Why a “Scalable” Wealth Plan Beats a One‑Off Budget

Most people treat money planning like a one‑time project: you sit down, make a budget, open a brokerage account, feel virtuous for a week and then life changes and the plan doesn’t. A scalable wealth plan is different. It’s a system that can handle a bigger salary, a new business, kids, market crashes, and even early retirement without being rebuilt from scratch every time. Think of it less like a static blueprint and more like an operating system that you periodically update instead of reinstalling.

At its core, a scalable plan separates *rules* from *numbers*. The rules—how you save, invest, manage risk, and make trade‑offs—stay consistent even as the numbers (income, portfolio size, tax bracket) grow. If a 20‑year‑old can run the same decision logic as their 50‑year‑old self, just plugging in bigger amounts and new constraints, you’ve built something that scales with you instead of snapping every time your life level‑ups.

—

Key Terms: Getting the Language Straight

Before going deeper, it helps to clarify a few terms that often get thrown around as buzzwords. *Wealth plan* is the full map: cash flow, investing, debt, insurance, taxes, goals and timelines. *Investment plan* is narrower: which assets you own, how much risk you take, and what you’ll do when markets move. *Risk management* covers insurance, emergency funds, and diversification. *Human capital* is your future earning power, which is usually your biggest “asset” in your 20s and 30s, shrinking as you age. When people talk about *comprehensive wealth management services*, they usually mean an integrated approach that deliberately connects all of these pieces instead of treating them in isolation.

Compare that to just “having a 401(k) and some savings.” That’s not a wealth plan; that’s a list of accounts. A scalable wealth plan explicitly states: what happens if your income doubles, if you lose your job for a year, if markets drop 30%, if you receive a windfall, or if you decide to move countries. Each scenario is mapped to rules (“increase savings rate”, “temporarily pause investing but keep allocation”, “harvest losses”, “boost cash buffer”), so you react by policy, not by panic.

