Why your personal money habits will make or break your business

Most new founders obsess over product, marketing, maybe even pitch decks — and quietly hope their personal finances will “somehow” sort themselves out. They don’t.

When you become an entrepreneur, your personal and business money flows are tied together like two communicating vessels. A cash crunch in the business hits your rent. Personal debt limits how long you can survive a slow sales month. Poor record‑keeping kills not just your startup, but your ability to get a mortgage later.

Let’s walk through a practical, beginner‑friendly guide to personal finance for new entrepreneurs, with real numbers, examples from the field, and a bit of forecasting on how this will look by 2030.

—

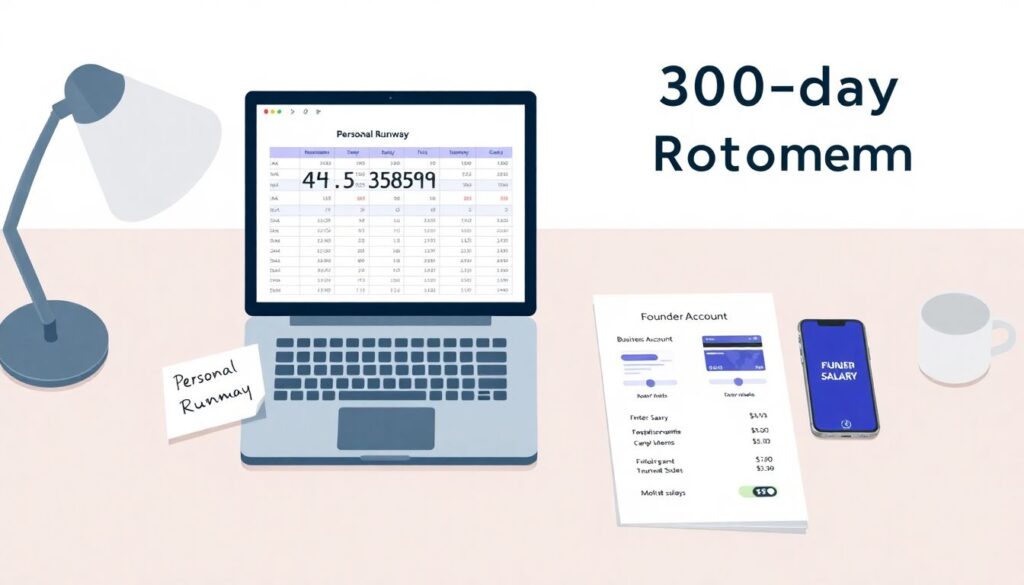

Step 1: Calculate your real “runway as a human”

Founders love talking about startup runway: “We’ve got 12 months of runway.”

Almost nobody calculates *personal* runway. That’s the number that secretly controls your risk tolerance.

1. List your *bare‑bones* personal monthly costs:

– Rent / mortgage

– Food and essentials

– Health insurance and medical

– Basic transport

– Debt payments (minimums)

– Childcare or family support

2. Strip out everything optional: fancy subscriptions, vacations, “experimental” spending.

3. Add a 10–15% buffer for surprises.

Example (realistic 2025 numbers in a mid‑cost city):

– Rent: $1,100

– Groceries & basics: $450

– Transport: $150

– Health insurance: $280

– Debt minimums: $220

– Phone & internet: $90

Bare‑bones: $2,290

+ 10% buffer ≈ $2,520 per month

If you have $12,600 in savings that you’re genuinely willing to spend on living costs, your *personal runway* is:

> $12,600 ÷ $2,520 ≈ 5 months

Five months is very different from the “18 months of runway” you might quote based on investor money or revenue optimism. That number should guide how fast you try to grow, how aggressively you reinvest, and whether you keep part‑time work.

> Technical detail — A simple personal runway formula:

> Personal runway (months) =

> (Liquid savings dedicated to living costs) ÷ (Monthly essential expenses × 1.1)

Once you know that figure, you can stop making vague decisions and start making calculated ones.

—

Step 2: Separate money on day one (even if you earn $0)

The second trap for early entrepreneurs is mixing personal and business money in one account “until it’s serious.”

That’s how you end up paying personal tax on business income twice, missing deductible expenses, or getting your account frozen during a tax review.

Even as a solo, pre‑revenue founder, open a separate business account as soon as possible. Search for the best business bank account for new entrepreneurs in your country and compare at least three options on:

– Monthly fees

– Card fees

– Integration with bookkeeping tools

– Limits on free transfers or ATM withdrawals

In 2025, most digital banks (in the US, UK, EU especially) will let you open a business account online in under 30 minutes with minimal paperwork if you’re a sole proprietor or simple LLC.

> Technical detail — Minimal setup that covers 90% of beginners:

> – 1 x Personal checking account (salary, rent, groceries)

> – 1 x Personal savings “runway” account (no card access)

> – 1 x Business checking account (all client payments + business expenses)

> – Optional: 1 x Tax sub‑account inside business banking (many fintech banks let you set this up with “pockets” or “spaces”)

This structure forces clarity: when money hits your business account, it’s business income first, and *only later* becomes personal income via a transfer or salary.

