Understand the Real Cost of Your Debt

Before you even think about creating a repayment plan, you need to understand exactly what you owe — and more importantly, what it’s costing you.

Start by listing all your debts: credit cards, personal loans, car loans, student loans, and any other liabilities. For each, note:

– Total balance

– Interest rate (APR)

– Minimum monthly payment

– Due date

Here’s the kicker: Most people underestimate how much interest eats into their financial future. For example, a $5,000 credit card balance at 22% APR, making only minimum payments, can take over 20 years to pay off — and you’ll pay more than $10,000 in interest alone.

Tech Tip: Use a Debt Calculator

Use online tools like the Bankrate Debt Payoff Calculator or Undebt.it to visualize how long it’ll take to pay off your debt with your current payments — and how much faster you could be debt-free with even small extra payments.

Choose a Strategy That Matches Your Psychology

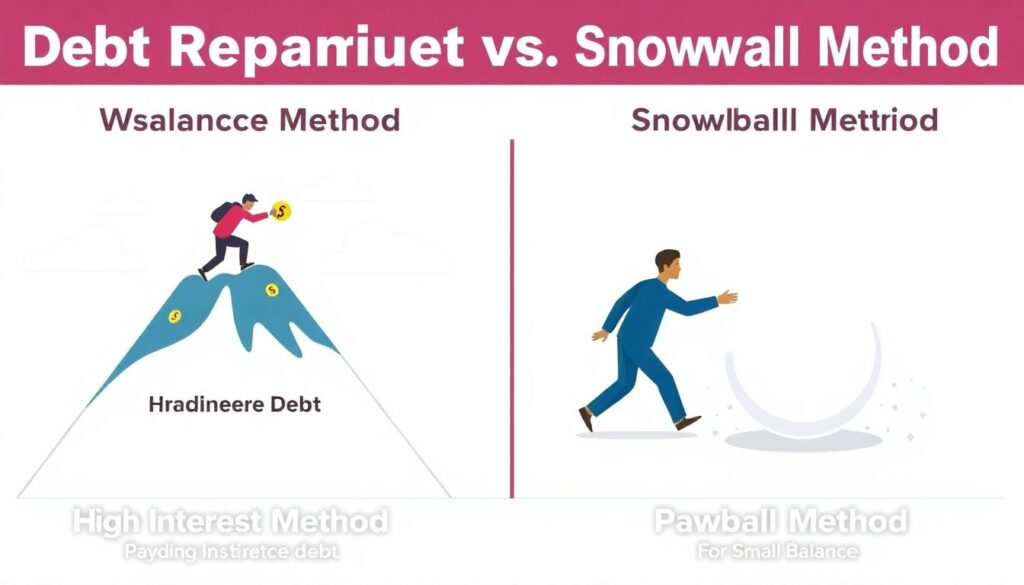

The two most popular strategies are the avalanche and the snowball methods:

– Avalanche Method: Pay off the debt with the highest interest rate first. This saves you the most money over time.

– Snowball Method: Pay off the smallest balance first for a quick psychological win, then roll that payment into the next debt.

But here’s a less common, hybrid approach that works for many people:

– The Momentum Method: Combine the emotional wins of the snowball method with the financial efficiency of the avalanche. Start with a small, high-interest debt to build confidence and save money, then move to the next highest interest rate.

Real-World Example

Jenna, a 32-year-old freelance designer, had four debts:

– $4,000 credit card at 24%

– $1,200 store card at 19%

– $6,500 car loan at 6%

– $9,000 student loan at 4.5%

She started with the $1,200 store card (smallest balance, high interest), then moved to the $4,000 card. Within 9 months, she cleared both and felt empowered to tackle the car loan next. By combining small wins with smart targeting, she stayed motivated and saved over $2,300 in interest.

Automate, but Stay Flexible

Automation is your best friend — to a point. Set up automatic payments for at least the minimums on all debts to avoid late fees and credit score damage. Then, manually pay extra toward your target debt.

Why not automate the extra payments too? Because your financial situation can change month to month. Keeping some flexibility allows you to adjust for unexpected expenses without derailing your plan.

Pro Move: Use Windfalls Strategically

Instead of throwing your entire tax refund or bonus at debt, split it:

– 50% toward your target debt

– 30% into emergency savings

– 20% for guilt-free spending

This prevents burnout and keeps you engaged for the long haul.

Track Progress Visually

Debt repayment is a marathon, not a sprint. Visual progress keeps you motivated. Some creative ideas:

– Color in a debt thermometer on your fridge

– Use a bullet journal to track monthly balances

– Create a spreadsheet with a progress bar that fills as your balance drops

Seeing your progress — even if it’s slow — reinforces the habit and builds momentum.

Negotiate and Optimize Where Possible

Most people don’t realize they can negotiate their debt terms. Call your credit card company and ask for a lower interest rate — especially if you’ve been a long-time customer with a solid payment history. You’d be surprised how often they say yes.

Other options:

– Balance transfer cards with 0% APR for 12–18 months (watch for transfer fees)

– Debt consolidation loans with fixed rates and structured payoff terms

– Credit counseling services that can help you renegotiate payments without damaging your credit

Tech Block: Watch Out for Hidden Fees

Some balance transfer cards charge 3–5% upfront. On a $10,000 transfer, that’s $300–$500 — potentially wiping out your interest savings. Always read the fine print.

Build a “Debt-Proof” Budget

A debt repayment plan that sticks must be rooted in a realistic budget. That doesn’t mean cutting every joy from your life — it means intentional spending.

Try the 60/20/20 budget:

– 60% for needs (rent, food, transportation)

– 20% for debt repayment

– 20% for savings and fun

If 20% toward debt feels impossible, start with 10% and increase it by 1% each month. The key is sustainability.

Final Thoughts: Make It Personal

The best debt repayment plan isn’t the one with the fanciest spreadsheet — it’s the one you’ll actually follow.

Make it personal. Write down why you want to be debt-free. Is it to start a family? Travel? Buy a home? Put that goal somewhere visible. Every payment gets you closer.

Debt freedom isn’t just about numbers. It’s about reclaiming control of your life. And with the right plan — one that fits your psychology, lifestyle, and goals — you’ll get there. And stay there.