—

Visualizing a Scalable Wealth Plan

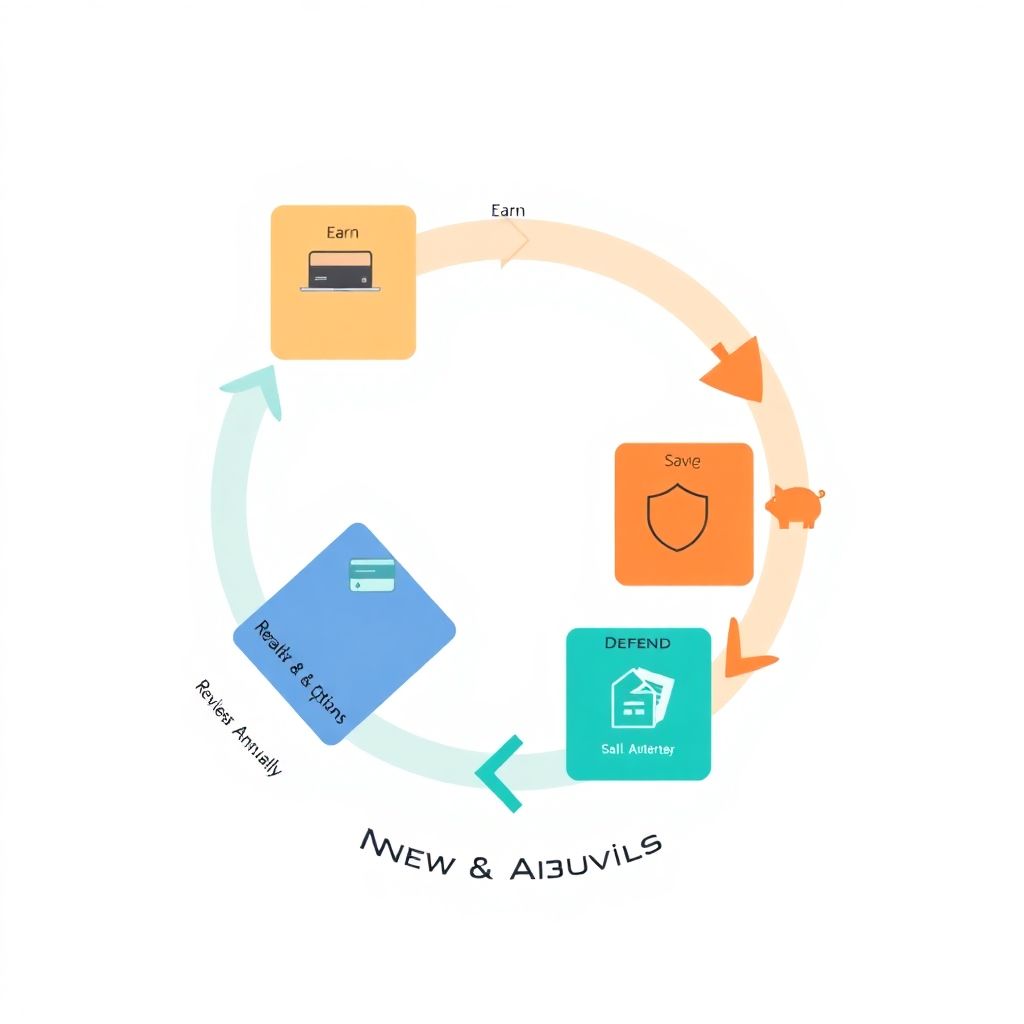

It sometimes helps to picture your money life as a few interlocking modules instead of a messy tangle of accounts and obligations.

[Diagram: Four boxes in a loop. Box 1: “Earn (salary, business, side gigs)”. Arrow to Box 2: “Allocate (spend, save, give, debt)”. Arrow to Box 3: “Grow (invest, build skills, build business)”. Arrow to Box 4: “Defend (insurance, legal, diversification, cash buffer)”. Arrow from Box 4 back to Box 1 titled “Resilience & Options”. Around the loop, an outer ring labeled “Review & Adjust annually”.]

Each box can scale. Earning more means the “Allocate” rules deploy surplus without reinventing everything. “Grow” uses percentage‑based portfolios instead of dollar‑based guesses. “Defend” adapts coverage and location of assets as your net worth rises. The outer “Review & Adjust” ring is what turns a static picture into a living plan that grows with you.

—

Step 1: Start With a Personal Balance Sheet

A business can’t scale without clean books. Same with you. A personal balance sheet lists everything you own (assets) and everything you owe (liabilities), at today’s values. Assets: cash, investments, home equity, business equity, pensions, and your “safe to assume” future earnings. Liabilities: mortgages, student loans, credit cards, tax debts. Net worth is the difference. It’s a blunt number, but it’s the main dashboard for tracking progress and stress‑testing decisions.

Short version: write down all accounts and approximate values, then all debts and interest rates. You’ll probably be surprised by the concentration risks—like 80% of your wealth being in your employer’s stock or in an illiquid home. A scalable plan aims to gradually reduce those concentrations as you grow, so that no single job, tenant, or stock can blow up your trajectory.

—

Step 2: Build a Cash‑Flow Engine, Not Just a Budget

A lot of advice dies on the word “budget.” For scaling, you want a cash‑flow *system* that reroutes money automatically as income rises. A simple structure is: fixed costs (housing, utilities, insurance), variable living (food, transport, fun), future you (investing, debt payoff, big goals), and optionality (cash buffer, experiments, career bets). Assign target percentages—say, 40% fixed, 20% variable, 30% future you, 10% optionality—then let those percentages float over bigger income.

This percentage logic is what makes the plan scale. If your income jumps from $60k to $120k, you don’t have to renegotiate every line item. Your automation just funnels larger amounts into “future you” and “optionality” without relying on fresh willpower. As your fixed costs become a smaller percentage, your financial resilience quietly increases, something that matters a lot more in your 40s and 50s than whether you skipped coffee in your 20s.

—

Step 3: Define Risk in Writing

Markets are noisy; your tolerance for that noise changes with context. A scalable plan defines risk up front. *Risk capacity* is how much volatility you can mathematically afford (based on time horizon, job security, emergency fund). *Risk tolerance* is how much volatility you can stand emotionally before doing something self‑destructive. They’re not the same. A long‑term investor with shaky nerves might need less stock exposure than the math says.

One practical approach is to write an “Investment Policy Statement” (IPS), even if it’s one page. It states your target allocation (e.g., 70% global stocks, 25% bonds, 5% cash), rebalancing rules, what you’ll do in a crash, and what you’ll never do (like borrowing to invest). The IPS doesn’t care whether you have $10k or $1M; only the dollar amounts change. That’s scale by design, and it’s almost exactly how institutional portfolios are managed.

