Why Long‑Term Vacation Saving Deserves Its Own Strategy

Planning a two‑week getaway is one thing; saving for a three‑month sabbatical or a year of slow travel is a completely different beast. The cash flow, risks and psychological traps меняются сильно when you stretch your time away.

Before we dive into the numbers and tools, let’s set a few shared definitions so we’re talking about the same thing.

Key Terms You’ll See Throughout This Guide

Long‑term vacation

A trip longer than 4–6 weeks where you’re not earning your regular income (or you’re earning much less), and you’re paying living costs away from home. Think extended backpacking, taking a career break, or a family sabbatical.

Travel fund

A dedicated “bucket” of money—separate from your emergency fund and day‑to‑day spending—used only for travel costs: flights, accommodation, insurance, visas, food, local transport and a cushion for surprises.

Savings rate

The percentage of your income that you set aside for a specific goal. Example: if you earn $3,000 per month and stash $600 into your travel fund, your savings rate for that goal is 20%.

Runway

How long your money lasts. For travel, your runway is:

> _Runway (months) = Total travel fund ÷ Average monthly trip costs_

If your travel fund is $18,000 and you expect to spend $1,500 per month, your runway is 12 months.

—

Step 1. Get Concrete About Your Long‑Term Trip

Vague dreams are hard to fund. Specific plans are much easier.

Sketch the Big Picture of Your Trip

Think in three dimensions:

– Length: How many months do you want to be away?

– Style: Budget backpacker, mid‑range comfort, or “I want a pool and air‑con everywhere”?

– Regions: Southeast Asia vs Europe vs Latin America have radically different daily costs.

A common beginner mistake is planning as if every destination costs like their home city. That’s how people show up in Norway with a Thailand budget and panic on day three.

Turn Your Dream Into Rough Numbers

Let’s build a simple diagram in words for thinking about trip costs:

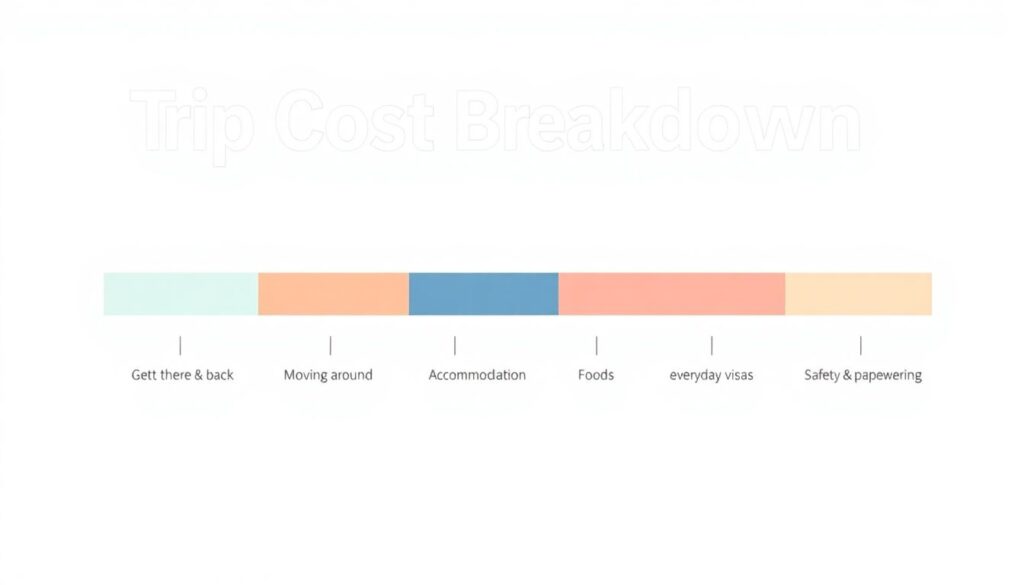

> Imagine a bar split into five chunks:

> 1) Getting there & back (long‑haul transport)

> 2) Moving around (local buses, trains, flights)

> 3) Roof (accommodation)

> 4) Food & everyday life

> 5) Safety & paperwork (insurance, visas, vaccines, backups)

Each chunk is a percentage of your total budget. The exact numbers vary, but you can roughly estimate:

– 10–20% flights in & out

– 10–20% internal transport

– 30–45% accommodation

– 20–30% food & day‑to‑day

– 5–15% insurance, visas, gear

For a travel savings plan for year long vacation, multiply your realistic monthly spend by 12, then add 10–20% as an “inevitable chaos” buffer. Underestimating the buffer is one of the most expensive rookie errors.

—

Step 2. Translate the Trip Into a Savings Target

Now we turn the dream into a number and a deadline.

Backwards Planning: Start From the Departure Date

Say you want to leave in 18 months and you estimate you’ll need $24,000 for a long‑term vacation:

– Target: $24,000

– Time: 18 months

– Needed per month: $24,000 ÷ 18 ≈ $1,335

That’s your required monthly savings. If that number makes you swallow hard, that’s good—it means you’re dealing with reality, not fantasy.

