The New Reality of Money for Small Business Owners

Being a small business owner in 2025 means your personal money and your business money are under more pressure—and more scrutiny—than ever. Cashless payments, instant loans, AI-driven accounting, and crypto-flavored investments all sound exciting, but they also make your financial life more complex.

This is exactly why *personal finance* is no longer a nice-to-have “later” topic. It’s core infrastructure for your business and your life.

Before we dive into tools and trends, let’s clarify a few basic terms in simple language:

– Personal finance – how you earn, spend, save, invest, and protect *your* money as a person, not as a company.

– Business finance – everything related to your company’s money: revenue, expenses, taxes, and investments made by the business.

– Cash flow – the speed and direction of money moving in and out, like water in pipes: inflow (sales, income) and outflow (costs, loan payments, taxes).

– Net worth – what you own minus what you owe, specifically on the personal side (savings, investments, house) minus (debt, loans, credit cards).

Why Personal Finance Matters More When You Run a Business

When you have a salary job, money usually behaves like a straight line: you get paid every two weeks, pay bills, save what you can.

When you run a business, money looks more like a heart monitor on a medical screen: spikes, dips, and sometimes scary flat lines. That volatility can seriously damage your personal life if you don’t handle it intentionally.

Two Financial Lives, One Decision-Maker

Here’s the tricky part: you are one person making choices for two systems:

1. Your household system (rent or mortgage, groceries, kid’s school, retirement).

2. Your business system (rent for the office, payroll, marketing, equipment, subscriptions).

A good way to imagine this is a diagram:

> Diagram (text description):

> Picture two circles: one labeled “Personal,” the other “Business.”

> – Each circle has arrows pointing inward (income) and outward (expenses).

> – Between the circles is a narrow “bridge” labeled “Owner draws / Salary / Dividends.”

> Your job is to keep the circles healthy while not overloading the bridge in either direction.

If you pull too much money from the business, the company starves.

If you sacrifice your entire personal life for the business, you burn out and increase the risk of bad decisions.

How to Separate Personal and Business Finances (Without Losing Your Mind)

The phrase *how to separate personal and business finances* gets thrown around constantly, but let’s translate it into clear, actionable moves.

Step 1: Physical Separation of Money Streams

Open at least:

– One business checking account

– One business savings/tax account

– One personal checking account

– One personal savings/emergency account

Different banks or at least different “workspaces” within the same digital bank can help psychologically. When you see the balances, you want your brain to say, “This is business money, I’m just its manager,” rather than “Nice, I’m rich today.”

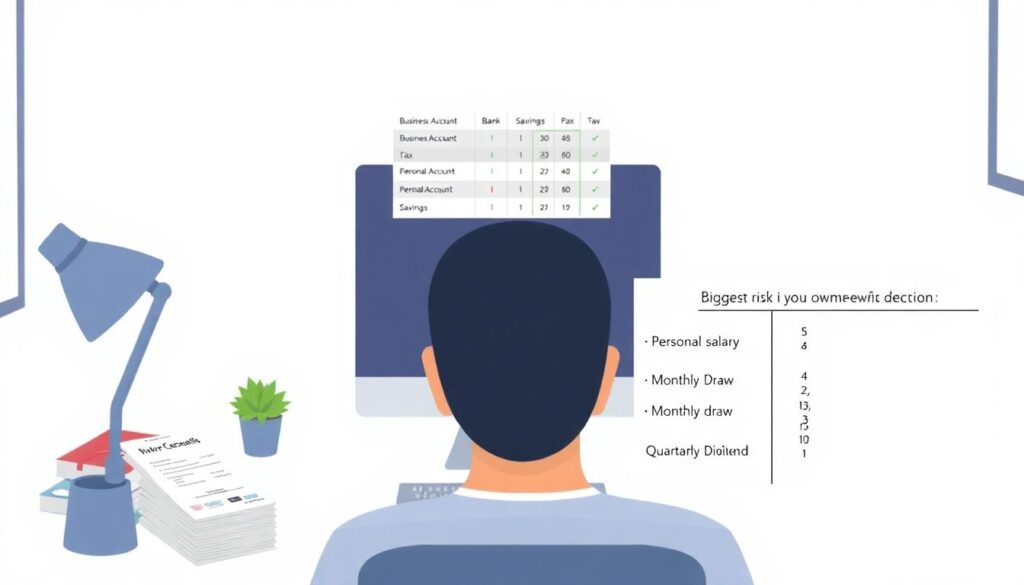

Diagram: Four-Bucket Layout

> Diagram (text description):

> Draw four boxes:

> – Top row: “Business Checking” → “Business Tax & Reserve”

> – Bottom row: “Personal Checking” → “Personal Emergency & Goals”

> Arrows flow from business income into Business Checking. From there, arrows split: some to Business Tax & Reserve, some across the “owner bridge” to Personal Checking. From Personal Checking, another arrow flows to Personal Emergency & Goals.

