Why Financial Literacy Suddenly Became Urgent

Over the last three years, money skills quietly moved from “nice to have” to “basic survival kit.” Between 2022 and 2024, household surveys in North America and Europe consistently showed that roughly 35–45% of adults struggled to answer simple questions about inflation, interest and risk, and around a third said they would have trouble covering an unexpected expense equivalent to one month of rent or mortgage. At the same time, the share of people using investing apps and digital banks kept rising every year, which means more decisions, more quickly, with less guidance.

In other words, the world gave you more financial responsibility, but not more financial education.

If that sounds familiar, you’re not alone. The good news: you don’t need a degree in economics. You need a focused, practical plan for the next 30–90 days.

—

From Ancient Clay Tablets to Budgeting Apps: A Short History

Financial literacy isn’t a buzzword from Instagram; it’s an old concept with a new label. Clay tablets from ancient Mesopotamia already recorded loans, interest and repayment schedules. Greek and Roman texts discussed debt traps and the dangers of living above your means. For centuries, though, this knowledge lived mostly with merchants, traders and the wealthy.

Mass financial education is much younger. Public schools began teaching basic money topics in the 20th century, but only in the last 25–30 years did “financial literacy” become a worldwide policy goal. After the 2008 crisis, governments and central banks pushed harder, yet surveys from 2022–2024 still show that fewer than half of adults in many developed countries can correctly answer three basic questions on interest, inflation and diversification. So if you feel like you “should have learned this in school,” history is on your side — most people didn’t.

—

The Core Principles You Must Understand First

Let’s cut through the noise and TikTok “money hacks.” Long before you compare an online financial literacy course or hunt for the best personal finance courses for beginners, you need a mental framework. Four principles matter more than everything else combined:

1. Cash flow is king

You must know, every month, what comes in, what goes out, and what’s left. That leftover piece (your surplus) is what builds savings, kills debt and funds investing. If nothing is left, or you’re in the red, fixing this is priority #1.

2. Time and interest can work for or against you

Compound interest grows investments quietly in the background — but high-interest debt compounds against you just as quickly. From 2022 to 2024, consumer credit data in several countries showed that people with high-interest card debt were far more likely to report financial stress, even when their income wasn’t low. The math is simple: 20% credit card interest will outrun a 7–8% investment return every time if you let both run unchecked.

3. Protection before growth

A modest emergency fund and basic insurance often create more real-world security than chasing the highest investment returns. Statistics from the last three years consistently show that households with even 1–3 months of expenses saved are significantly less likely to miss bill payments or take on expensive debt during a shock.

4. Systems beat willpower

People who automate savings, bill payments and investing tend to stick with good habits longer than people who “try to be disciplined.” Your goal is to design a money system that works even when you’re tired, stressed or busy.

If you keep these four ideas in the back of your mind, every tactic you learn later — from choosing an app to reading a statement — will suddenly make more sense.

—

Step‑by‑Step: A 30‑Day Plan to Boost Financial Literacy Fast

You don’t have to fix your entire financial life in a month, but you *can* dramatically raise your understanding. Here’s a practical sequence you can follow.

1. Days 1–3: Get a brutally honest snapshot

– Pull the last 3 months of bank and card statements.

– List all income sources and all regular bills.

– Write down every debt: balance, interest rate, minimum payment.

This isn’t fun, but it’s the baseline that turns vague anxiety into clear numbers.

2. Days 4–7: Learn how to manage money and budget effectively

Spend one week focused on just two skills: tracking and planning.

– Pick one of the best apps to improve financial literacy or a simple budgeting app your bank provides.

– Categorize the last month’s spending (housing, food, transport, debt, fun, etc.).

– Design a “starter budget” where:

– Essentials are covered first.

– High-interest debt gets extra attention.

– You set a specific savings or debt‑reduction target (even if it’s small).

3. Days 8–14: Do a guided learning sprint

This is where a structured resource shines. Signing up for an online financial literacy course with short, daily lessons can compress years of trial‑and‑error into a week or two. Look for something that covers:

– Basics of banking and credit

– Debt strategies (snowball vs. avalanche)

– Saving and beginner investing

– Understanding paychecks and taxes

Keep it practical: after each lesson, apply *one* idea to your real numbers.

4. Days 15–21: Set up simple automation

– Schedule automatic transfers to savings the day after payday.

– Automate minimum debt payments; add manual extra payments to the highest‑interest debt.

– Turn on bill reminders or auto‑pay for essentials (rent, utilities, insurance).

This is where literacy turns into behavior change.

5. Days 22–30: Sketch your first mini‑plan

You’re not building a 30‑year roadmap yet — just a 12‑month outline:

– Target emergency fund level (e.g., 1–3 months of expenses).

– Debt payoff goal (e.g., “erase card A by December”).

– First investing step (e.g., opening a retirement or brokerage account).

If you feel stuck, this is a good moment to talk to a pro; many financial planning services for individuals now offer short, one‑time sessions or affordable online packages focused on basic planning rather than complex wealth management.

—

Real‑World Examples of Fast Progress

To make this concrete, let’s walk through three simplified scenarios based on patterns seen in surveys and coaching data from 2022–2024.

