Why Most Budgets Fail (And Why Yours Doesn’t Have To)

Most people don’t quit budgeting because they can’t do the math – they quit because the plan on paper has nothing to do with their real life. You can download the best budgeting apps to stick to a budget, color-code every category, and still give up after a month if your numbers ignore how you actually spend, think, and react to money. A realistic budget is less about discipline and more about designing a system that works with your habits instead of fighting them. That’s exactly what we’ll build here: not a “perfect” spreadsheet, but a flexible plan you can live with for years, not weeks.

Step 1. Map Your Real Spending Before You “Fix” Anything

Before experts touch anyone’s budget, they first observe the current behavior. Certified financial planners often spend a whole session just digging into bank statements and card history, not to judge but to see patterns. You should do the same. Pull the last 60–90 days of transactions from all accounts and categorize them roughly: housing, food at home, eating out, transport, debt payments, subscriptions, random “how did I spend this much?” stuff. Don’t round or guess; your brain will conveniently forget some guilty pleasures. The goal is not to feel bad, but to see how your money already behaves without your permission.

How to Turn Raw Transactions Into Insight

Once transactions are grouped, look for clusters and surprises. Are groceries weirdly high on weeks when you work late? Do rideshares spike when it rains? Experts call this the “friction map”: where life pushes you into spending more than you thought. Instead of telling yourself “I’ll just stop doing that,” write down the triggers. For instance, if you always order food on busy Thursdays, that’s not about weak willpower, that’s about energy management. This analytical step is crucial: if you skip it and jump straight into cutting categories, you’ll design a budget that looks tidy but collapses the moment real life shows up.

Step 2. Define What “Realistic” Means for You

A realistic budget is not one you could follow in a perfect month; it’s one you can follow in an average month. Money coaches often ask clients a simple question: “On your most typical, mildly chaotic month, what absolutely must be paid?” Start with non-negotiables: rent or mortgage, utilities, minimum debt payments, basic transport, and essential food. Then add what keeps you functional and sane: a bit of social life, hobbies, and small comforts. If your budget assumes you’ll never buy coffee, never go out, and cook every meal from scratch, it’s not realistic – it’s a wish list dressed up as a plan.

The 4 Categories Every Real Budget Needs

Any solid structure for how to create a realistic monthly budget usually includes four buckets: fixed essentials, variable needs, lifestyle choices, and future-you items (savings, investments, sinking funds). Within each, give yourself a range instead of a single rigid number when possible. For example, groceries might be $350–$400 rather than exactly $365. That band absorbs the small swings that normally lead to “I blew the budget, so why bother?” thinking. Realism comes from acknowledging that prices fluctuate, moods change, and some months just punch harder than others.

Step 3. Choose the Right Budgeting Method for Your Personality

Experts rarely insist on one “correct” method for everyone. Instead, they match methods to personalities. If you love detail and control, a category-based budget with 20–30 line items might actually be satisfying. If you hate tracking every little thing, a simpler “bucket” system with just a few big categories might keep you consistent. The method you can stick to beats the method that looks sophisticated but overwhelms you. It’s like fitness: a simple workout you’ll do three times a week is better than a perfect plan you abandon after day three.

Three Practical Budget Frameworks to Consider

- 50/30/20 approach. Around 50% of take-home for needs, 30% for wants, 20% for savings and debt. It’s good if you want guardrails but not microscopic detail. You can refine over time as you see patterns.

- Zero-based budgeting. Every dollar of income is assigned a job: spending, saving, or debt payoff. Great for people who like structure and want to squeeze the most out of limited income, but it does require regular check-ins.

- Envelope or bucket system. Digital or physical “envelopes” for major categories. When one is empty, that’s it. This is effective for impulse spenders who need a clear, visible stop sign rather than vague intentions.

If you’re a complete beginner, treating your setup as a personal budget planner for beginners rather than a lifetime commitment helps mentally. Test one method for 60 days, then adjust or switch. Experimentation is not failure; it’s data.

Step 4. Start With Clean, Verified Numbers

Now that you know your past spending and have chosen a broad framework, plug in real numbers. Financial therapists often warn that people sabotage budgets by starting from “what they wish” rather than “what is.” Use your last three months as a baseline: average your spending in each category and then decide where to trim, hold, or increase. If your goal is to work out how to start a budget and pay off debt faster, find at least one or two categories to intentionally squeeze and redirect the freed-up cash toward loans or credit cards. Even modest shifts, like $50–$100 per month, add up surprisingly quickly.