A frequent beginner mistake is setting a savings number based on “what feels comfortable” instead of “what the math demands.” The gap silently becomes future credit‑card debt.

Visualizing the Savings Path (Simple Diagram)

Picture a line chart:

– Horizontal axis: months until departure (0–18)

– Vertical axis: total saved ($0–$24,000)

– A straight diagonal line climbs from $0 at month 0 to $24,000 at month 18

Now imagine a second, wobbly line representing your actual savings:

– Some months are above the straight line (bonus at work, tax refund)

– Some months are below (car repair, vet bills)

Your job is to keep the average close to that straight line, not to hit the same number every month. Saving for a trip is rarely perfectly smooth.

—

Step 3. Choose Where Your Travel Fund Lives (and Why It Matters)

Where you store your savings changes how fast it grows and how safe it is.

Comparing Common Options

1. Standard checking account

Pros: Accessible, familiar.

Cons: Very low or zero interest, easy to “accidentally” spend.

2. Regular savings account

Pros: Slightly better interest, often easy to automate transfers.

Cons: Still pretty low returns, can be linked to main banking app (temptation).

3. High yield savings account

Pros: Much better interest, usually separate from your day‑to‑day checking, FDIC/insured in many countries.

Cons: Might take a day or two to transfer money back, rates can change.

For many people, the best high yield savings account for vacation fund is simply the one that’s:

– Insured,

– Offers a top‑tier rate _for your country_, and

– Lets you set up automatic transfers in and out.

4. Short‑term investments (like bond funds or CDs)

Pros: Potentially higher return than savings accounts.

Cons: Risk, complexity, and often lock‑in periods. For a 1–3 year horizon, you probably don’t want your travel money swinging with the stock market.

A common novice mistake is chasing higher returns with complex investments for a trip that’s only 1–2 years away. If the market dips right before you leave, your “dream trip fund” might suddenly be short.

For a long‑term vacation that’s within the next 3 years, a high yield savings account or very conservative instruments are usually safer than volatile investments.

—

Step 4. Design a Travel Savings Plan You Can Actually Stick To

The smartest plan is the one you’ll follow when you’re tired, stressed and tempted.

Build a Simple Monthly Budget First

To understand how to save money for long term travel, you need a clear picture of where your current money goes.

Short version:

1. List your take‑home income.

2. Track a normal month of spending with brutal honesty.

3. Categorize into:

– Needs (rent, utilities, food, transport)

– Obligations (debt payments, child support)

– Wants (dining out, entertainment, “fun online shopping”)

4. Decide how much of the “wants” bucket can be re‑routed to your travel fund.

Many beginners skip step 2 and rely on guesses. Their “I probably spend about $200 eating out” turns out to be $450 when they check their statements.

Use a Budgeting App and Automation

Technology is your friend here. A good budgeting app to save for vacation will:

– Pull transactions from your accounts automatically

– Let you tag expenses as “travel fund sabotage” (joking… sort of)

– Show progress towards your travel goal in real time

Combine this with automatic savings tools for travel fund, such as:

– Scheduled transfers every payday into your travel account

– “Round‑up” tools that move spare change from purchases into savings

– Rules like: “Every time I get paid, send 10% straight to the travel fund”

The goal is to make your travel saving default, not something you have to remember and decide about every time.

A frequent mistake is relying on discipline alone: “I’ll move whatever is left at the end of the month.” For most people, “what’s left” is close to zero.

—

Step 5. Common Rookie Mistakes and How to Dodge Them

Let’s go through the errors that bite first‑timers again and again.

Mistake 1: Ignoring Home‑Base Costs While You’re Gone

Many travelers budget only for costs on the road and forget about the bills that keep arriving at home.

Hidden home‑base costs can include:

– Storage units

– Health insurance at home

– Minimum debt payments

– Property tax or rent to hold your place

– Subscriptions you forgot to cancel

Fix: Make a separate mini‑budget called “Costs while away” and include that in your total savings target. Your travel runway should cover both “life over there” and any automated payments “back here.”

Mistake 2: No Emergency Buffer

Going all‑in on the travel fund and leaving yourself with no emergency savings is risky. If you blow an engine three months before departure, you don’t want to choose between cancelling your trip and credit‑card debt.

Fix: Keep your emergency fund and travel fund separate. Two different buckets, two different jobs. The emergency fund is for unexpected life problems; the travel fund is for expected adventure.

Mistake 3: Underestimating Boring, Unsexy Costs

First‑timers love to budget flights and hostels and completely forget:

– Travel insurance (especially for year‑long travel)

– Visa fees, border‑crossing taxes

– Vaccinations and any required medications

– Replacement gear (phones get wet, shoes wear out)

For longer trips, these “boring costs” can be 10–20% of your total budget.