—

Step 3: Decide what you pay yourself — and stick to it

A beginner mistake: treating the business account like a piggy bank. Some months you pull $800, some months $3,000, depending on how “flush” it feels.

This destroys both your personal budget and your ability to read the business’s health.

Instead, pay yourself a *fixed* “founder salary” as early as possible — even if it’s modest.

Example:

Let’s say your business brings in $4,000 in a typical month, and essential business expenses are $1,600 (software, marketing, tools, taxes estimate, etc.). You might:

– Allocate $2,000 as your founder salary

– Keep $400 as a buffer

– Reinvest the remaining $0–$1,000 in growth, depending on actuals

Even if one month you earn $7,000, try to keep your salary stable and let the difference cushion your business or future salary increases.

This is the discipline that lets you say, “I can stay on this salary for 18 months,” rather than oscillating between feast and famine.

—

Step 4: Design a personal budget that survives variable income

Your income as a founder will be lumpy. Some months you’ll feel rich. Others you’ll wonder if you should apply for a job at the coffee shop downstairs.

A traditional, rigid monthly budget breaks easily under that volatility. You need something more flexible.

One proven method: pay yourself from an “income smoothing” buffer.

> Technical detail — How the smoothing buffer works:

> – All business revenue ⇒ Business account

> – Once a month, business account ⇒ Your personal account (fixed salary)

> – You yourself maintain a 1–2 month salary buffer in the *business* account

> – Personal budget is based on that stable salary, not on fluctuating revenue

If your personal cost base from earlier is $2,520 and you pay yourself $2,800, you have $280 left each month for personal savings or debt payoff — but only if you respect the numbers.

A simple personal budget for a founder might look like:

– 60–70% — Core living (rent, food, bills, transport)

– 10–15% — Debt repayment or building an emergency fund

– 10–15% — Long‑term investing (retirement, index funds)

– 5–10% — Fun / “guilt‑free” spending

It’s not glamorous, but it’s sustainable.

—

Step 5: Build a realistic emergency and “opportunity” fund

Classic personal finance advice says: “Save 3–6 months of expenses.” For entrepreneurs, that’s often too low.

A more realistic goal is:

– 6–12 months of *personal* bare‑bones costs

– Plus 2–3 months of *business* fixed costs

If your personal base is $2,520 and your business needs $1,600/month just to exist (tools, minimal marketing, compliance), then:

– 9 months of personal ≈ $22,680

– 2 months of business ≈ $3,200

– Target combined buffer ≈ $25,880

That number may feel huge at the start. It’s fine if it takes years. The critical part is directional: each month, something goes towards that buffer.

Many savvy founders also build a small opportunity fund — say $1,000–$3,000 — specifically for things like:

– A conference where your top clients will be

– A short-term ad experiment that shows great early numbers

– Hiring a contractor when work suddenly spikes

This is not your flight money or rent backup; it’s strictly for optional upside.

—

Step 6: Use tools early — not as an afterthought

A surprising number of new entrepreneurs still track everything in random spreadsheets and screenshots. That’s survivable at 1–2 clients. It becomes chaos at 10+ clients or multiple revenue streams.

At minimum, pick simple accounting software for startups and entrepreneurs that:

– Connects to your bank accounts

– Categorizes transactions semi‑automatically

– Generates basic profit & loss reports

– Lets you export clean records for tax season or an accountant

Even a low‑cost tool (in the $10–30/month range in 2025) can save you hours a month and hundreds of dollars a year in avoided penalties and missed deductions.

> Technical detail — Metrics to check monthly from your software:

> – Revenue vs. same month last year (if you have the history)

> – Average gross margin (Revenue – Direct costs) ÷ Revenue

> – Top 10 expense categories and their trends

> – Taxes set aside vs. likely liability

If you hate this kind of work, outsource: many financial planning services for small business owners offer light packages for solopreneurs, often starting around $100–300/month in 2025 for quarterly reviews and tax planning. That can be far cheaper than the cost of a single major mistake.

—

Step 7: Master the one thing that sinks most founders: cash flow

Profitable businesses go bankrupt all the time. The usual reason: they run out of cash before they get paid.

So understanding how to manage cash flow for a new small business is not optional — it’s the survival skill.

Concrete example:

– You land a $10,000 contract.

– You pay $3,000 in subcontractors and $1,000 in ads up‑front.

– The client pays you *60 days after project completion*.

– The project takes 45 days.

That’s potentially 105 days between spending $4,000 and receiving $10,000. If you only have $3,000 in the bank when you start, you’re in trouble despite this being a “profitable” deal on paper.

Simple fixes that beginners often ignore:

– Ask for 30–50% upfront on projects.

– Offer a small discount for quicker payment (e.g., 2% off if paid within 10 days).

– Shorten payment terms on invoices to 7–14 days instead of 30+ if feasible.

– Automate invoice reminders so you don’t emotionally avoid “awkward” follow‑ups.

> Technical detail — Basic monthly cash flow check:

> – Open your accounting tool or bank export

> – For the last 30 days, add: all inflows (client payments, refunds, etc.)

