From Factory Whistles to Zoom Calls: Why Budgeting Changed with Flexible Work

In the early 1900s, personal finance was almost boringly predictable: fixed wages, fixed hours, and fixed paydays. You worked at the factory, office, or mine, got your weekly envelope, and your entire household budget revolved around that stable cash flow. The modern idea of a flexible work schedule really took off much later: first with freelancers and consultants in the 1980s–1990s, then with digital nomads in the 2000s, and finally with mass remote and hybrid work after the COVID‑19 pandemic.

By 2025, global consulting firms estimate that over 30–35% of workers in advanced economies have some form of flexible schedule or variable income, whether through gig platforms, hybrid roles, or project‑based contracts. That means old-school budgeting rules, built for steady paychecks, simply stop working. Learning how to create a budget with irregular income and flexible work is no longer a niche skill for freelancers; it’s becoming a survival tool for a big chunk of the workforce.

Why Flexible Schedules Break Traditional Budgets

Income Volatility and Cash-Flow Risk

Flexible work and stable cash flow rarely come together. When you jump from a 9‑to‑5 to a flexible setup, your income often turns from a straight line into a rollercoaster. Some months you bill record hours; others, a project gets delayed and your bank account feels it instantly. Financial planners call this “income volatility,” and since 2020, it has been rising across knowledge work, not just in gig jobs.

This volatility means the classic “50/30/20 rule” (needs/wants/savings from a fixed paycheck) becomes unsafe. The core challenge of how to manage finances with flexible work hours is less about how much you earn and more about when you receive it. Cash‑flow gaps can force even high earners to use credit cards or overdrafts, turning short‑term dips into long‑term debt. To stay solvent, you need a plan that smooths out erratic income into something you can rely on month after month.

Psychological Load and Decision Fatigue

There’s also a psychological cost. A flexible timetable often blurs boundaries between “on” and “off” time, and the same happens with money: there is no clear “payday,” so you can feel permanently in budgeting mode. That mental load can cause decision fatigue and reactive behavior: overspending in a good month, panic saving in a bad one.

Modern flexible work schedule budgeting tips have to take this into account, shifting from one-time “make a budget” advice to building small, automated systems that reduce daily money decisions. The goal is to stabilize your emotions around money as much as your numbers.

Historical Context: How We Got to 2025’s Flexible Work Economy

From Industrial Time Clocks to Knowledge Work Flexibility

Historically, budgeting manuals from the 1920s to the 1960s all assumed a steady wage. Only small business owners and farmers dealt with seasonal or uneven cash flow. By the late 20th century, the rise of independent contractors, IT consultants, and creative professionals introduced more irregular income, but they were still a minority.

The spread of broadband internet, cloud software, and global outsourcing in the 2000s began to normalize remote and freelance work. Still, many corporations clung to fixed office hours. The catalyst was the 2020 pandemic: forced remote work, followed by a wave of employees demanding more autonomy. Between 2020 and 2024, surveys show flexible schedules (flextime, compressed weeks, remote-first) went from a perk to an expectation in sectors like tech, design, marketing, and professional services.

The 2025 Landscape: Data and Trends

By 2025, labor economists are tracking three notable trends directly linked to budgeting challenges:

1. Growth of hybrid and project-based roles. Estimates suggest that in OECD countries, up to 40% of knowledge workers now have at least partial flexibility in hours or location. Many of them also receive bonuses, commissions, or project-based pay, making income less predictable.

2. Rise of multi‑income households. More families combine salaries, freelance gigs, and side hustles, complicating their personal budget planner for variable income and flexible schedules.

3. Normalization of “portfolio careers.” Younger workers in particular take parallel roles—consulting, content creation, and part-time employment—trading stability for autonomy.

All of this makes historical “salary-based” budgeting advice incomplete. Financial tools and habits have to adapt to this mixed, fluid reality.

Core Principles: How to Budget for a Flexible Work Schedule

The “Baseline Income” Model

The central principle that works for a flexible schedule is to stop budgeting around what you *could* earn and start budgeting around what you can *safely* count on. Think of this as your “baseline income” model.