This visual reminds you that every transfer out of the business is a deliberate choice, not a casual move.

Step 2: Legal and Tax Separation

If you haven’t already, talk to a tax pro or lawyer about operating as an LLC or corporation instead of as a sole proprietor. The point isn’t just liability protection; it’s also discipline.

When your business is a legally distinct entity, it becomes easier to convince yourself:

> “This is the company’s money. I pay myself a salary or distribution. I don’t swipe the business card for groceries.”

That mental gap is huge.

Step 3: Behavior Separation

Even with multiple accounts and a legal structure, the biggest risk is still… you.

A few rules of thumb:

1. No mixed receipts. If an expense is 100% personal, use personal money.

2. Clear owner compensation plan. Decide how you get paid: regular salary, monthly draw, quarterly dividend, or a combination.

3. Emergency rule: Only borrow from the business or from yourself with a simple written agreement about how and when you’ll pay it back.

This may sound formal, but nine times out of ten, chaos starts with “I’ll just do it this once.”

Modern Cash Flow Management: From Spreadsheets to AI

In the early 2010s, most owners lived inside Excel and hoped for the best. By the mid-2020s, we have a very different toolkit.

Why Basic Spreadsheets Aren’t Enough Anymore

Spreadsheets are flexible but fragile. One wrong cell edit, and your profit vanishes. They don’t “talk” automatically to your bank, payment processor, or tax system unless you force them to with manual exports.

Modern small business accounting and budgeting software behaves more like a financial autopilot:

it connects to your bank in real time, categorizes transactions using machine learning, and even suggests budgets based on your past patterns.

Trend: AI-Powered Budgeting and Forecasting

Most current cloud tools can now do at least three smart things:

1. Spending pattern detection – “Your software subscriptions jumped 40% in 6 months.”

2. Cash flow forecasting – “If sales stay the same, you’ll be short on cash in week 3 of next month.”

3. Scenario simulations – “What happens if you hire one more person at $3,000/month?”

Compared to older desktop software, the new generation adds “brains” on top of the ledger. The result: instead of looking backward at what went wrong, you get early warnings.

Example: Forecast Alert in Real Life

Imagine you run a small design studio. Your software pings you:

> “Based on your current invoices and recurring costs, you will hit a negative balance of $1,200 in 24 days if you don’t collect on overdue invoices or cut expenses.”

You now have three weeks to act, not three days. That time difference is the entire game.

Personal Safety Nets for Unpredictable Income

A salary employee can get away with a small emergency fund. Entrepreneurs typically can’t.

Defining Your Emergency Fund (For Real)

Emergency fund = a separate pile of cash or instant-access savings that covers several months of your essential personal expenses (housing, food, insurance, basic bills), not your ideal lifestyle.

For a small business owner, a reasonable target is:

– 6–12 months of essential living costs on the personal side

– plus 2–3 months of operating expenses on the business side (in a separate business reserve)

You build this gradually, not overnight. The point is to survive bad quarters without maxing out credit cards or raiding your retirement.

Comparing Two Safety Strategies

– Old-school approach: Rely mostly on a personal credit line “just in case.”

– Modern approach: Build cash buffers + access to flexible fintech credit lines that can be turned on/off quickly.

The second approach combines the stability of cash with the agility of on-demand credit, which is far more aligned with the fast-moving 2025 payment and lending ecosystem.

Investing When You’re Both the Boss and the Asset

When you run a business, you’re tempted to pour all spare money back into it. It feels rational—until something breaks.

The “All-In” Trap

Your business is already a concentrated bet. It depends on:

– Your health and energy

– Market conditions

– A few big clients or platforms (think: Amazon, Etsy, Google Ads, Meta, App Stores)

If all your personal net worth lives inside that same bet, a single shock can wipe out both your income and your savings.

Balanced Approach: Business vs. Personal Investing

Here’s a simple way to think about it:

1. Reinvest in the business for growth that has a clear rationale (new product, paid marketing with solid metrics, systems that save you time).

2. Build personal investments outside the business (index funds, retirement accounts, perhaps some real estate or bonds) that do not depend on your company’s survival.

This way, your future doesn’t vanish even if this particular business doesn’t play out as planned.

Diagram: Risk Diversification

> Diagram (text description):

> Imagine a bar chart showing three bars that represent your total wealth.

> – Bar 1 (Now): 90% Business, 10% Personal Investments

> – Bar 2 (3–5 Years): 60% Business, 40% Personal Investments

> – Bar 3 (Long Term): 40% Business, 60% Personal Investments

>

> The shift over time is the point: you intentionally build a “life raft” outside your company.

Debt, Credit, and Funding in the Mid-2020s

The way small businesses borrow money is changing rapidly. Traditional bank loans still exist, but fintech is everywhere.

