Why “Just Cutting Coffee” Doesn’t Work Anymore

If you’ve tried to budget as a military family by “spending less” and “eating out less” and it still doesn’t work — the problem isn’t you. It’s that the old-school advice ignores how military life actually functions in 2025: PCS jumps every few years, surprise TDYs, unemployment gaps for spouses, childcare chaos, and a cost of living that changes every time your zip code does.

A sustainable budget for a military family has to bend without breaking. It has to survive a PCS, a deployment, a sudden car repair, and the “congratulations, your BAH just changed” email — without you feeling like you’re starting from zero every time.

Let’s build *that* kind of budget.

—

Step 1. Start With Your Real Life, Not a Perfect Spreadsheet

Forget the fantasy version of your life where nobody gets sick, the car never breaks, and you never DoorDash. We’re going to budget around what you *actually* do.

Track 30 Days the Lazy Way

Instead of manually logging every dollar in a notebook, connect your main accounts to one app and let it spy on your spending for a month. In 2025, the best budgeting apps for military families automatically recognize things like commissary, Tricare co-pays, PCS hotel stays, and even split expenses into “reimbursable” and “real” spending.

You just:

1. Connect checking, credit cards, and savings

2. Tag obvious “military stuff” (PCS, uniforms, moves)

3. Highlight problem zones: food, Amazon, kids’ activities

That 30-day snapshot is your baseline. No shame, no drama — just data.

—

Real Case: The “We Don’t Eat Out Much” Illusion

A dual-military couple I worked with both swore they “barely ate out.” Their app summary said otherwise: $780 on food delivery and off-base lunches in a single month.

The fix wasn’t “never eat out again.” Instead, they:

– Kept one weekly family dinner out (non‑negotiable)

– Swapped weekday lunches to meal-prepped burrito bowls

– Set a $100 “deployment comfort food” budget for the spouse at home

Result: They cut food spending by ~$400/month without feeling punished — and that money went straight into an emergency fund for the next PCS.

—

Step 2. Build a PCS-Proof Budget Structure

A sustainable military family budget planner has to work whether you’re CONUS, OCONUS, deployed, or bouncing between Airbnbs during a delayed move.

Think of your money in layers, not random categories.

Layer 1: Non-Negotiables

This is everything that keeps the lights on and your credit clean:

– Housing (rent/mortgage, utilities, renters insurance)

– Basic food and household supplies

– Transportation and minimum debt payments

– Childcare you absolutely must have

– Essential insurances

Short paragraph: add these up. This total should be safely covered by base pay plus BAH/BAS alone, *without* counting special pays, bonuses, or overtime.

If it isn’t, that’s your red flag — your “fixed” lifestyle needs to shrink before you mess with any other category.

—

Layer 2: Mission-Critical Goals

Next, carve out money for what Future You desperately needs:

– 3–6 months of expenses in an emergency fund

– Retirement (TSP, IRAs)

– Short-term goals: next PCS, car replacement, maternity/paternity leave gap

In 2025, many commands are pushing financial literacy harder, and solid financial planning services for military families are easier to access (often free through Military & Family Readiness Centers or virtual briefings). Use them to:

– Run “what if” scenarios (spouse job loss, medical leave, early separation)

– Optimize TSP contributions with current match rules

– Clarify how much emergency savings *you* specifically need based on rank, location, and dependents

—

Layer 3: Lifestyle and Sanity Money

This is where most budgets collapse, because folks either eliminate this layer (and then binge-spend) or never limit it at all.

Include:

– Eating out, streaming, hobbies, gaming

– Kids’ sports and lessons

– Gifts, trips, and visits home

– “Deployment coping” category — yes, make it explicit

A sustainable budget doesn’t pretend you won’t ever stress-spend during deployment. It anticipates it and gives you a controlled outlet.

—

Step 3. Use “Military Math” Instead of Civilian Rules

Most money advice you see on social media wasn’t written for people whose income swings with COLA, OHA, hazard pay, or special duty pay. You need your own math.

BAH as a Tool, Not a Lifestyle Meter

One non-obvious move: Don’t treat BAH as “housing money.” Treat it as *flexible* money.

