Rethinking Money When Your Career Is in Motion

Changing careers shakes up more than your LinkedIn headline; it rewires your entire relationship with money. Instead of asking “Will I be okay?” start with “What would ‘okay’ actually look like in numbers?” That shift turns foggy fear into measurable scenarios. A calm approach to financial planning during career change means treating this phase as a finite project with a start, middle and end, not a free‑fall. You’re buying time to grow into a new role, not “running out of savings.” Once вы quantify your monthly “survival budget,” emergency buffer and likely income dips, you can make deliberate trade‑offs: maybe you push the move by three months, downgrade housing temporarily, or add a side gig as a stabilizer.

Essential Tools for a Flexible Transition

Core budgeting tools for career change

You don’t need a Wall Street terminal, но you do need a clear dashboard. Good budgeting tools for career change let you track cash flow weekly, not just monthly, because the transition period is lumpy: severance, bonuses, freelance invoices, gaps. Apps like YNAB or PocketGuard help you give each dollar a job, while a plain spreadsheet can do the same if you’re disciplined. Build separate sections: fixed costs, flexible costs, irregular big spends and one‑off transition costs like training or certification. The goal isn’t ascetic minimalism; it’s seeing exactly how each choice—canceling a subscription, renting out a room, delaying a vacation—extends your financial runway in months, not just dollars.

Data and people: your offbeat financial toolkit

Beyond apps, think in terms of a “decision cockpit.” First, a simple net‑worth tracker: accounts, debts, interest rates, and their monthly change. Second, a calendar that shows when key cash events hit: last paycheck, potential job start dates, course payments. Then add people to the toolkit. A short session with the best financial advisor for career transition can surface blind spots: tax pitfalls, equity vesting traps, or insurance gaps. Supplement that “traditional” advice with peers a few steps ahead of you in the same field. They’re your real‑time data source on hiring cycles, realistic pay ranges and practical hacks for surviving the first unstable months.

Step‑by‑Step Process: financial planning during career change

Map your runway and worst‑case scenario

Start with a brutally honest inventory. List all savings, potential income sources and mandatory expenses. Translate that into a “runway” number: how many months can you cover essentials if income drops to zero? Then define your personal worst‑case scenario—not the cinematic disaster, but the realistic floor you could tolerate for 6–12 months: smaller apartment, roommate, moving back with family, selling a car. When you spell out how to manage money when changing jobs under that scenario, fear loses leverage. You now have a contingency plan instead of vague dread. From here, you can intentionally decide how much risk you’re truly willing to take and where you refuse to compromise.

