7,500 at 5%

3. In that case, you’d ignore the tiny $600 first and attack the $2,000 at 22%, because that’s what’s costing you most in interest.

4. Over the full journey, you pay less interest and often finish a few months earlier than with Snowball—if you stay consistent.

Where Avalanche can feel tough: early on, you might go several months without fully eliminating a single account, especially if that top-rate debt is one big balance. Progress is real—but less visible.

—

Choosing Between Snowball and Avalanche: Key Questions

When people ask which is the best debt payoff strategy snowball vs avalanche, they’re often really asking: “Which method will I stick with when life gets messy?”

Ask yourself:

– Do I get discouraged if I don’t see quick, visible wins?

– Am I comfortable focusing on long-term savings even if the short term feels slower?

– Have I quit plans in the past because they felt too abstract or slow?

If short-term wins keep you engaged, Snowball can be the better *behavioral* choice even if Avalanche wins on the spreadsheet.

To decide more concretely, weigh:

– Motivation:

– Snowball: frequent emotional wins

– Avalanche: intellectual satisfaction of “I’m saving the most money”

– Complexity:

– Snowball: simpler to explain and track

– Avalanche: needs a bit more attention to interest rates

– Total cost:

– Avalanche: usually less interest

– Snowball: might cost more, but often improves follow-through

—

Where Debt Consolidation Fits In

There’s a third option people often ask about: debt consolidation vs snowball vs avalanche.

Debt consolidation means rolling multiple debts into one new loan or one new credit line—ideally with a lower interest rate or more manageable payment.

You might consolidate with:

– A personal loan

– A balance transfer credit card

– A home equity loan or line of credit (with serious risks if misused)

Important point: consolidation is not a payoff *strategy* by itself. It restructures the debt, but you still need a plan afterward. In fact, many people:

– Consolidate several credit cards into one loan

– Leave the cards open

– Then slowly rack those cards up again

Consolidation can work well if:

– You have a clear budget and stick to it

– You close or strictly limit old cards

– You still apply a Snowball or Avalanche mindset to pay off the new single debt aggressively

In other words, consolidation can simplify the battlefield, but Snowball or Avalanche is still the tactic you use to win.

—

Common Myths and Misconceptions

A lot of bad advice floats around. Let’s address some frequent misunderstandings.

Myth 1: “Avalanche is always better, period.”

Avalanche is better mathematically, assuming identical behavior. But humans don’t behave identically under different psychological conditions. If Snowball keeps you engaged where Avalanche would make you give up, Snowball becomes superior in the real world.

Myth 2: “Snowball is financially irresponsible.”

Snowball doesn’t mean you ignore interest rates forever; it means you sequence debts differently to generate faster victories. You’re still paying everything down. For many people, this is the bridge from “I’m overwhelmed” to “I’m in control.”

Myth 3: “If I choose one method, I’m stuck with it.”

You can switch. For example:

– Start with Snowball for 3–6 months to build habits and confidence.

– Then, once your system is running smoothly, reorder your debts by interest rate and switch to Avalanche.

Or hybridize: clear two or three smallest balances, then pivot to highest interest first.

Myth 4: “I don’t need help; it’s just math.”

Debt is rarely just about arithmetic. It’s about habits, emotions, and sometimes shame. A financial advisor for debt repayment strategies or a nonprofit credit counselor can help you design a plan that accounts for your psychology, not just your interest rates. Guidance can also prevent you from choosing expensive or risky consolidation products.

—

How to Decide What’s Best for You

If you’re still undecided, do a quick self-assessment:

Ask:

– Have I tried to get out of debt before and stalled out?

– Do I feel overwhelmed by how many accounts I have?

– Does seeing one account hit zero feel deeply motivating to me?

If yes, Snowball likely aligns better with your behavior.

On the other hand:

– Do I like optimizing, spreadsheets, and squeezing every dollar?

– Am I relatively disciplined once I commit to a plan?

– Will I stay the course even if the first visible “win” is months away?

If so, Avalanche will probably serve you best.

You can also road-test both:

– Run your numbers in a calculator using Snowball and Avalanche.

– Compare: payoff dates, total interest, and how often you would see accounts disappear.

– Ask which scenario you are honestly more likely to stick with for 18–24 months.

—

Practical Tips to Make Any Strategy Work

No method can fix a broken system by itself. A few practices dramatically increase your odds of success with either Snowball or Avalanche:

– Automate minimum payments to avoid late fees and dings to your credit score.

– Set a “target extra payment” and treat it like a bill, not a leftover.

– Track your total debt monthly—even a small drop each month reinforces progress.

Consider:

– Building a tiny “starter” emergency fund (even $500–$1,000) before going hard at debt, so one unexpected bill doesn’t blow up your plan.

– Updating your payoff order if interest rates or balances change significantly.

– Celebrating milestones: each $1,000 paid off or each account closed.

These behavior supports matter more than arguing which method is theoretically perfect.

—

So, Snowball or Avalanche?

Here’s the clean summary:

– If you value fast psychological wins and you’ve struggled with consistency, Snowball probably fits you better.

– If you’re highly disciplined and motivated by minimizing interest and time, Avalanche is usually superior.

– If your debt is seriously tangled, consider whether consolidation plus a clear strategy (Snowball or Avalanche) will reduce chaos—just watch the fees and terms.

There isn’t a single universal “best” approach. The best strategy is the one that leads you, personally, to the finish line with the least chance of quitting midway.

Pick a method, write the order of your debts, decide on your monthly extra payment—even if it’s small—and start this month, not next year. The moment you commit and make that first targeted payment, you’re no longer “someone with debt problems.” You’re someone with a debt plan.