For many families, the smartest play is:

– Aim for rent or mortgage that’s under your BAH

– Keep the difference as a “mobility buffer” for PCS costs, broken leases, or double rent months

Real talk: in high-cost areas, you might *need* to go over BAH. If that’s you, offset it by cutting other fixed commitments instead of pretending it doesn’t matter.

—

Alternative Method: Base Your Budget on Last Year’s Income

If your pay fluctuates a lot (deployments, bonuses, spouse contracting income), here’s a pro move:

– Add up last year’s total take-home

– Divide by 12 — that’s your “safe” monthly income

– Build your budget using *that* number, not your current, possibly inflated income

Any extra you earn this year? Treat it like a PCS bonus: automatically routed to savings, debt payoff, or upcoming big expenses — not regular spending.

—

Step 4. Deal With Debt the Modern Way

Ignoring debt doesn’t make it disappear, and “just pay more than the minimum” isn’t a plan.

When Debt Feels Like a Second Job

In 2025, interest rates have been volatile and a lot of families leaned on credit cards during moves and gaps in childcare. If you’re juggling multiple cards and personal loans, consider structured help.

Done right, debt consolidation for military families can:

– Lower your total interest

– Reduce 5–6 payments to just 1

– Stabilize your monthly outflow so you can actually budget

But skip the sketchy ads. Start with:

– Your bank or credit union (especially military-focused ones)

– On-base financial counselors to review terms before you sign

– A clear rule: consolidation only works if you stop adding new debt

Pro hack: Once you consolidate, keep one low-limit card for emergencies and online purchases only — and freeze the others (literally, in water, in your freezer) for six months.

—

Step 5. Make Tech Do the Boring Work

You should not be manually moving money into five different accounts every payday in 2025. Automation is your best friend.

Autopilot Paydays

Set up your system so that on payday:

1. A fixed percentage goes directly into savings

2. Bills are auto-paid from a “bills only” checking account

3. Whatever’s left in your “spending” account is your real, guilt-free money

This is where a well-chosen military family budget planner or app shines. Look for:

– PCS mode: easy category exports, easy address/bank updates

– Goal tracking: “Car fund, $8,000 by June 2026”

– Shared views: both partners can see the same numbers, from anywhere

—

Case: The Deployed Auto-Saver

An Army NCO deployed to Europe in 2024 decided to live mostly on base pay and ignore the extra pays. He directed all additional deployment income straight into:

– High-yield savings

– TSP contributions

– A specific “post-deployment car upgrade” fund

By the time he got home, he had enough cash to pay off an old car loan and avoid a new one — which dropped his monthly expenses by almost $400. That made his post-deployment budget *easier*, not harder.

—

Step 6. Budgeting as a Team Sport, Not a Lecture

Money fights in military marriages are common, especially with different stress levels during deployment, shift work, and spouse career sacrifices.

15-Minute Money Huddles

Instead of a huge, tense “budget meeting,” do a quick weekly huddle:

– 5 minutes: Look at the app dashboard together

– 5 minutes: Decide any adjustments (“We’re overrunning on food; where do we pull from?”)

– 5 minutes: Confirm upcoming events: TDYs, visits, birthdays, field exercises

Keep it fast, factual, and blame-free. The goal is to course-correct early, not yell about last month.

Pro hack: Always end with one “win” — even if it’s tiny:

“We actually stayed under our Amazon budget this week.”

“We added $50 to the PCS fund.”

“We didn’t touch the emergency card.”

—

Step 7. Plan for The Inevitable: PCS, Deployments, and Transitions

You cannot pretend PCS costs are a surprise. Yes, you’ll get reimbursed for some things — but almost never instantly, and almost never for *everything*.