> – Add: all outflows (rent, software, salaries, ads)

> – Net cash flow = inflows – outflows

> – If net cash flow is negative for 2–3 months in a row, treat it as a red alert and cut or adjust something *immediately*, not “when things improve.”

Good cash flow habits in the business directly stabilize your personal finances — because your “founder salary” starts to feel like a salary, not a gamble.

—

Step 8: Balance debt and investing when you’re just starting out

A common 2025 founder profile:

– $20,000–$60,000 in student loans

– $2,000–$8,000 in credit card debt

– A small emergency fund or none at all

– Maybe 1–2 old retirement accounts from previous jobs

So what do you prioritize: pay off debt, invest, or fund the business?

Analytically, it usually looks like this:

1. Kill high‑interest consumer debt first (anything >10–12% APR). This is mathematically crushing your future freedom.

2. Maintain at least a mini‑emergency fund (e.g., $1,000–$2,500) so every small crisis doesn’t go back on a credit card.

3. Invest small but regularly (e.g., 5–10% of your take‑home) into a broad, low‑cost index fund or retirement account to keep the habit and capture compounding.

4. Reinvest the rest intelligently into the business, but track return on that investment (does that $300/month on ads bring back more than $300 over time?).

Credit card APRs in 2025 often sit between 18–30%. It’s extremely hard to beat that as an investor without enormous risk. That’s why paying those down can be considered a *guaranteed* high‑return use of your dollars.

—

Step 9: Upgrade your financial skills like you would a product

Think of your money skills as a product in version 1.0 today. You wouldn’t ship a product once and never iterate; don’t treat your financial literacy that way either.

Instead of binging random YouTube tips, treat it as a skill path. A structured personal finance for entrepreneurs course can accelerate you, especially if it covers:

– Reading basic financial statements

– Understanding taxes and entity types for your country

– Pricing strategies and margin management

– Scenario planning (best case, base case, worst case)

The evidence from coaching and accelerator programs is fairly consistent: founders who can read and interpret their own numbers with confidence make faster, less emotionally driven decisions — and tend to hit sustainability 6–18 months earlier.

Allocate 1–2 hours a week, especially in your first year, just for financial education and review. That’s a small, boring habit with outsized impact.

—

Step 10: How this all changes by 2030 — a quick forecast

We’re in 2025. The way entrepreneurs manage money is already shifting fast, and that affects what “good” personal finance for founders will mean in a few years.

Here are the most likely developments in the next 3–5 years that you should anticipate:

1. Hyper‑automated bookkeeping for solopreneurs

Bank feeds, AI categorization, and tax rule engines are getting good enough that, for many small businesses, 80–90% of bookkeeping will be auto‑handled. Your job will be interpretation, not data entry.

2. Real‑time tax estimates and micro‑withholding

Instead of waiting for a giant surprise tax bill, more banks and platforms will automatically set aside the right percentage per transaction. Expect dashboards that constantly show “after‑tax” spendable cash.

3. Integrated personal + business financial dashboards

Today, your personal and business views are mostly siloed. By 2030, it’s likely you’ll have a consolidated view: runway as an individual, runway as a business, and the interplay between them. That will make decisions like “Can I afford to hire?” or “Can I drop my freelance gig?” more data‑driven.

4. More founder‑specific financial planning services

Traditional financial advisors often assume a stable salary and standard retirement path. We’re already seeing niche firms specialising in founders with irregular income, equity, and multiple entities. Expect these to become more affordable and modular — think “Netflix for advisory,” with retainer‑style access rather than expensive annual packages.

5. Regulation + transparency on small business finance products

Governments in the US, EU, and elsewhere are tightening rules on small business lending and fintech products. You’ll probably get clearer disclosures on true costs of loans, payment processors, and credit lines — which makes it easier to analyze what’s a healthy tool vs. a debt trap.

The constant: the bar for financial literacy will rise. As tools automate more of the grunt work, your advantage will come from understanding the story your numbers tell — and having the personal financial stability to act on that story without panic.

—

Putting it all together: a simple action plan

To keep this practical, here’s a lean 30‑day roadmap you can actually follow:

1. Calculate your personal runway and write the number down where you can see it.

2. Open a separate business account and route all new business income through it.

3. Decide a provisional founder salary, even if it’s low, and start paying it monthly.

4. Set up simple accounting software and connect your accounts.

5. Track one month of real spending to confirm your true bare‑bones costs.

6. Create a mini‑emergency fund target (e.g., one month of essentials) and set an automatic transfer.

7. Review your debt and prioritize any balances above 10–12% interest.

8. Block weekly “money meetings” with yourself (30–45 minutes) to review numbers.

9. Study one structured learning resource (book, workshop, or course) aimed at entrepreneur finance.

10. By day 30, write a one‑page “money operating system”: how accounts are organized, how you pay yourself, what your priorities are this quarter.

You don’t need perfection. You need a clear structure that protects *you* while you build the business. That structure is what turns unpredictable entrepreneurial income into a stable, long‑term life — not just a wild story you tell later.