—

Step 4: Investment Architecture That Grows With You

A scalable investment setup is boringly modular. You choose asset classes (global stocks, bonds, real assets, maybe private investments at higher levels), wrappers (brokerage, retirement accounts, company plans), and rules (percentage targets, rebalancing bands, tax priorities). Then every new dollar knows where to go. That’s how the best wealth management firms for high net worth individuals operate—they systematize decisions so each extra million gets slotted into the same framework instead of getting its own “special” idea that’s hard to monitor.

In practical terms, this usually means using broad, low‑cost index funds or ETFs across tax‑advantaged and taxable accounts, and only layering complexity (like factor tilts, real estate partnerships, or venture bets) once your core is bulletproof. The framework doesn’t change when your net worth passes six or seven figures; you just unlock additional modules that fit inside the same overall allocation and risk rules.

—

Step 5: Taxes and Legal Structure as Scaling Tools

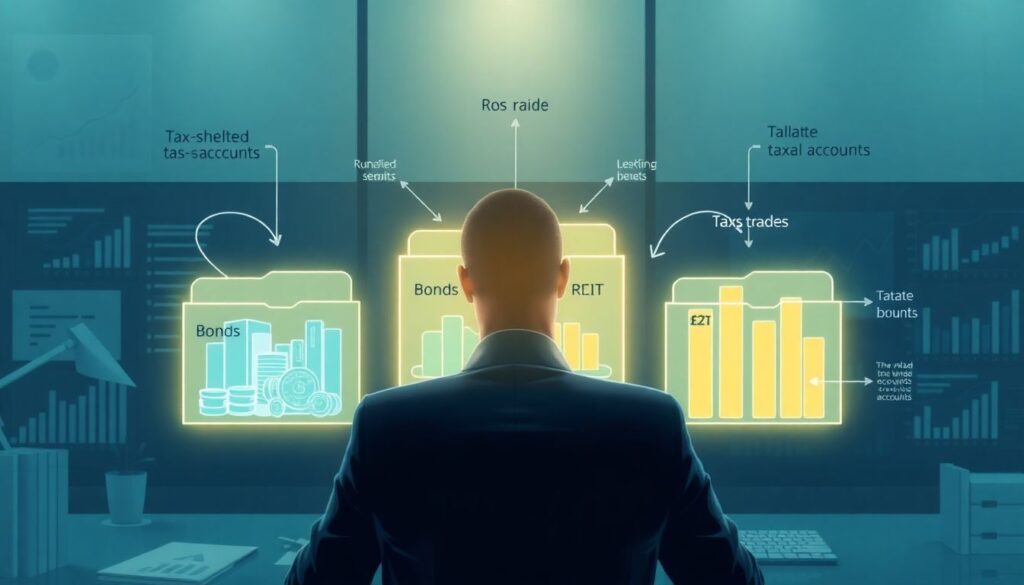

Once your income and assets grow, taxes and legal structure move from background noise to central design tools. *Tax efficiency* is about which assets sit in which accounts (e.g., bonds and REITs in tax‑sheltered accounts, broad stock funds in taxable accounts), how often you trade, and whether you harvest losses in down years. *Legal structure* covers things like using LLCs for a business, choosing between filing statuses, and later on, trusts and estate planning.

This is where a financial advisor for wealth planning can justify their existence if they understand your local tax code and your country’s cross‑border issues, especially if you earn in one place and invest in another. The scalable part: you use the same decision rules—asset location, holding periods, drawdown order in retirement—year after year, adjusting only when laws change or your life circumstances materially shift.

—

Stats: What the Last 3 Years Tell Us About Scaling Wealth

Let’s anchor this in some recent numbers. According to the Federal Reserve’s 2022 Survey of Consumer Finances (released in 2023), U.S. median family net worth jumped roughly 37% in real terms between 2019 and 2022, driven by rising home and stock prices plus pandemic savings. But that growth was uneven: households in the top 10% by wealth captured a disproportionately large share, which underlines how people with scalable systems benefit most from bull markets.

On the retirement side, Fidelity reported in early 2024 that the average 401(k) balance it administers rose about 14% in 2023, after a rough 2022, but participation gaps remained; smaller employers and lower‑income workers lagged in contributions and access. Vanguard’s “How America Saves 2023” showed automatic enrollment plans had participation rates around 93%, versus roughly 66% for voluntary ones. That’s automation at work: when systems handle decisions, more people actually invest, and their wealth paths scale with income rather than being capped by inaction.