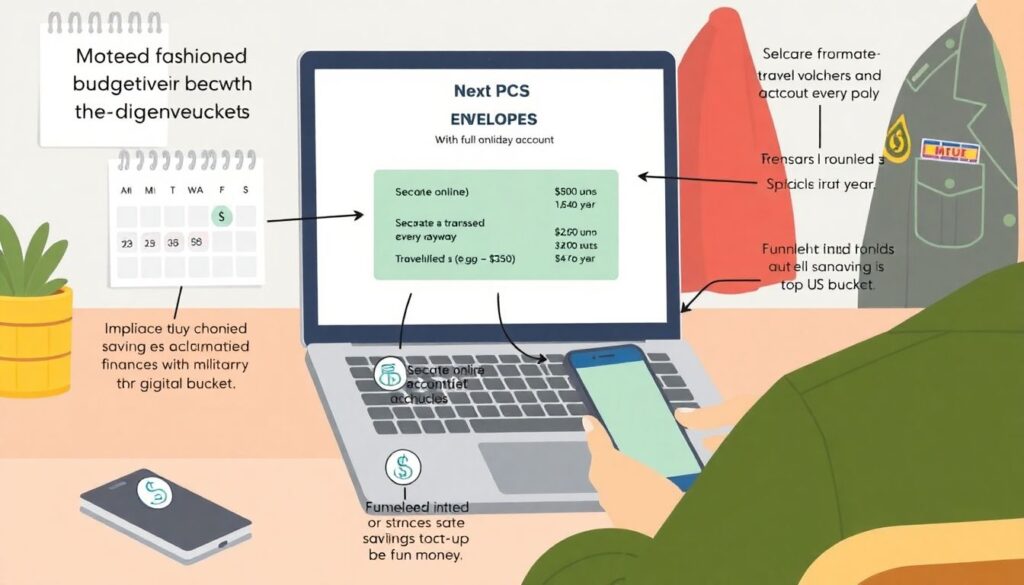

The PCS Envelope Strategy, 2025 Edition

Instead of old-school cash envelopes, use digital “buckets”:

– Open a separate online savings account labeled “Next PCS”

– Auto-transfer a small amount each payday (even $40–$60 adds up over a year)

– Treat refunds, travel vouchers, and tax returns as top-ups, not bonus play money

By the time orders drop, you’ve already got cash for:

– Cleaning fees

– Temporary lodging overages

– Replacing stuff that broke in the move

– Emergency childcare during packing and unpacking

This is one of the most powerful military family money management tips that almost nobody talks about early enough.

—

Alternative Income Planning for Spouses

2025 reality: spouse employment is still messy. Remote work is easier to find, but time zones, childcare, and on-base internet issues are real.

When building your budget:

– Treat spouse income as variable, not guaranteed

– Avoid depending on it for fixed bills like rent or car payments

– Use it primarily for goals, savings, debt payoff, and “nice-to-haves”

That way, a job loss or change is painful, but not catastrophic.

—

Pro-Level Hacks to Make Your Budget Truly Sustainable

Hack 1: Annual “Base Change Simulation”

Once a year, pretend you just got PCS orders to a higher-cost region.

– Pull up BAH and COLA for a pricier area

– Roughly model rent, utilities, gas, and food there

– Ask: “Could we survive this with our current commitments?”

If the answer is no, start reducing your fixed lifestyle now (lower car payments, fewer subscriptions, cheaper phone plans) while you still have breathing room.

—

Hack 2: The “Third Check” Rule

If you’re paid biweekly, two months a year you get a third paycheck. Most families accidentally blow it.

Instead, pre-decide that every “third check” goes to:

1. Upcoming travel home

2. Car repairs and maintenance

3. Bulk buys (diapers, pantry staples, uniforms)

You’ll thank yourself the next time the car needs tires the same month as school shopping.

—

Hack 3: One Big “Life Happens” Category

Instead of five tiny categories (“medical”, “pets”, “household”, “misc”), maintain one larger “Life Happens” pot. It covers:

– Surprise field trip fees

– Broken glasses

– Lost uniform pieces

– That one random fee every school year brings

This keeps you from constantly “breaking the budget” while still tracking reality.

—

Bringing It All Together

A sustainable budget for a military family in 2025 is not about perfection. It’s about building a flexible system that:

– Survives PCS orders and deployments

– Uses tech and automation so you’re not living in spreadsheets

– Recognizes emotional spending and plans around it

– Protects your future self without wrecking your present

Use one solid app as your military family budget planner, lean on reputable financial planning services for military families, take advantage of modern tools, and remember: the goal isn’t to follow every rule. The goal is to create a money system that still works when the military does what it always does — change everything on short notice.