How to Pressure-Test Your Draft Budget

Before you declare the new budget final, run a stress test. Ask: “What if this month has two birthdays, one car repair, and higher utilities?” If your plan collapses the moment something goes wrong, it’s not robust enough. This is where sinking funds come in – small monthly amounts set aside for irregular but inevitable costs like medical copays, gifts, car maintenance, and vacations. Experts emphasize that these are not luxuries; they are reality. Adding them makes your budget look tighter in the short term but saves you from panic swipes and new debt later.

Step 5. Use Tools, But Don’t Outsource Awareness

Apps and software can automate parts of the process, but they don’t remove the need to think. Choose budgeting tools to manage monthly expenses based on your habits: if you live on your phone, a mobile-first app with instant alerts might be best; if you’re more reflective, a desktop tool or even a simple spreadsheet may encourage deeper review. The goal is to reduce friction in tracking, not to hide from the numbers. Remember, tools are assistants, not saviors. You still need to open them, look at the data, and make adjustments.

What Experts Look For in Good Budgeting Tools

Many financial coaches recommend features rather than specific brands. They want to see automatic transaction import, simple categorization, customizable reports, and easy ways to separate needs from wants. When evaluating the best budgeting apps to stick to a budget, pay more attention to whether the interface nudges you to check in frequently and less to fancy graphics. If an app feels like a chore after a week, it’s not the right one for you. Some people even end up combining a minimalist app for tracking with a weekly notebook review for reflection – low-tech plus high awareness.

- Pick tools that match your tech comfort level; you shouldn’t need a tutorial every time you log in.

- Avoid overcomplicated systems if money already stresses you – cognitive overload kills consistency.

- Schedule a 15-minute weekly review where you actually look at reports and adjust categories.

Step 6. Build in Flexibility Instead of Guilt

Rigid budgets break the moment something slightly unusual happens. That’s when people say, “I blew it,” and stop tracking entirely. Experts recommend adding a “buffer” or “miscellaneous” line on purpose – not as a failure, but as a shock absorber. Think 3–5% of your income parked there to catch the weird small stuff. Another pro tip is to create a small “fun money” category for each adult in the household. This is no-questions-asked spending. When you know you have a guilt-free amount to enjoy, it’s easier to say no to random temptations that aren’t as important.

Negotiating With Yourself: Trade-Offs Instead of Deprivation

Budgeting works better if you see it as a series of conscious trade-offs, not a punishment. For example, if you want more dining out this month, you might deliberately lower your clothing or entertainment spending. Saying “I’m choosing X instead of Y” is psychologically different from “I can’t have anything.” Behavioral economists note that people stick with systems that preserve a sense of autonomy. So, rather than forcing yourself into an all-or-nothing plan, approach your budget as a way to prioritize what you genuinely care about and trim what turned out not to matter as much.

- List 3–5 expenses that truly improve your life quality; protect them where possible.

- List 3–5 expenses you barely notice; those are candidates for cuts or automation.

- Review these lists every few months; your values and circumstances will shift over time.

Step 7. Automate the Boring, Keep the Decisions Where They Matter

One reason experts love automation is that it bypasses procrastination. Automate fixed bills, minimum debt payments, and transfers to savings right after payday so you don’t have to rely on constant willpower. But don’t automate everything. Variable categories like groceries, dining out, or personal spending deserve conscious choices each week. That’s where you learn about your habits. Think of automation as putting your financial essentials on rails while leaving some areas flexible so you can steer in real time based on what the month brings.

Pay Yourself First (But Define What That Means)

“Pay yourself first” is old advice, but it only works if you decide what “yourself” includes. Is it just retirement savings? Emergency fund? Debt payoff? For many people, especially those with obligations or inconsistent income, it’s more practical to define a tiered system: first, protect rent and food; second, fund debt and minimum savings; third, add extra to long-term goals when there’s room. This layered approach makes you more resilient in lean months without abandoning the whole plan. Consistent, smaller steps beat sporadic big pushes that burn you out.

Step 8. Turn Your Budget Into a Weekly Habit, Not a Monthly Event

A budget checked once a month is like weighing yourself once a year and expecting precision. Financial planners typically meet with clients at least monthly and encourage shorter check-ins in between. Adopt a short, repeatable weekly ritual: look at what came in, what went out, and what’s left in each main category. Move small amounts around as needed while the month is still salvageable. This is how you course-correct early instead of discovering at month’s end that you overspent by hundreds in groceries, gas, or takeout.

What to Do During a 15-Minute Money Check-In

Skip the drama and make it mechanical. Log in, categorize new transactions, compare spending to your planned numbers, and ask three quick questions: Did anything surprise me? Do I need to shift money between categories? Is there any upcoming expense I need to prepare for? That’s it. By repeating this every week, your budget stops being a judgment report and becomes a dashboard. Many coaches note that the simple act of looking often is more powerful than any fancy technique; awareness alone usually leads people to adjust behavior without feeling forced.

