Why You Need a Personal Finance Dashboard

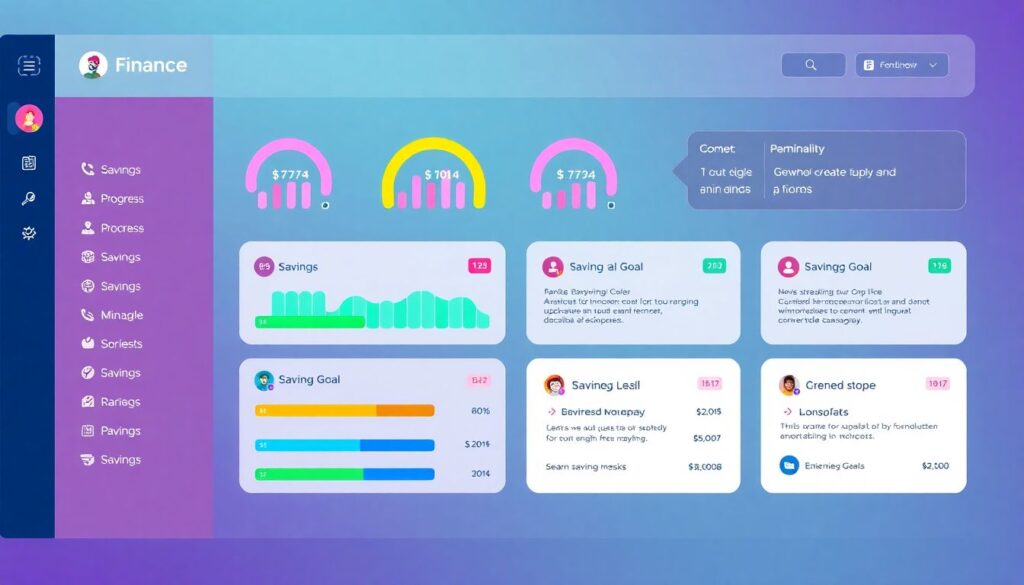

If you’ve ever opened your banking app, scrolled through transactions, and thought, “Where did all my money go?”, you’re not alone. A well-designed personal finance dashboard doesn’t just show you numbers—it gives you clarity. Think of it as your financial command center. It consolidates your income, expenses, savings, debts, and goals in one place, so you can make informed decisions based on real data.

What makes a dashboard “loveable”? Simplicity, customization, and automation. You shouldn’t have to spend hours updating spreadsheets or deciphering vague pie charts. It should fit your financial goals like a glove and work quietly in the background while you live your life.

Start With the Right Tools

Before diving into design, pick the tool that best suits your workflow. You don’t have to be a finance nerd to get started—just pick one platform and build from there.

Popular Tools for Building Your Dashboard

– Google Sheets or Excel – Full control, flexible formulas, but requires some spreadsheet knowledge.

– Notion – Great for integrating financial planning with life goals, but limited in automation.

– Tiller Money – Syncs directly with your bank accounts and imports transactions into Google Sheets.

– YNAB (You Need A Budget) – Budget-first platform with built-in dashboards, ideal if your focus is cash flow management.

Choose a platform based on your comfort with data entry, automation needs, and long-term financial habits.

Core Components Your Dashboard Should Include

A personal finance dashboard isn’t just a budget tracker. It’s a real-time snapshot of your financial health. Here’s what to include:

1. Net Worth Tracker

At its core, your net worth is assets minus liabilities. Set up a section that updates automatically (or manually if you prefer) with:

– Checking and savings balances

– Investment accounts (brokerage, retirement)

– Real estate or other assets

– Outstanding debts (credit cards, loans)

Tracking net worth over time gives valuable insight into your financial trajectory.

2. Income and Expense Overview

This is where most dashboards fall flat. Avoid generic categories like “miscellaneous” and break down expenses into meaningful segments:

– Recurring bills (rent/mortgage, utilities)

– Variable spending (groceries, entertainment, dining out)

– Non-monthly expenses (insurance premiums, car maintenance)

Use conditional formatting to flag overspending or irregularities. Consider integrating a rolling average to track trends over 3-6 months.

3. Budget vs. Actual Analysis

Budgeting isn’t about restriction—it’s about intention. A good dashboard compares your projected budget to actual spending in each category. This is where automation tools like Tiller or custom scripts in Google Sheets can shine.

Bonus tip: Use sparklines or simple graphs to visualize deviations. Seeing a red spike in the “Dining Out” category mid-month? That’s your cue to rein it in.

Real-Life Use Case: Streamlining Family Finances

Emily and James, a married couple from Portland, used to manage finances separately. Bills were missed, and savings were inconsistent. They decided to build a shared Google Sheets dashboard using Tiller Money.

They created tabs for:

– Joint and personal accounts

– Monthly expense tracking

– Vacation and emergency savings buckets

– A debt payment tracker

By centralizing everything, they reduced financial arguments and hit their savings goal for a trip to Japan within eight months. What changed? Visibility. James said, “Once I could see where our money was going, I felt way more in control.”

Best Practices for a Dashboard You’ll Actually Use

Creating a dashboard is just the first step. To make it sustainable, stick with these habits:

Automate Where Possible

– Link bank feeds with tools like Tiller or YNAB

– Set up monthly recurring formulas for savings contributions

– Use scripts or add-ons to categorize expenses automatically

Schedule Check-ins

– Weekly: Review recent transactions

– Monthly: Update goals, net worth, and category budgets

– Quarterly: Analyze trends and adjust projections

Think of it like a financial health check-up—you don’t skip doctor visits, so don’t skip your money reviews.

Customize for Motivation

– Add visuals like progress bars for savings goals

– Use color coding to highlight financial “wins”

– Include motivational quotes or reminders tied to your goals

Financial dashboards don’t have to be dry—they should reflect your priorities and keep you engaged.

Closing Thoughts

A personal finance dashboard isn’t just for number crunchers or spreadsheet fans. It’s a dynamic tool that, when designed thoughtfully, can transform how you manage money. The key is to focus on functionality, data clarity, and personal relevance. Start small, iterate often, and let it evolve as your financial life changes.

With the right setup, checking your dashboard can go from being a chore to a moment of empowerment.