A 25‑year‑old with two credit cards and no savings spends a weekend going through statements and realizes 20% of their income is disappearing into delivery food and impulse online shopping. They switch to a basic budgeting app, cap “fun” spending, and redirect just $150 a month toward the highest‑interest card. Within a year, they clear that card and build a $1,000 emergency cushion. The math isn’t heroic — it’s awareness plus a system.

A 38‑year‑old freelancer, anxious about irregular income, enrolls in one of the best personal finance courses for beginners that includes sections on variable income. They learn to calculate a conservative “baseline income,” create a bare‑bones budget around that, and treat anything above it as seasonal or bonus money. Twelve months later, their income hasn’t doubled, but their stress is dramatically lower and they’ve stopped using cards to bridge between gigs.

A couple in their mid‑40s, worried they’re “behind for retirement,” books a short session with a planner after doing some self‑study. They bring a rough budget, debt list and retirement account statements. The planner helps them re‑allocate contributions, trim a few low‑value expenses and prioritize paying off one high‑interest loan. Follow‑up surveys like these over 2022–2024 often show that the biggest shift isn’t wealth overnight, but clarity and confidence — people finally feel they’re driving, not just reacting.

—

Common Myths That Slow You Down

Some beliefs quietly sabotage financial growth long before numbers do. Clearing them out is part of becoming literate.

One myth is “I’m just bad with money; it’s a personality thing.” Yet education data from the last three years shows that basic knowledge and simple tools are much stronger predictors of behavior than personality labels. When people learn how interest works and see their numbers clearly, their “type” suddenly looks a lot more responsible.

Another myth is “I’ll start learning when I have more money.” In reality, skills scale better than income. If you can manage $2,000 a month wisely, you’ll be ready for $4,000. People who wait until “later” often carry the same habits into a higher income — just with larger mistakes.

A third myth: “Investing is only for the rich or the reckless.” Over 2022–2024, participation in simple, diversified index funds continued to grow among everyday investors, especially through workplace retirement plans and low‑fee platforms. The risky part isn’t investing itself; it’s investing in things you don’t understand, with money you can’t afford to lose, on a timeline that doesn’t match your goals. Basic literacy lets you filter out nonsense and choose plain, boring options that compound quietly.

Finally, there’s “I can learn everything from social media snippets.” Short videos and posts can *spark* curiosity, but they’re a terrible substitute for structured learning. Algorithms reward excitement, not accuracy. That’s why pairing bite‑sized content with a well‑reviewed course or book is so effective: the fun content keeps you interested; the structured material keeps you honest.

—

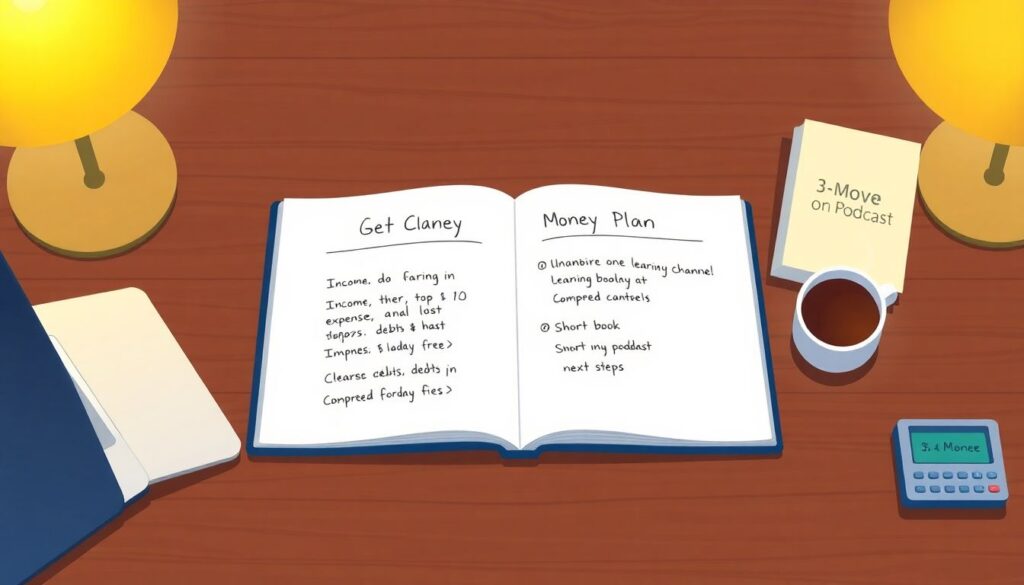

Bringing It All Together: Your Next Three Moves

To wrap this into something you can act on today, here’s a simple three‑move plan:

1. Get clarity

Tonight, list your income, top 10 expenses and all debts with interest rates. No judgment, just data.

2. Choose one learning channel

Over the next week, commit to either a short book, a curated podcast series or a compact course — even a free online financial literacy course from a reputable institution — and set a daily time slot for it. Consistency beats intensity.

3. Install one system

Before the week is over, set up *one* automation: a small automatic transfer to savings, or auto‑pay on a high‑priority bill. Start tiny if needed; the switch from “manual” to “automatic” is the real upgrade.

Improve these three areas a little each month — knowledge, clarity of numbers and systems — and your financial literacy will rise faster than you expect. You don’t need perfection, advanced math or a rich family; you need a plan, repetition and a willingness to look your money straight in the eye.