Understanding “Good” vs “Bad” Debt (With Nuance)

– Productive debt – borrowed money that is very likely to increase your earning power more than the cost of interest (e.g., financing equipment that directly produces saleable work).

– Consumption debt – borrowed money for lifestyle upgrades or non-essential business “toys” that don’t generate clear returns.

The line between them is not always obvious, but one test helps:

> If this investment fails completely, will I still be okay financially and mentally?

If “no,” that might be more risk than is healthy, regardless of how cheap the loan looks.

Trend: Revenue-Based Financing & Embedded Credit

Instead of asking for collateral and long forms, modern lenders and platforms look directly at your sales data:

– Payment processors offer advances based on your card volumes.

– Marketplaces and e-commerce platforms offer inventory loans based on your store metrics.

Compared to older bank loans, these are faster, algorithm-driven, and integrated into the tools you already use—but often more expensive on a per-dollar basis. Convenience is traded for higher implied interest.

Insurance and Risk Management: The Boring Hero

One serious accident or lawsuit can destroy decades of good budgeting. That’s why insurance is a core part of personal finance for entrepreneurs, not a side note.

Key Protections to Understand

– Health insurance – prevents medical events from becoming financial catastrophes.

– Disability insurance – replaces part of your income if you can’t work due to illness or injury.

– Life insurance (term, not fancy investment hybrids) – protects your family if something happens to you.

– Liability and professional insurance – protects the business from claims, and indirectly protects your personal assets.

Compared to standard employees, you must pick and design this safety net. No HR department is coming to save you.

Digital Tools and Services Worth Knowing About in 2025

You don’t need to become your own CFO, but you do need a basic tech stack.

Accounting, Budgeting, and Automation

Modern apps can:

– Sync with banks and cards

– Auto-categorize spending

– Tag transactions as “personal,” “business,” or “mixed”

– Generate tax-ready reports and simple forecasts

This is where most small business owner personal finance tips now start: automate what a machine can do faster and more accurately, so you can spend your brainpower on strategy and sales.

Human Help: Planners and Coaches

While software can crunch numbers, humans are still better at dealing with your fears, blind spots, and big decisions. That’s why many experts now recommend a hybrid approach:

Use automation for tracking, and then lean on the best financial planning services for small business owners you can reasonably afford for strategic guidance once or twice a year.

This could be:

– A fee-only financial planner

– A CPA who understands both your business and personal goals

– A money coach who helps you build habits but doesn’t sell products

Learning the Foundations: Courses and Education

The internet is overflowing with advice. Some of it is excellent; some is thinly veiled advertising. You’ll move faster if you deliberately learn the basics instead of just skimming social media.

Why Structured Learning Beats Random Tips

TikTok and YouTube might spark ideas, but solid understanding usually comes from content that’s:

– Structured (one topic builds on another)

– Transparent about assumptions and risks

– Clear about what it *doesn’t* cover

That’s why more owners are signing up for personal finance courses for entrepreneurs specifically tailored to those with irregular income, tax complexity, and business risk. Compared to generic budgeting courses for employees, these programs talk about owner’s draw, quarterly taxes, and exit planning—things that actually matter in your life.

Putting It All Together: A Simple 7-Step Roadmap

To avoid overwhelm, here’s a straightforward sequence you can follow over the next few months.

Step-by-Step Action Plan

1. Separate your accounts.

Open dedicated business and personal accounts. Stop mixing cards and receipts starting today.

2. Automate the basics.

Connect your accounts to reliable small business accounting and budgeting software and set up automatic transaction categorization.

3. Define how you pay yourself.

Choose a base salary or owner draw and stick to it for at least three months before changing it.

4. Build dual emergency funds.

Aim, over time, for 6–12 months of essential personal costs and 2–3 months of business operating costs. Start tiny if you must.

5. Map and reduce risky debt.

List all personal and business debts, interest rates, and due dates. Prioritize paying down high-interest, non-productive debt.

6. Start (or restart) investing outside the business.

Even if it’s a small monthly amount into a diversified fund or retirement account, begin building wealth that doesn’t depend on your company.

7. Schedule your learning and reviews.

Block two recurring slots: one monthly money review with your software, and one quarterly deeper session (alone, with a planner, or via a course).

Modern Trends, Same Core Principles

Contactless payments, AI forecasts, crypto experiments, and instant lending have changed the *shape* of money in 2025—but not the fundamentals.

You still need:

– Clear separation between you and your business

– Control over cash flow and debt

– Buffers for the unexpected

– Diversified investments for the long run

– A basic, evolving understanding of how money works

The tools and buzzwords will keep changing. The essentials of personal finance for small business owners will not. If you keep your systems simple, your buffers real, and your learning ongoing, your business becomes a powerful engine for your life—not the other way around.