—

Real‑World Example: A Plan That Survives Promotions and Crashes

Consider Alex, 29, making $70k as an analyst. Alex sets a 25% “future you” savings rate (15% retirement accounts, 10% taxable investing), keeps fixed costs under 45% of take‑home, and writes a simple IPS: 80% global stocks, 20% bonds, annual rebalancing, no single stock over 5% of portfolio. A three‑month emergency fund lives in a high‑yield savings account. That’s the entire framework at the start—simple but explicit.

At 35, Alex is making $150k, with some RSUs and a side consulting gig. Instead of reinventing the plan, Alex keeps the same percentages but raises the emergency fund to six months, caps company stock at 10% of the portfolio, and adds disability insurance. The same engine just pushes more dollars through. At 45, Alex launches a small firm; cash flow turns lumpy. The allocation shifts to 70/30, with a year of personal expenses in cash. Still the same written rules—just updated inputs and slightly adjusted risk settings. No panic, no guessing.

—

Comparing DIY, Robo, and Human Advisors for Scale

There are three broad ways to implement a scalable plan: DIY, algorithmic platforms, and humans. DIY gives maximum control and minimum fees but demands time, discipline, and some technical comfort with taxes and investing. Robo‑advisors automate asset allocation and rebalancing cheaply, which is often enough for early wealth building, but they usually don’t deeply integrate your business, real estate, or complex tax issues.

Human advice ranges from product‑driven salespeople to a fee only financial planner for long term wealth who charges flat or hourly fees and doesn’t earn commissions. That last type tends to be best at integrating cash flow, taxes, investing, insurance, and goals into a coherent whole. As your situation grows more complex—private company equity, cross‑border issues, estate planning—it becomes harder for a pure robo solution to handle the nuances, and you start to resemble the client base of firms offering comprehensive wealth management services.

—

How Location and Access Shape “Near Me” Decisions

The question a lot of people quietly Google is “retirement and investment planning near me,” hoping for a local expert who understands regional taxes, property markets, and employer plans. Local context does matter—for example, state tax treatment of municipal bonds, real estate transfer costs, or typical pension rules. But scalability depends more on process quality than proximity. A well‑structured remote relationship with a planner who documents everything in plain language often beats an in‑person relationship that runs on vibes and opaque products.

If you do seek help, ask how decisions are made and documented. Does the advisor produce an IPS? Do they run scenarios—job loss, early retirement, market downturns—and show how your plan behaves? Can they articulate how your plan scales if your income doubles, or if you sell your business? A good process looks reassuringly similar whether you have $200k or $2M; only the stakes change.

—

Common Pitfalls That Break Scalability

Most broken plans fail for surprisingly predictable reasons: lifestyle creep that outruns income, random one‑off investments that don’t fit any allocation, over‑concentration in employer stock or local real estate, and tax decisions driven by the current year instead of a decade‑long view. Another frequent trap is mixing short‑term and long‑term money in the same account, then being forced to sell investments at bad times because there was no dedicated cash buffer.

Psychology also plays a bigger role than people admit. Without written rules, market euphoria leads to chasing fads, while fear leads to selling everything after a crash. Both behaviors destroy the mathematical beauty of compounding. By contrast, investors with a clear IPS and scheduled reviews tend to trade less, pay fewer fees, and actually stay invested through volatility, which is why they showed up disproportionately among households whose net worth climbed fastest during the last three years of market whiplash.

—

Bringing It All Together

A wealth plan that scales with you isn’t about predicting the future; it’s about pre‑deciding how you’ll behave across a wide range of futures. You map your personal balance sheet, build an automatic cash‑flow engine, define risk in writing, set a modular investment architecture, and layer in tax and legal structure as complexity grows. Then you commit to regular reviews—annually, plus after major life events—so the system evolves without being reinvented.

If you’re early in your journey, you may be perfectly fine with a DIY setup or a low‑cost robo, especially if you’re willing to learn. As your finances get more layered—business equity, multiple properties, kids, cross‑border concerns—getting a skilled financial advisor for wealth planning or one of the best wealth management firms for high net worth individuals can help ensure your decisions are coherent instead of opportunistic. The goal in either case is the same: a living plan that quietly upgrades itself as you do, turning higher income and occasional windfalls into lasting, compounding wealth.