Design a lean but livable budget

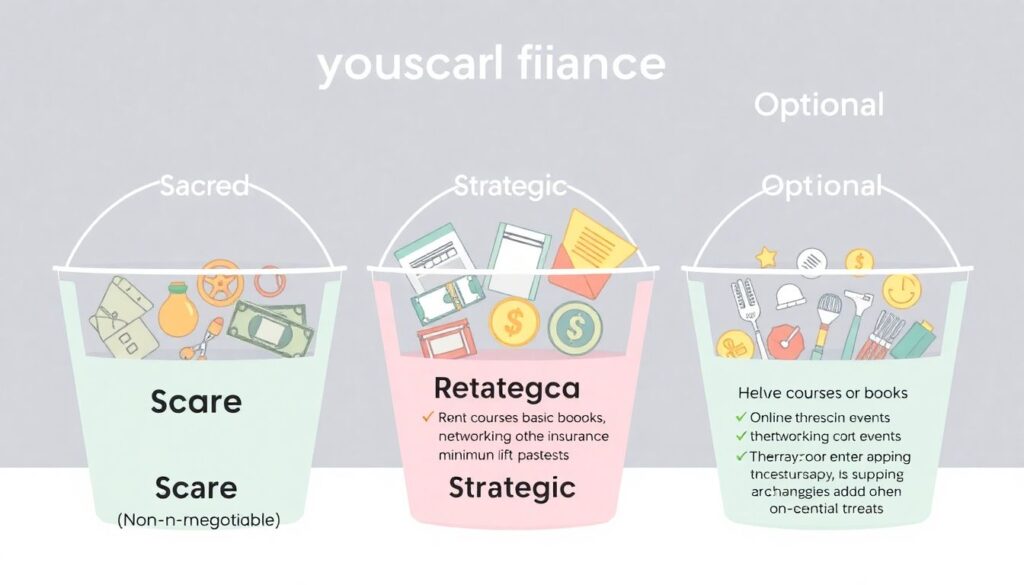

Next, separate costs into three buckets: sacred (non‑negotiable), strategic (helps the transition) and optional (nice‑to‑have). Rent, basic food, insurance and minimum debt payments are sacred. Strategic costs include courses, networking trips or a therapist supporting you through change. Optional is everything else you could pause for six months without long‑term harm. Build a trial budget based on these buckets and test‑drive it for two months before the jump. This live rehearsal will reveal friction points: maybe you underpriced your food needs or forgot about annual subscriptions. Adjust before you actually depend on that budget; treat this like a beta version of your new financial life.

Move money like a project manager

Turn your plan into a concrete workflow instead of vague intentions:

1. Open a separate “Runway” savings account and move 3–12 months of essentials there.

2. Automate transfers on payday: first to runway, then to debt, then to everyday spending.

3. Create a small “risk lab” fund (even $50–$100/month) to test side gigs or micro‑business ideas.

4. Schedule a 30‑minute weekly money review: update balances, compare actual vs planned spend, adjust.

5. Once a month, model three scenarios—optimistic, realistic and pessimistic—so you always know your updated runway.

This systematic loop is essentially DIY career change financial planning services: light‑weight, but responsive.

Unconventional Strategies to Stretch and Grow Money

Micro‑experiments and test income

Instead of hunting for the perfect next job from day one, think like a scientist. Use your transition as a lab for small, fast income experiments. Offer a paid audit, a one‑day workshop, or a niche consulting sprint that uses your old skills in a new industry. These “test balloons” won’t fully replace a salary, but they do three things: extend your runway, validate your new direction and expand your network in the target field. Structure each experiment with a clear hypothesis (“Can I earn $300 in a weekend doing X?”), a fixed time box and a debrief. Over time, the best experiments evolve into real offers—or convince you to pivot cheaply.

Negotiation and lifestyle arbitrage

One underrated lever is “lifestyle arbitrage”—intentionally misaligning your living costs with your earning potential. If your future field has high remote‑work tolerance but low starting salaries, consider relocating temporarily to a cheaper city or even country while you ramp up; you’re trading zip code prestige for breathing room. On the income side, get creative with negotiation. When an employer can’t budge on base pay, ask for a signing bonus targeted to cover transition debts, funded training aligned with your career pivot, or a four‑day week that lets you keep a side project. These tweaks influence how to manage money when changing jobs far more than a token raise.

Troubleshooting Common Money Problems

When savings drain faster than expected

If your runway is shrinking faster than planned, don’t respond with random cost‑cutting. First, diagnose: are your assumptions wrong (rent increase, medical bill), or is behavior drifting (impulse buys, “comfort spending”)? Rebuild the budget using last three months of real transactions rather than memory. Then rank interventions by impact and reversibility: subletting a room, renegotiating debt rates, pausing investments temporarily. Consider short, targeted stints of high‑pay, low‑prestige work—delivery, temp roles, tutoring—framed as “runway repair sprints,” not failure. The goal isn’t a perfect narrative; it’s securing enough time for the right move. Use this moment to refine your personal financial planning during career change rather than abandoning it.

When anxiety blocks decisions

Money stress during a transition often comes from ambiguity, not actual numbers. If you find yourself doom‑scrolling jobs instead of making choices, build a simple decision protocol. For any new expense or opportunity, ask three questions: Does this shorten or lengthen my runway? Does it move me closer to the target role or just soothe my ego? What’s the downside if I say no for 30 days? Writing answers down separates facts from stories. Some people also benefit from lightweight career change financial planning services like group coaching programs that mix financial check‑ins with career strategy; the social rhythm and external deadlines can break the paralysis.

Choosing expert help without overpaying

Professional advice can be a force multiplier, но paying traditional wealth‑management fees when your income is unstable rarely makes sense. Look for fee‑only planners who offer one‑off or hourly sessions and are familiar with career transitions, stock options and self‑employment. When screening for the best financial advisor for career transition, ask blunt questions: How many clients in career change do you serve? How do you get paid on this engagement? What concrete deliverables will I walk away with in 90 minutes? Often, a short, focused session to map taxes, benefits and risk coverage is enough. Combine that expert blueprint with your own weekly money reviews, and you’ve got a practical, sustainable system.