Why Money Feels Tighter Than Ever for New Parents

From Single Breadwinners to Dual-Income Norm — and Back Again

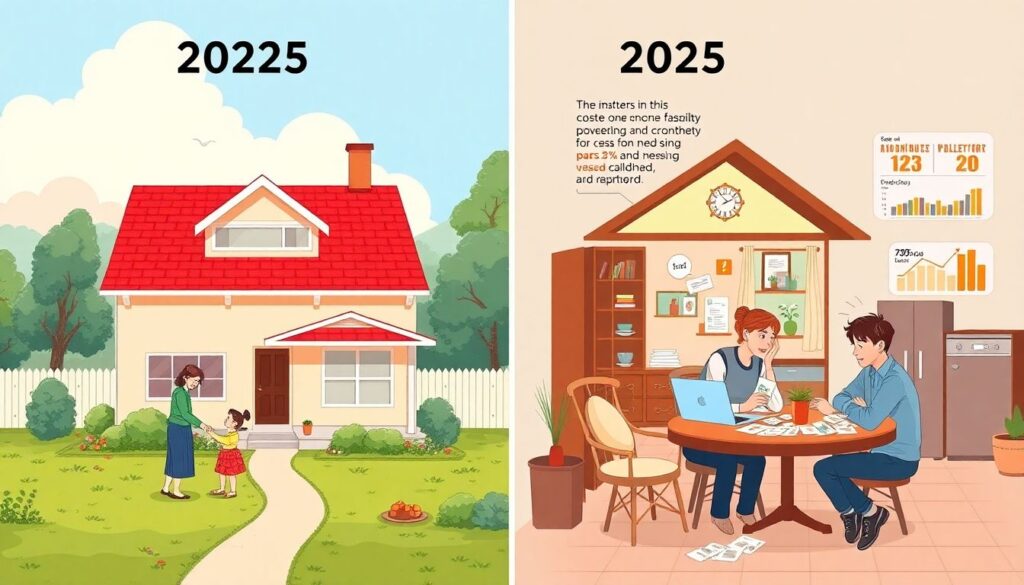

Becoming a one‑income family in 2025 feels scary partly because the whole system assumes two paychecks. In the 1950s a single salary often covered a house, food and a stay‑at‑home parent; childcare costs were low and education was cheaper. Starting from the 1980s, wages for many jobs lagged behind living costs, so dual‑income households became the default. Fast‑forward to today: housing, healthcare and daycare have exploded in price, while job stability shrank. That’s why dropping to one income after having a baby can look like financial suicide, even though people have raised kids on one income for generations. The difference now is you must be far more intentional, armed with numbers and a clear plan instead of vague hope.

How the 2020s Changed Money for New Parents

The last few years reshaped family finances. Remote work and flexible jobs opened chances to stay home longer, yet inflation made groceries, rent and utilities painfully expensive. Governments in many countries expanded child benefits or parental leave, but these programs are patchy and often temporary. Meanwhile, social media shows curated lifestyles that hide debt and stress, making your own budget feel inadequate. If you’re searching for budgeting tips for new parents on one income, remember that survival now depends less on “earning like your parents did” and more on using digital tools, realistic expectations and clear priorities. You can’t copy past generations’ approach, but you can borrow their discipline and combine it with modern tech.

Core Principles of Money Management on One Income

Know Your Real Numbers, Not Your Wishes

Before you tweak subscriptions or argue about lattes, pin down the hard facts. List your net monthly income, then track every expense for at least one full cycle, ideally three. Don’t guess; use bank statements and receipts. Sort costs into essentials (housing, utilities, food, transport, insurance, minimum debt payments, baby basics) and lifestyle (streaming, eating out, hobbies, nicer clothes). This gives you a baseline for financial planning for new parents on a single income. The goal isn’t to feel guilty but to see where each unit of currency actually goes. Once you’ve got that picture, you can deliberately choose what to keep, shrink or eliminate, instead of wondering why your card keeps declining mid‑month.

Priorities First: Safety, Then Comfort, Then Extras

Living on one paycheck with a newborn means you can’t afford fuzzy priorities. Rank your financial goals by urgency. Tier one is survival and safety: rent or mortgage, food, utilities, basic baby gear, essential healthcare and minimum debt payments. Tier two is resilience: emergency fund, extra debt reduction and basic insurance coverage. Tier three is comfort and long‑term progress: nicer vacations, frequent dining out, extra subscriptions and nonessential shopping. When you map your monthly cash flow onto these tiers, it becomes clearer which “must‑haves” are actually “nice‑to‑haves.” This mental model turns money arguments into practical choices, because you’re no longer debating taste — you’re deciding which level of security you’re willing to trade for each comfort.

A Simple Roadmap for How to Live on One Income After Having a Baby

Think of the transition as a phased project. Step one: pre‑baby, run a “practice month” where you live only on the future single income and save the rest. That stress‑tests your plan and builds a cushion. Step two: during the last trimester, prepay or pre‑plan what you can — stock up on nonperishable essentials, review insurance, schedule any elective medical or dental work while benefits still cover two incomes. Step three: in the first six months postpartum, keep your budget tight and flexible; sleep deprivation makes impulse spending easy, so automate bills and savings. Optionally, step four: around month six to twelve, reassess whether the stay‑at‑home partner wants to start light freelance work or part‑time shifts, treating any new income as pure bonus, not something you depend on.