You calculate a conservative monthly income figure based on your worst 6–12 months, not your best. This baseline becomes the engine for your regular bills: rent, utilities, groceries, insurance, minimum loan payments. Any income above that number is treated as variable and assigned to savings, investments, and non‑essential spending.

This approach is the practical answer to how to create a budget with irregular income and flexible work: you build your spending plan for the floor, not the ceiling, so bad months are survivable without panic.

Separate Operating and Safety Buffers

For flexible workers, an emergency fund alone is too blunt an instrument. It helps in crises but doesn’t solve small, recurrent fluctuations. A more robust structure includes:

1. A cash‑flow buffer (1–2 months of baseline expenses) to absorb normal ups and downs.

2. A full emergency fund (3–6 months or more) for job loss, illness, or big system shocks.

By creating two different layers of reserves, you prevent every slow month from “attacking” your emergency fund. This framework directly reduces cash-flow risk and gives you more freedom to accept flexible gigs without constant financial anxiety.

Practical Steps: A Simple System for Flexible Income

Building a Flexible-Work Budget in 5 Concrete Steps

Here’s a straightforward workflow that you can adapt based on your country and tax rules:

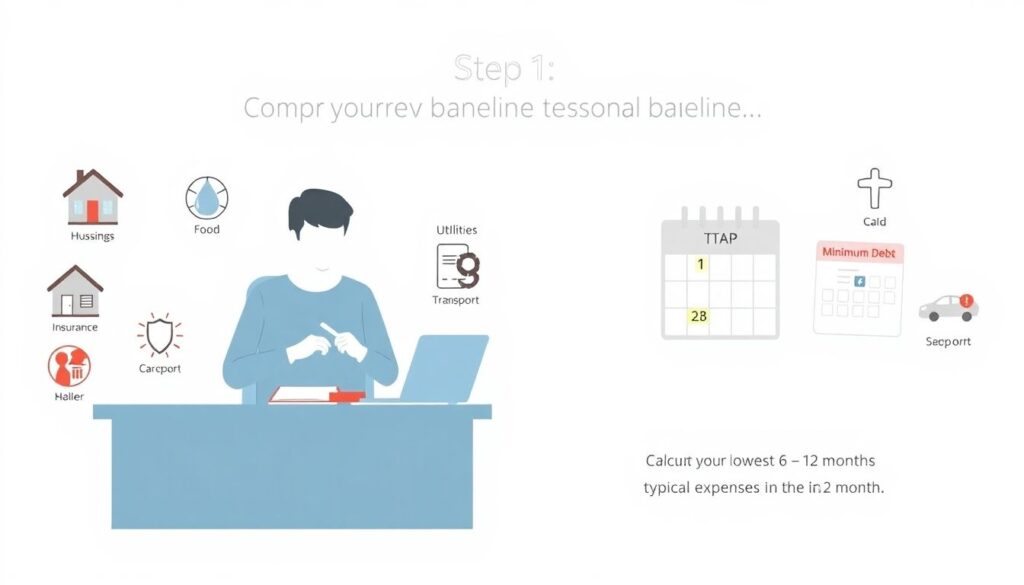

1. Compute your baseline number.

Add up your essential monthly costs: housing, food, utilities, transport, insurance, basic healthcare, child‑related costs, and minimum debt payments. Then take your lowest 6–12 months of income, average them, and make sure that average still covers those essentials with some margin. That figure becomes your baseline income target.

2. Open dedicated accounts.

Use separate accounts for:

– Income inflow (all payments land here)

– Bills and fixed expenses

– Taxes (crucial for freelancers)

– Buffer and emergency fund

This “bucket” structure turns budgeting into basic cash routing rather than daily micromanagement.

3. Automate core transfers by percentage.

Every time money comes in, route fixed percentages automatically: for example, 25–35% to taxes (depending on your jurisdiction), a certain cut to your bills account, and another slice to your buffer until it reaches your target. You’ll quickly see how to manage finances with flexible work hours without relying on willpower each payday.