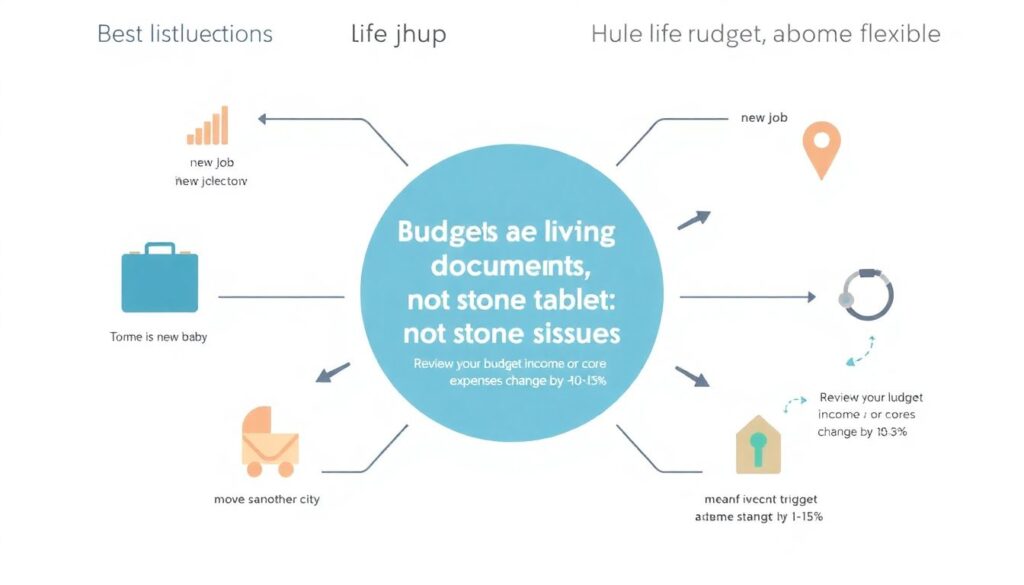

Step 9. Adjust Faster When Life Changes

Budgets fail when they’re treated as stone tablets instead of living documents. New job, new baby, move to another city, health issues – all of these should trigger a budget review. Expert recommendation: every time your income or core expenses shift by more than 10–15%, redraw your plan. Don’t wait to “see how it goes,” because you’ll likely fill the gap with unconscious spending. If money gets tighter, prioritize essentials and minimum debt payments, then slowly rebuild savings contributions as you stabilize. If income grows, resist lifestyle inflation by deciding in advance what percentage of the increase goes to goals versus nicer living.

Use Short Feedback Loops, Not Yearly Resolutions

Instead of annual financial resolutions that fade, set 30–90 day experiments. For the next three months, you might aim to cut dining out by 20% and divert that amount to an emergency fund. At the end, review: was the target realistic, and did the trade-offs feel acceptable? This short-cycle testing, borrowed from behavioral science, makes budgeting more like running small experiments than enforcing strict rules. It reduces shame and gives you hard evidence about what works for you, which is far more valuable than generic advice.

Step 10. When Debt Is Involved, Make It Part of the Plan (Not an Afterthought)

If you’re juggling debt, your budget must integrate it, not tack it on at the end. Professionals working with clients in debt usually start by ensuring all minimums are covered in the “essentials” bucket. Then they look for room to add targeted extra payments. Two common strategies appear again and again: the avalanche method (extra money to the highest interest rate) and the snowball method (extra money to the smallest balance for quicker wins). Mathematically, avalanche wins; psychologically, snowball often keeps people more motivated. The best approach is the one that you are willing to continue for the long haul.

Balancing Aggressive Payoff With a Life You Recognize

There’s a temptation to throw every spare dollar at debt, but many advisors warn against going so extreme that you snap and give up. Think in terms of sustainable intensity. Can you commit to this level of extra payment for at least a year without feeling constantly deprived? If not, trim it slightly and keep a small budget for joy. Long-term change almost always beats short, heroic bursts. Over time, your budget becomes both the roadmap for how to start a budget and pay off debt and the safety net that prevents you from falling back into old patterns.

Final Thoughts: Treat Budgeting as a Skill, Not a Personality Test

Sticking to a budget is not proof of being “good with money”; it’s a skill set you can learn, refine, and adapt. Skills improve with feedback, practice, and better tools, not with self-criticism. You’ve seen how to create a realistic monthly budget by grounding the numbers in your actual life, matching methods to your personality, using technology thoughtfully, and allowing for human behavior rather than fighting it. If you treat your budget as an ongoing experiment, not a verdict, you’ll be far more likely to stick with it – and over time, that quiet consistency does more for your finances than any dramatic, one-time overhaul ever could.