Practical Tactics and Real‑Life Examples

Day‑to‑Day Budget Moves That Actually Work

On paper, most budgets look sane. Real life ruins them through decision fatigue and tiny leaks. To solve this, automate whatever you can: set fixed transfer dates for rent, utilities and minimum debt payments right after payday, then move a small amount into a separate “baby and health” account. Leave a controlled sum in your main spending account for groceries and incidentals. Separate “fun money” for each partner, even if it’s small; it prevents resentment and secret purchases. If you’re wondering how to save money on one income with a newborn, focus on recurring costs: negotiate internet and phone plans, downsize or share streaming services, cook in batches and buy diapers and wipes in bulk once you’ve confirmed your baby’s size and skin tolerance to avoid waste.

- Automate essentials and savings so they happen before you can spend impulsively.

- Keep a dedicated baby account to track real child‑related costs across the year.

- Give each adult a modest no‑questions‑asked personal spending allowance.

Using Tech: Budgeting Apps That Make One Income Easier

You don’t need twenty spreadsheets to stay afloat; you need one clear system you’ll actually open. The best budgeting apps for families living on one income have three things in common: they sync with your bank accounts, support shared access for both parents and allow flexible “envelopes” or categories like diapers, medical, gifts and childcare. Try a couple of free trials and pick the interface that feels least annoying; consistency matters more than features. Set weekly check‑ins of ten to fifteen minutes to review spending together on the couch instead of arguing at the checkout line. Use app alerts when you approach your grocery or eating‑out limits; think of them as guardrails, not judgment. Over time, these small nudges build reliable habits without constant willpower.

- Choose one main budgeting tool and commit to it for at least three months.

- Share logins or reports so both partners see the same real‑time numbers.

- Turn on notifications for categories you typically overspend in, like food or online shopping.

Example: A Couple Shifting from Two Incomes to One

Imagine a couple earning together 6,000 per month after tax. After deciding one parent will stay home for at least a year, they’ll live on 3,500. Three months before birth, they run a trial: everything above 3,500 goes into savings. During the test, they spot weak points — frequent food delivery, unused subscriptions and an expensive gym contract. They switch to home workouts, cook on weekends and cut overlapping streaming services. They also move to a smaller car with lower insurance. By the time the baby arrives, they’ve built a four‑month emergency fund and already know their one‑income routine. The key is that they used the transition time like a training period rather than waiting for panic to force sharp decisions under pressure.

Common Myths That Sabotage New Parents

Myth 1: “Kids Are Too Expensive; We Simply Can’t Afford Them on One Income”

There’s a grain of truth: modern parenting can become wildly expensive if you treat every trend as mandatory. However, a big part of the “kids are unaffordable” narrative comes from lifestyle inflation, not just higher prices. New parents are bombarded with premium strollers, designer clothes and smart gadgets that promise perfect sleep or development. In reality, babies need safe sleep space, feeding, hygiene and love; almost everything else is optional or available second‑hand. If you feel trapped, run the numbers on your real necessities versus assumptions. Many families find that by adjusting housing expectations, car choices and social habits, one income is tight but workable — especially when they channel savings from the second income into a solid pre‑baby buffer.

Myth 2: “If One Parent Stays Home, Career and Money Are Ruined Forever”

Taking a break from paid work carries risks, but it’s not a financial death sentence if you plan it. Keep one foot in your field: maintain your network, attend occasional online meetups, or take short courses while the baby naps. Document any freelance projects, tutoring, consulting or volunteering; this counts as recent experience when you re‑enter the job market. Discuss in advance what “temporary” means — is it twelve months, three years or until school starts? Periodically reassess whether the trade‑off still makes sense emotionally and financially. You’re allowed to change course. Seen over a forty‑year career, a few years at home can be a pause, not a derailment, especially if you combine it with strategic upskilling or gradual part‑time work.

Myth 3: “Budgeting Means Killing All Joy”

Plenty of people avoid money talk because they equate budgeting with punishment, as if you’re signing up for a lifetime of instant noodles. In reality, a good budget is just a plan for how you’ll use limited resources to support what matters most now. When you’re figuring out how to live on one income after having a baby, your priorities shift: maybe vacations shrink, but you gain unhurried mornings and less daycare stress. A realistic plan includes fun on purpose — low‑cost date nights at home, free parks instead of pricey attractions, occasional takeout built into the numbers. The difference is that joy is scheduled, not random. That reduces guilt and arguments, because you’re no longer “failing” every time you treat yourselves.

Pulling It Together for the Long Haul

Living on one paycheck with a baby is demanding, but it isn’t purely about sacrifice. It’s about clarity: knowing your real costs, your genuine priorities and your options over time. If you’re searching for long‑term budgeting tips for new parents on one income, think in seasons, not forever. The newborn phase is expensive in sleep and emotions; later, daycare or school changes the equation again. Revisit your plan every few months, adjust as your baby grows and your energy returns, and don’t copy anyone else’s script blindly. Some families go back to two full‑time jobs, others blend part‑time and side gigs, and some stay single‑income for years. The “right” answer is the one that balances financial stability with the kind of family life you actually want.