4. Use tech intelligently, not obsessively.

Explore the best budgeting apps for freelancers and flexible workers, prioritizing tools that handle irregular income flows, envelope-style budgeting, and tax tracking. The goal is to have real-time insight into what is “available to spend” versus what is already committed to bills, taxes, or savings.

5. Review monthly, rebalance quarterly.

Once a month, compare actual income and expenses to your baseline. Once a quarter, adjust your baseline, savings rates, and categories as your workload and rates change. This light but regular review cycle keeps your system aligned with the realities of a flexible schedule.

Digital Tools and Data-Driven Budgeting

Why Apps Matter More with Flexible Schedules

In a traditional job, you can often get away with a static spreadsheet. With flexibility, data complexity ramps up: multiple clients, currencies, platforms, and payout dates. This is precisely where tech becomes a force multiplier. Many modern tools can import transactions automatically, categorize expenses using machine learning, and project your likely cash balance based on historical patterns.

When comparing the best budgeting apps for freelancers and flexible workers, look for features such as: variable income planning, “sinking funds” or envelopes for irregular but predictable expenses, integration with invoicing platforms, and simple dashboards that show future obligations. These features shift you from “looking backward at what you spent” to “looking forward at what you can afford to commit.”

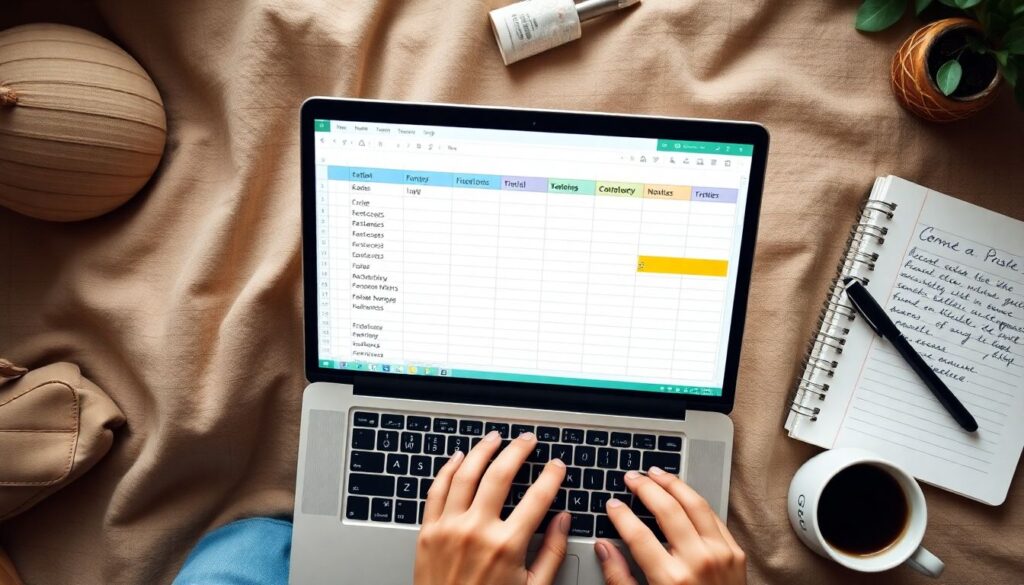

Personal Budget Planners for Variable Income

If you prefer a more hands-on approach, you can build your own personal budget planner for variable income and flexible schedules using a spreadsheet or note-taking app. The design principles are similar: one tab or page for recurring fixed costs, another for variable categories, and a separate area where you model different income scenarios (slow month, typical month, strong month).

By 2025, some personal finance platforms even incorporate probabilistic forecasting, offering basic simulations of future balances under different income patterns. While these projections are not perfect, they help you stress‑test your lifestyle: can you still meet your obligations if your flexible hours drop by 20% for three months?

