Introduction to Financial Statements for Small Business Owners

Understanding financial statements is a critical skill for entrepreneurs aiming to make data-driven decisions. These reports offer a structured summary of a business’s financial performance and position, enabling small business financial analysis that goes beyond intuition. Financial statements for small business owners typically include the balance sheet, income statement, and cash flow statement. Each report serves a unique purpose: while the income statement reflects profitability, the balance sheet reveals financial stability, and the cash flow statement tracks liquidity. Mastering how to read financial statements empowers business owners to detect inefficiencies, manage growth, and appeal to investors or lenders.

The Core Financial Statements Explained

1. Income Statement – Measuring Profitability

The income statement, also known as the profit and loss (P&L) statement, illustrates revenues, expenses, and net income over a specific period. It answers the fundamental question: Is the business making money? For example, a typical income statement might show $100,000 in sales, $60,000 in cost of goods sold (COGS), resulting in a gross profit of $40,000. After subtracting operating expenses and taxes, the net income reflects the firm’s bottom-line profitability. Entrepreneurs must analyze trends in revenue and cost structures to identify areas for margin improvement. Compared to other reports, the income statement offers the most immediate insights into operational success.

2. Balance Sheet – Assessing Financial Health

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It follows the accounting equation: Assets = Liabilities + Equity. Assets represent what the company owns, such as cash, inventory, or equipment. Liabilities indicate obligations, including loans and accounts payable. Equity is the residual interest in assets after deducting liabilities. For instance, if a small business has $200,000 in assets and $120,000 in liabilities, the owner’s equity stands at $80,000. Delving into this information helps owners evaluate solvency and capital efficiency, key components of any financial statement guide for entrepreneurs.

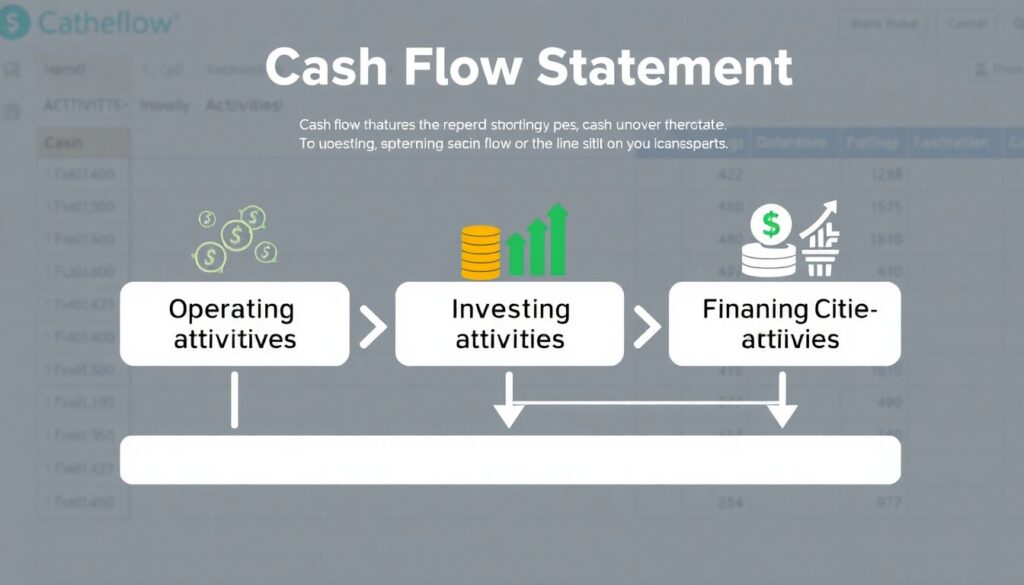

3. Cash Flow Statement – Tracking Liquidity

Unlike the income statement, which includes non-cash revenues and expenses, the cash flow statement focuses solely on the movement of cash in and out of the business. It is divided into three sections: operating, investing, and financing activities. A typical example may show positive cash flow from operations but negative cash flow from investing due to equipment purchases. This provides clarity on whether the business can meet short-term obligations and fund growth initiatives. In small business financial analysis, this report is crucial for identifying periods of cash strain and planning accordingly.

How to Read Financial Statements Effectively

Grasping how to read financial statements involves more than scanning numbers. Business owners must interpret relationships between figures to extract actionable insights. Here’s a practical 3-step method:

1. Analyze Ratios: Common financial ratios include gross margin (Gross Profit / Revenue), current ratio (Current Assets / Current Liabilities), and return on equity (Net Income / Equity). These indicators help compare performance over time or against industry benchmarks.

2. Compare Periods: Review year-over-year or quarter-over-quarter changes. If net income grows but cash flow declines, it may signal problems in receivables collection or inventory management.

3. Use Vertical and Horizontal Analysis: Vertical analysis expresses each line item as a percentage of a base figure (e.g., each expense as a percentage of revenue), while horizontal analysis tracks changes over time. These methods help normalize data and highlight trends.

Expert Recommendations for Entrepreneurs

Financial experts emphasize the importance of integrating regular financial reviews into business operations. According to CPA and small business advisor Laura Mitchell, “A monthly review of financial statements for small business leaders can prevent cash flow crises and highlight profitability leaks before they become serious.” She recommends using accounting software to automate reports and engaging with a professional for quarterly deep-dives.

Additionally, entrepreneurs should establish key performance indicators (KPIs) linked to their financial statements. For example, a retail business might track inventory turnover by dividing COGS by average inventory. This metric reflects operational efficiency and can guide purchasing decisions.

Comparative Insight: Manual Records vs. Financial Statements

Some small business owners rely on spreadsheets or manual records instead of formal reports. However, this approach lacks the structure and clarity of standardized financial statements. Unlike informal tracking, properly prepared reports conform to accounting principles, facilitating transparency and comparability. Moreover, investors and lenders typically require formal documentation, making understanding financial statements essential for accessing capital.

Conclusion: Building Financial Literacy as a Strategic Asset

Understanding financial statements transforms financial data into a strategic tool. It allows small business owners to diagnose problems, plan for growth, and communicate effectively with stakeholders. A financial statement guide for entrepreneurs is not merely about compliance—it is a roadmap to informed decision-making. By learning how to read financial statements and applying small business financial analysis, entrepreneurs equip themselves with the knowledge needed to navigate economic uncertainties and scale sustainably.