Fix: When you estimate your trip, add a line called “Admin & safety” and give it real money. Then add a 10–20% buffer on top of your entire plan.

—

Step 6. Decide How Much Comfort You Actually Want

Your travel style is a financial decision more than a personality trait.

Comparing Travel Styles by Daily Cost

Imagine three simplified “daily budget” diagrams as stacks of coins:

1. Shoestring backpacker

– Shared hostel dorms

– Street food and cooking

– Buses and slow trains

Daily stack: 🟡🟡 (small)

2. Mid‑range comfort

– Private rooms or simple Airbnbs

– Mix of local restaurants and cooking

– Occasional flights for long hops

Daily stack: 🟡🟡🟡🟡 (medium)

3. High‑comfort / family

– Private accommodation, often with kitchen

– Eating out more, activities for kids

– Comfortable transport, more flights

Daily stack: 🟡🟡🟡🟡🟡🟡 (tall)

New travelers often mis‑label themselves. They say, “I’m fine with hostels,” and then discover they don’t sleep well in dorms and start upgrading rooms halfway through the trip—without having budgeted for it.

Fix: Do a short “test trip” with the style you think you want. Track your actual spending per day. Use that real number for your long‑term budget, not wishful thinking.

—

Step 7. Build a Realistic Travel Savings Timeline

Now you know:

– Rough trip cost (with buffer)

– Your current savings capacity

– Your preferred travel style

Time to combine them.

Example: Turning a Dream into a Plan

Let’s put numbers on an example:

– Target: 6‑month trip, mid‑range style

– Estimated daily cost: $60

– 6 months ≈ 180 days → $60 × 180 = $10,800

– Add 15% buffer: $10,800 × 1.15 ≈ $12,420

– Add $1,500 for flights, insurance and visas → ≈ $13,920

Round up to $14,000 target

Assume:

– You can save $700/month initially

– You can increase to $900/month after paying off a small loan in 6 months

Text‑diagram of your savings progress:

– Months 1–6: $700/month → $4,200

– Months 7–18: $900/month → $10,800

Total after 18 months: $15,000 → you hit your $14,000 target with a $1,000 cushion.

This is what a travel savings plan for year long vacation or multi‑month sabbatical looks like in practice: boring, predictable monthly contributions, plus a realistic sense of when you can actually leave.

A common novice mistake is expecting huge lifestyle changes (“I’ll cut everything!”) to magically appear and then not following through. Using your existing, proven behavior as the baseline is more honest.

—

Step 8. Make It Easier to Stay Motivated

Long‑term saving is more psychology than math.

Use Milestones Instead of One Giant Number

If you’re starting from zero, “I need $20,000” can feel impossible. Break it into chunks tied to trip components:

– Milestone 1: “Flights funded” – $2,000

– Milestone 2: “First 3 months of living costs funded” – $5,000

– Milestone 3: “Remaining months funded” – $8,000

– Milestone 4: “Emergency travel cushion funded” – $5,000

Each time you cross a milestone, you’re not just inching closer; a concrete piece of your trip is now fully paid for.

Reduce Everyday Friction

Quick ways to keep going:

– Keep your travel account in a separate bank from your everyday spending

– Hide the travel card from your digital wallet so you’re not tempted

– Put a sticky note on your laptop with your “Why”:

“3 months in Mexico learning Spanish > daily take‑away coffee”

One more common mistake: only tracking the big wins. Celebrate the small, boring deposits just as much. That $25 from selling an old backpack? It’s a night in a guesthouse somewhere new.

—

Step 9. What to Do as Departure Gets Closer

The last 3–6 months before leaving are where people either lock everything in or unravel.

Safety Checks Before You Go

Run through:

– Cash cushion: Aim to arrive with at least 1 extra month of expenses untouched

– Access: Do you have backup cards, offline copies of documents, and a way to move money quickly if needed?

– Home base: Are all recurring bills either cancelled, paused or budgeted into your runway?

If your savings came in lower than planned, don’t ignore it and hope for the best. Adjust:

– Shorten the trip

– Focus on cheaper regions

– Trim the “comfort” level a little

Putting uncomfortable facts on the table before you buy your first ticket is the difference between a relaxed sabbatical and constantly worrying you’ll run out of cash.

—

Wrapping It All Together

Saving for a long‑term vacation isn’t about heroic sacrifice or secret hacks. It’s mostly:

– Clear definitions (trip length, style, true cost)

– Simple math (how much per month, for how long)

– The right tools (accounts, automation, a budgeting app to save for vacation)

– Avoiding classic mistakes (no buffer, mis‑judged daily costs, ignoring home‑base bills)

– Honest trade‑offs (less short‑term consumption for more time and freedom later)

If you treat your long‑term trip like any other serious project—define, estimate, plan, automate, review—you move it from “someday” to an actual date on a calendar. And when that date comes, you’ll step on the plane knowing the money side is handled, so you can focus on everything else.