Economic and Industry-Level Impacts

Macro Trends: Household Finance and Consumption

From an economic perspective, the shift toward flexible work reshapes not only individual budgets but also aggregate consumption patterns. When more people live with fluctuating income, they tend to hold higher precautionary savings and delay large purchases, especially in housing and durable goods. Central banks and policy analysts have already noted that the rise of gig work and flexible contracting since the 2010s contributes to more cautious consumer behavior, even when average incomes look strong on paper.

By 2025, forecasters expect flexible, project-based work arrangements to keep expanding, particularly in sectors like software development, digital media, healthcare consulting, and education technology. As this happens, demand grows for financial products tailored to irregular income: dynamic credit lines, income-smoothing accounts, and portable benefits. Governments in several countries are experimenting with portable retirement and insurance schemes designed to follow the worker across contracts, helping stabilize household finances.

Industry Disruption: Finance, HR, and Tech

Industries built on the assumption of stable paychecks are being forced to adapt. Traditional lenders that underwrite loans based on pay stubs and employer letters are under pressure to develop new scoring models that factor in multi‑source, flexible income histories. Fintech startups are already analyzing platform payouts, invoices, and tax records to assess creditworthiness for freelancers and independent contractors more accurately.

On the HR side, large employers are moving beyond rigid time-tracking toward outcome-based compensation structures. This reconfiguration of work changes how benefits, bonuses, and variable pay are structured, which in turn affects personal budgeting practices. Financial advisors and planning software are increasingly adding modules specifically geared to flexible and gig‑based work, embedding flexible work schedule budgeting tips directly into onboarding flows for new clients.

Future Forecasts: What Budgeting Might Look Like by 2030

More AI, More Personalization, and Less Manual Tracking

Looking ahead to 2030, it is reasonable to expect budgeting for flexible schedules to become more automated and predictive. With improvements in AI and open banking regulations, apps will likely aggregate data from payroll tools, gig platforms, and bank accounts, then classify income types and volatility patterns automatically. Instead of manually deciding how much to send to each category, you might simply approve or tweak recommendations generated from your past behavior and risk tolerance.

There is also likely to be closer integration between calendar data and financial planning: your system could see upcoming projects, expected invoices, vacations, or sabbaticals and automatically adjust spending recommendations. This will further reduce the cognitive burden of handling irregular income, especially for those juggling multiple flexible roles.

Policy Changes and Safety Nets for Flexible Workers

On the policy front, several OECD and EU discussions already focus on smoothing income for flexible workers using mechanisms like income-averaging for tax purposes, portable unemployment insurance, and more flexible retirement contribution rules. If these reforms accelerate by 2030, they could substantially reduce the financial penalty often associated with flexible schedules, making it easier for workers to choose autonomy without sacrificing long‑term security.

Economists expect the share of flexible, hybrid, and independent workers to continue climbing, potentially surpassing 45–50% in some advanced economies by the early 2030s. This will further normalize conversations about how to manage finances with flexible work hours, moving them from niche freelancing forums into standard HR training and school curricula.

Putting It All Together: A Quick Recap

Key Takeaways for Real-World Use

To convert all of this analysis into something you can actually use, you can think of the process in three layers:

1. Stabilize the basics.

– Calculate a conservative baseline income.

– Cover essentials from that baseline only.

– Build a cash‑flow buffer plus a traditional emergency fund.

2. Structure your money flows.

– Use separate accounts for income, bills, taxes, and reserves.

– Automate percentage-based transfers whenever money arrives.

– Leverage apps or a custom planner tuned for variable income.

3. Iterate with data and future in mind.

– Review and adjust monthly and quarterly as your flexible schedule evolves.

– Track volatility and slowly increase your buffer size as needed.

– Watch emerging tools and policies that can reduce your personal risk.

Budgeting in 2025 isn’t about chasing perfection; it’s about designing a system that can bend without breaking when your hours and income shift. Once your financial infrastructure is able to handle that volatility, a flexible schedule stops being a source of constant stress and becomes what it was supposed to be in the first place: a tool to give you more control over your time and your life.