The Fundamentals of Personal Finance for Beginners

Understanding the Basics Before You Dive In

Let’s be honest — managing money isn’t exactly taught in school. Yet, personal finance affects everything, from your ability to rent an apartment to how (and when) you retire. For beginners, this topic can feel overwhelming. But with the right guidance, you can take control of your financial future.

Let’s break down what personal finance really means and how to master it — even if you’re starting from scratch.

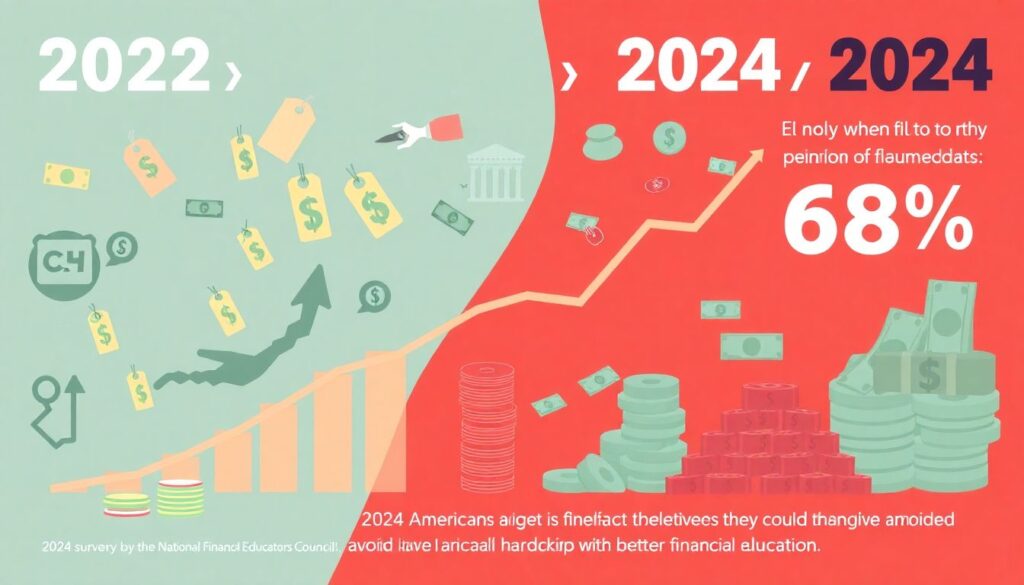

Why Personal Finance Matters More Than Ever

Between 2022 and 2024, inflation, wage stagnation, and rising debt levels have underscored how crucial it is to actively manage your money. According to a 2024 survey by the National Financial Educators Council (NFEC), 68% of Americans said they could have avoided financial hardship if they had received better personal finance education.

And here’s the kicker: over 43% of Gen Z adults (ages 18–27 in 2025) report that they feel “extremely unprepared” for financial independence. That’s where foundational knowledge comes in.

1. Start With a Simple Budget

Budgeting for Beginners: It’s Not About Restriction

A budget isn’t a punishment. It’s a plan. Think of it as a blueprint for how you want to use your income. It puts you in control.

A basic structure to follow is the 50/30/20 rule:

– 50% on needs (rent, groceries, insurance)

– 30% on wants (entertainment, dining out)

– 20% on savings and debt repayment

If that breakdown feels off for your lifestyle or income, adjust it. The critical part is knowing where your money goes.

Budgeting Tools You Should Try

There are several intuitive apps designed for budgeting for beginners, such as:

– YNAB (You Need A Budget)

– Mint

– PocketGuard

These tools help automate tracking and categorize expenses — a huge time-saver when you’re not used to managing a budget manually.

2. Master the Art of Saving

How to Save Money Consistently (Without Cutting Joy)

Saving money isn’t just about skipping lattes. It’s about building a cushion between you and life’s unpredictable moments.

Here are some practical personal finance tips to build savings without living like a monk:

– Automate transfers to a savings account right after payday

– Use cashback apps and loyalty programs

– Set spending “cool-down” periods for non-essential purchases

According to the Federal Reserve’s 2023 Report on the Economic Well-Being of U.S. Households, only 64% of Americans could cover a $400 emergency expense without borrowing or selling something. If that stat hits close to home, your goal should be to build an emergency fund—3 to 6 months of essential expenses.

3. Get a Grip on Debt

Debt isn’t inherently bad. But unmanaged debt is.

Start by making a list of all your debts — include interest rates, minimum payments, and due dates. Then pick a strategy:

– Avalanche method: Pay off the highest interest debt first

– Snowball method: Pay off the smallest balance first for motivational wins

Whichever you choose, the important part is consistency.

Pro tip: Avoid only making minimum payments. It extends your repayment period and increases the amount of interest you’ll pay.

4. Start Investing (Yes, Even With $50)

Investment Strategies for Beginners Who Don’t Want to Gamble

Investing isn’t just for the wealthy. It’s how you grow your wealth over time.

If you’re new to this, start with:

– Low-cost index funds (e.g., S&P 500 ETFs)

– Target-date retirement funds

– Micro-investing platforms like Acorns or Robinhood

The key is to stay long-term and diversified. According to Vanguard’s 2024 Investor Report, individuals who started investing in their 20s accumulated nearly 3x more retirement wealth by age 60 compared to those who started in their 30s, assuming consistent contributions.

Don’t try to time the market. Time *in* the market beats timing the market.

5. Learn Continuously

Knowledge Is a Financial Asset

There’s no shortage of free and paid personal finance courses out there. A few worth checking out:

– Coursera: Personal Finance 101 (University of Illinois)

– Khan Academy: Personal Finance Modules

– Udemy: Finance for Non-Financial Professionals

These programs demystify terms like APR, 401(k), Roth IRA, compound interest, and asset allocation — all essential to competent money management.

As of 2024, the U.S. Department of Education is working to integrate financial literacy into high school curricula, but for many adults, self-education remains the most reliable path.

Final Thoughts: Build the Foundation Now

Personal finance isn’t about being rich. It’s about being prepared.

You don’t need to understand complex algorithms or be an Excel wizard to manage your money effectively. What you do need is intention, basic structure, and the discipline to follow through.

To recap:

- Create a consistent budget that reflects your goals.

- Automate your savings and build an emergency fund.

- Pay off high-interest debt strategically.

- Start investing early — even in small amounts.

- Take personal finance courses to deepen your understanding.

Remember, money is a tool — not a master. Use it thoughtfully, and your future self will thank you.

Whether you’re just out of college, switching careers, or trying to recover from financial mistakes, the fundamentals remain the same. Start small, but start now.